Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chuck's Computer Shop sells computer parts and supplies and provides repair and upgrade services to its customers. The following slide provides inventory cost and

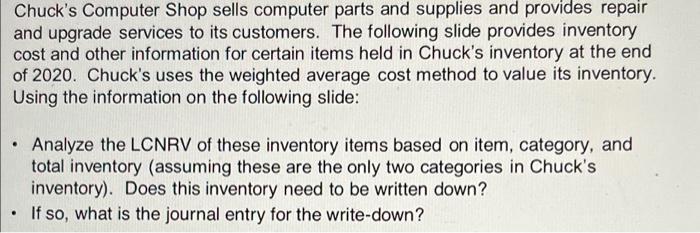

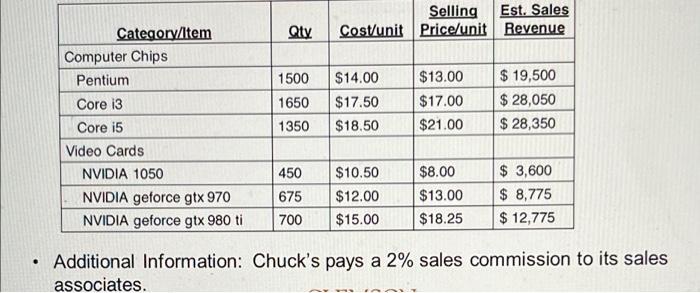

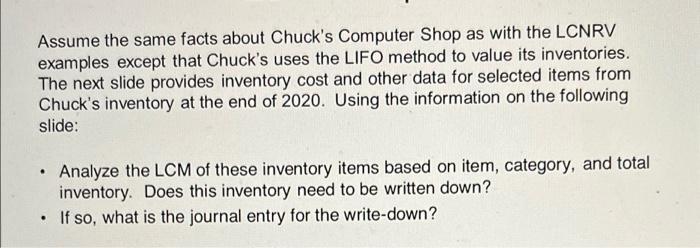

Chuck's Computer Shop sells computer parts and supplies and provides repair and upgrade services to its customers. The following slide provides inventory cost and other information for certain items held in Chuck's inventory at the end of 2020. Chuck's uses the weighted average cost method to value its inventory. Using the information on the following slide: Analyze the LCNRV of these inventory items based on item, category, and total inventory (assuming these are the only two categories in Chuck's inventory). Does this inventory need to be written down? If so, what is the journal entry for the write-down? Est. Sales Selling Cost/unit Price/unit Revenue Category/Item Qty Computer Chips $ 19,500 $ 28,050 $ 28,350 Pentium 1500 $14.00 $13.00 Core i3 1650 $17.50 $17.00 Core i5 1350 $18.50 $21.00 Video Cards $ 3,600 $ 8,775 $ 12,775 NVIDIA 1050 450 $10.50 $8.00 NVIDIA geforce gtx 970 675 $12.00 $13.00 NVIDIA geforce gtx 980 ti 700 $15.00 $18.25 Additional Information: Chuck's pays a 2% sales commission to its sales associates. Assume the same facts about Chuck's Computer Shop as with the LCNRV examples except that Chuck's uses the LIFO method to value its inventories. The next slide provides inventory cost and other data for selected items from Chuck's inventory at the end of 2020. Using the information on the following slide: Analyze the LCM of these inventory items based on item, category, and total inventory. Does this inventory need to be written down? If so, what is the journal entry for the write-down? Chuck's Computer Shop sells computer parts and supplies and provides repair and upgrade services to its customers. The following slide provides inventory cost and other information for certain items held in Chuck's inventory at the end of 2020. Chuck's uses the weighted average cost method to value its inventory. Using the information on the following slide: Analyze the LCNRV of these inventory items based on item, category, and total inventory (assuming these are the only two categories in Chuck's inventory). Does this inventory need to be written down? If so, what is the journal entry for the write-down? Est. Sales Selling Cost/unit Price/unit Revenue Category/Item Qty Computer Chips $ 19,500 $ 28,050 $ 28,350 Pentium 1500 $14.00 $13.00 Core i3 1650 $17.50 $17.00 Core i5 1350 $18.50 $21.00 Video Cards $ 3,600 $ 8,775 $ 12,775 NVIDIA 1050 450 $10.50 $8.00 NVIDIA geforce gtx 970 675 $12.00 $13.00 NVIDIA geforce gtx 980 ti 700 $15.00 $18.25 Additional Information: Chuck's pays a 2% sales commission to its sales associates. Assume the same facts about Chuck's Computer Shop as with the LCNRV examples except that Chuck's uses the LIFO method to value its inventories. The next slide provides inventory cost and other data for selected items from Chuck's inventory at the end of 2020. Using the information on the following slide: Analyze the LCM of these inventory items based on item, category, and total inventory. Does this inventory need to be written down? If so, what is the journal entry for the write-down? Chuck's Computer Shop sells computer parts and supplies and provides repair and upgrade services to its customers. The following slide provides inventory cost and other information for certain items held in Chuck's inventory at the end of 2020. Chuck's uses the weighted average cost method to value its inventory. Using the information on the following slide: Analyze the LCNRV of these inventory items based on item, category, and total inventory (assuming these are the only two categories in Chuck's inventory). Does this inventory need to be written down? If so, what is the journal entry for the write-down? Est. Sales Selling Cost/unit Price/unit Revenue Category/Item Qty Computer Chips $ 19,500 $ 28,050 $ 28,350 Pentium 1500 $14.00 $13.00 Core i3 1650 $17.50 $17.00 Core i5 1350 $18.50 $21.00 Video Cards $ 3,600 $ 8,775 $ 12,775 NVIDIA 1050 450 $10.50 $8.00 NVIDIA geforce gtx 970 675 $12.00 $13.00 NVIDIA geforce gtx 980 ti 700 $15.00 $18.25 Additional Information: Chuck's pays a 2% sales commission to its sales associates. Assume the same facts about Chuck's Computer Shop as with the LCNRV examples except that Chuck's uses the LIFO method to value its inventories. The next slide provides inventory cost and other data for selected items from Chuck's inventory at the end of 2020. Using the information on the following slide: Analyze the LCM of these inventory items based on item, category, and total inventory. Does this inventory need to be written down? If so, what is the journal entry for the write-down?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer The Eastman Kodak Company referred to simply as Kodakkoudk is an American public company that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started