Pakistan taxation

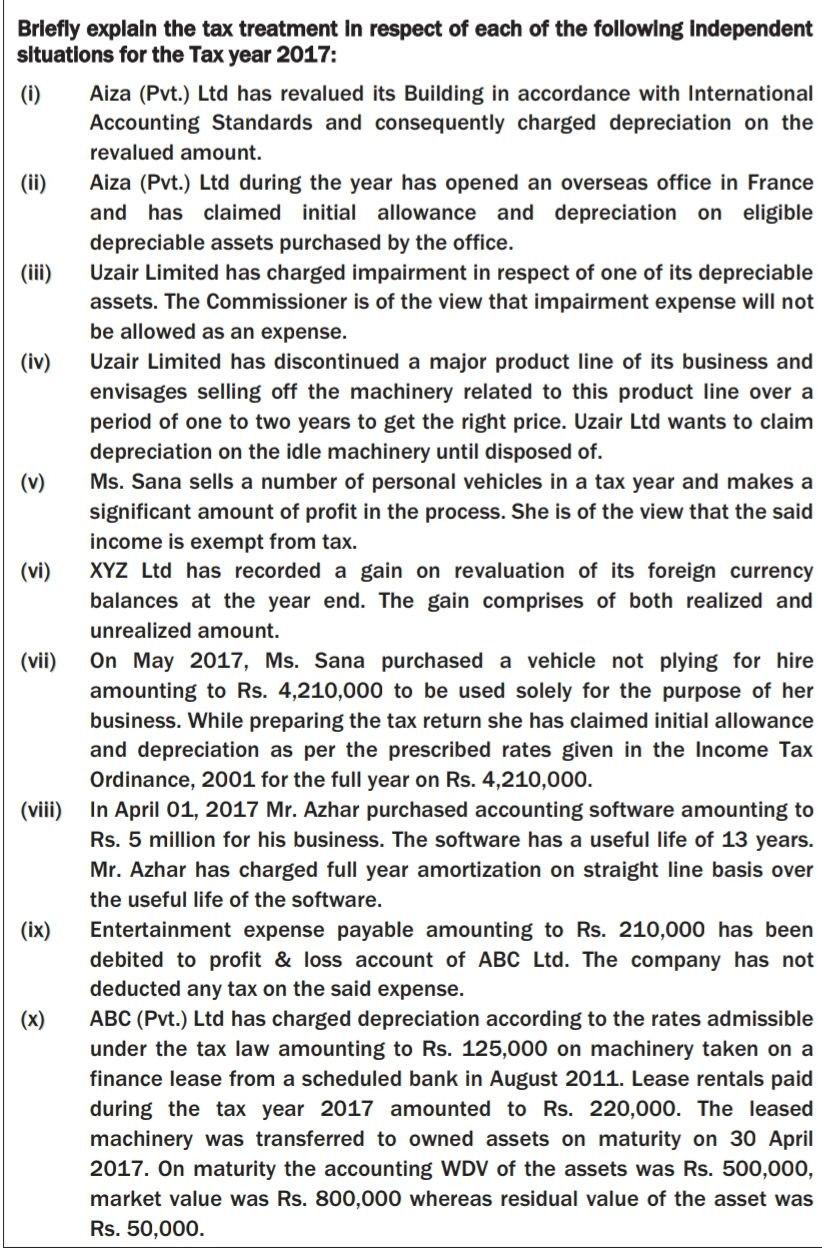

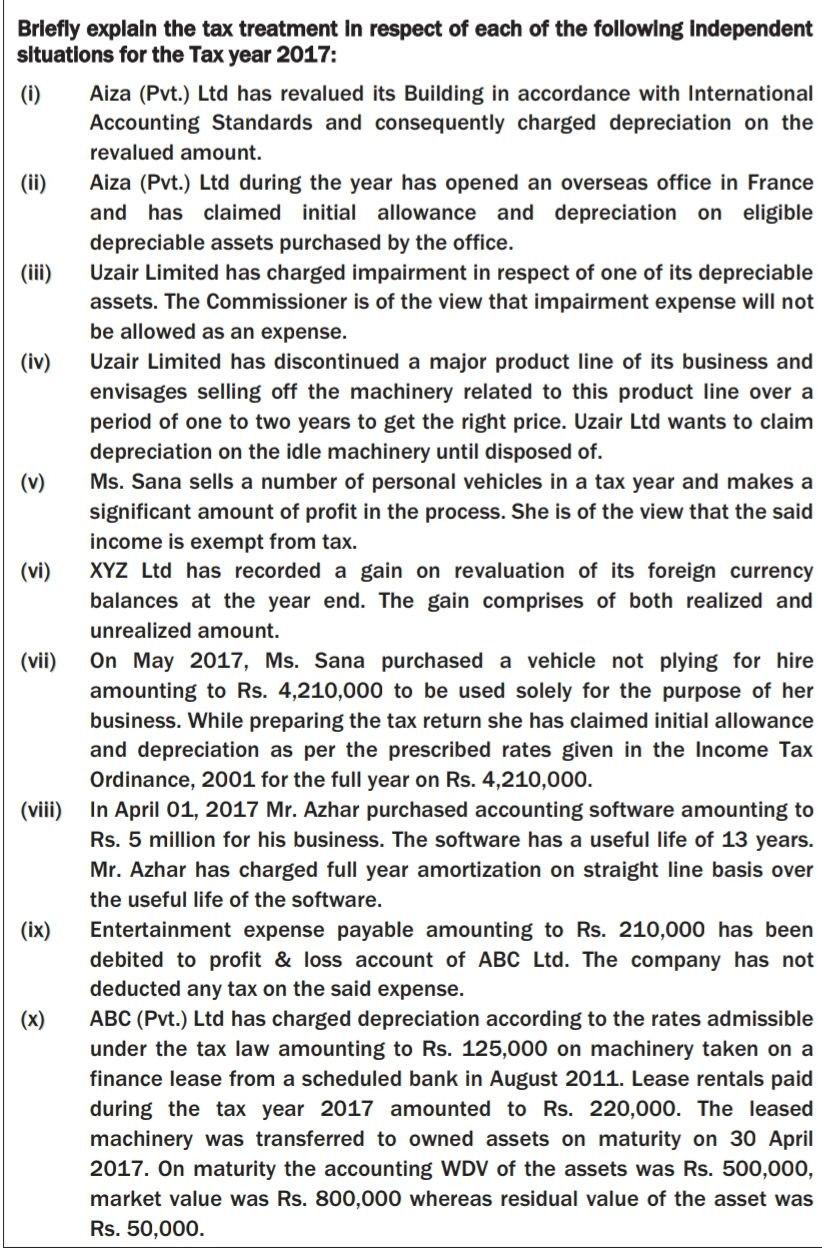

Briefly explain the tax treatment In respect of each of the following Independent situations for the Tax year 2017: (0) Aiza (Pvt.) Ltd has revalued its Building in accordance with International Accounting Standards and consequently charged depreciation on the revalued amount. (ii) Aiza (Pvt.) Ltd during the year has opened an overseas office in France and has claimed initial allowance and depreciation on eligible depreciable assets purchased by the office. (iii) Uzair Limited has charged impairment in respect of one of its depreciable assets. The Commissioner is of the view that impairment expense will not be allowed as an expense. (iv) Uzair Limited has discontinued a major product line of its business and envisages selling off the machinery related to this product line over a period of one to two years to get the right price. Uzair Ltd wants to claim depreciation on the idle machinery until disposed of. (v) Ms. Sana sells a number of personal vehicles in a tax year and makes a significant amount of profit in the process. She is of the view that the said income is exempt from tax. (vi) XYZ Ltd has recorded a gain on revaluation of its foreign currency balances at the year end. The gain comprises of both realized and unrealized amount. (vii) On May 2017, Ms. Sana purchased a vehicle not plying for hire amounting to Rs. 4,210,000 to be used solely for the purpose of her business. While preparing the tax return she has claimed initial allowance and depreciation as per the prescribed rates given in the Income Tax Ordinance, 2001 for the full year on Rs. 4,210,000. (viii) In April 01, 2017 Mr. Azhar purchased accounting software amounting to Rs. 5 million for his business. The software has a useful life of 13 years. Mr. Azhar has charged full year amortization on straight line basis over the useful life of the software. (ix) Entertainment expense payable amounting to Rs. 210,000 has been debited to profit & loss account of ABC Ltd. The company has not deducted any tax on the said expense. (x) ABC (Pvt.) Ltd has charged depreciation according to the rates admissible under the tax law amounting to Rs. 125,000 on machinery taken on a finance lease from a scheduled bank in August 2011. Lease rentals paid during the tax year 2017 amounted to Rs. 220,000. The leased machinery was transferred to owned assets on maturity on 30 April 2017. On maturity the accounting WDV of the assets was Rs. 500,000, market value was Rs. 800,000 whereas residual value of the asset was Rs. 50,000