Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Palm Corporation acquired 70% of the outstanding voting stock of Sail Corporation for $45,500 cash on January 1, 20X8 when Sail's stockholders' equity was

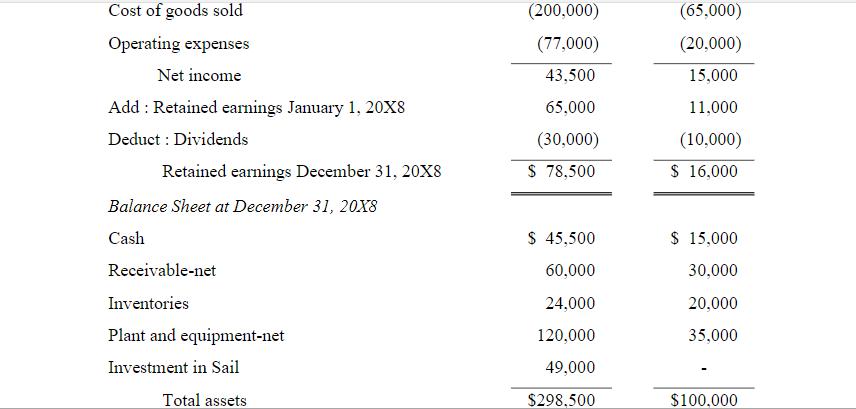

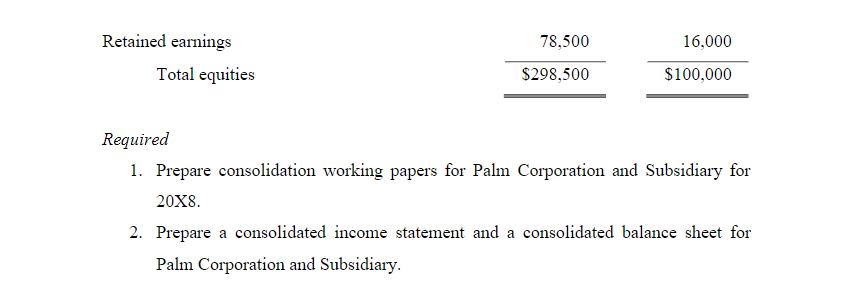

Palm Corporation acquired 70% of the outstanding voting stock of Sail Corporation for $45,500 cash on January 1, 20X8 when Sail's stockholders' equity was $65,000. All the assets and liabilities of Sail were stated at their fair values when Palm acquired its 70% interest. Financial statements of the two corporations at and of the year ended December 31, 20X8 are summarized as follows: Combined Income and Retained Earnings Statements for the Year Ended December 31, 20X8 Sales Income from Sail Palm $310,000 10,000 Sail $100,000 Cost of goods sold Operating expenses Net income Add: Retained earnings January 1, 20X8 Deduct: Dividends Retained earnings December 31, 20X8 Balance Sheet at December 31, 20X8 Cash Receivable-net Inventories Plant and equipment-net Investment in Sail Total assets (200,000) (77,000) 43,500 65,000 (30,000) $ 78,500 $ 45,500 60,000 24,000 120,000 49,000 $298.500 (65,000) (20,000) 15,000 11,000 (10,000) $ 16,000 $ 15,000 30,000 20,000 35,000 $100,000 Accounts payable Other liabilities Capital stock, $10 par Other paid-in capital $ 30,000 20,000 150,000 20,000 $ 18,000 12,000 50,000 4,000 Retained earnings Total equities 78,500 $298,500 16,000 $100,000 Required 1. Prepare consolidation working papers for Palm Corporation and Subsidiary for 20X8. 2. Prepare a consolidated income statement and a consolidated balance sheet for Palm Corporation and Subsidiary.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

W1 Retained Earnings As Per Books Pre Acquisition Palms Share of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started