Question

Palmer Ltd is a British importer of computer chips. The company has contracted to purchase 4,000 units of chips at a unit price of

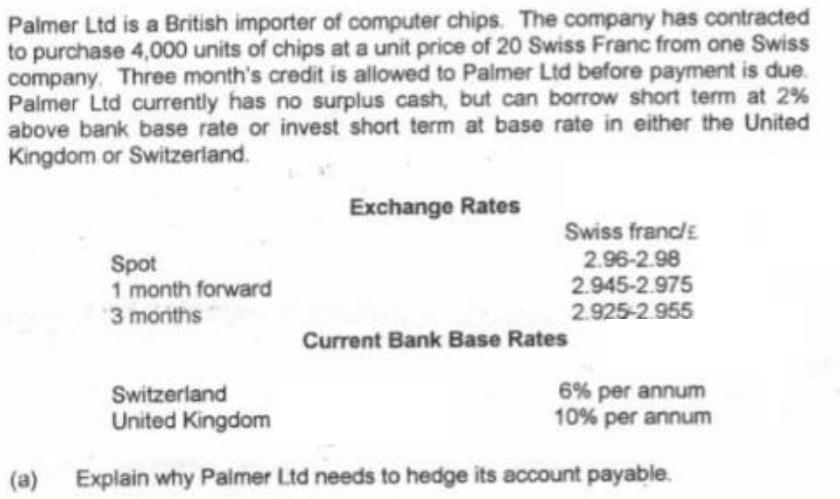

Palmer Ltd is a British importer of computer chips. The company has contracted to purchase 4,000 units of chips at a unit price of 20 Swiss Franc from one Swiss company. Three month's credit is allowed to Palmer Ltd before payment is due. Palmer Ltd currently has no surplus cash, but can borrow short term at 2% above bank base rate or invest short term at base rate in either the United Kingdom or Switzeriand. Exchange Rates Spot 1 month forward 3 moriths Swiss franc/E 2.96-2.98 2.945-2.975 2.925-2.955 Current Bank Base Rates 6% per annum 10% per annum Switzerland United Kingdom Explain why Palmer Ltd needs to hedge its account payable.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

franeuro spot 296298 1 29452975 29252955 payable 80000 franc If hedging thro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

13th Edition

978-0073379616, 73379611, 978-0697789938

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App