Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Palmer Manufacturing produces weather vanes. For the year just ended, Palmer produced 10,000 weather vanes with the following total costs: Direct materials $20,000 Direct

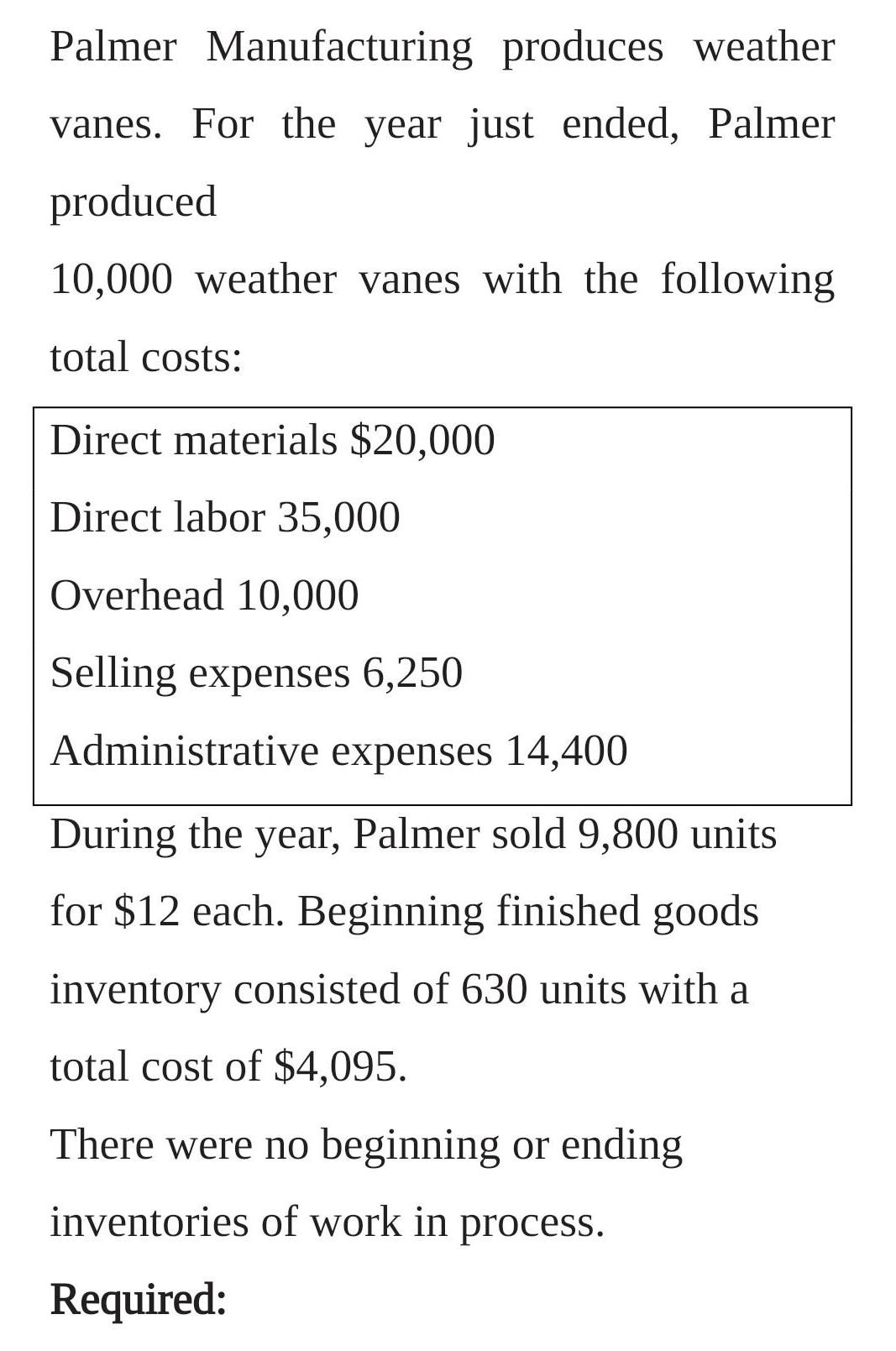

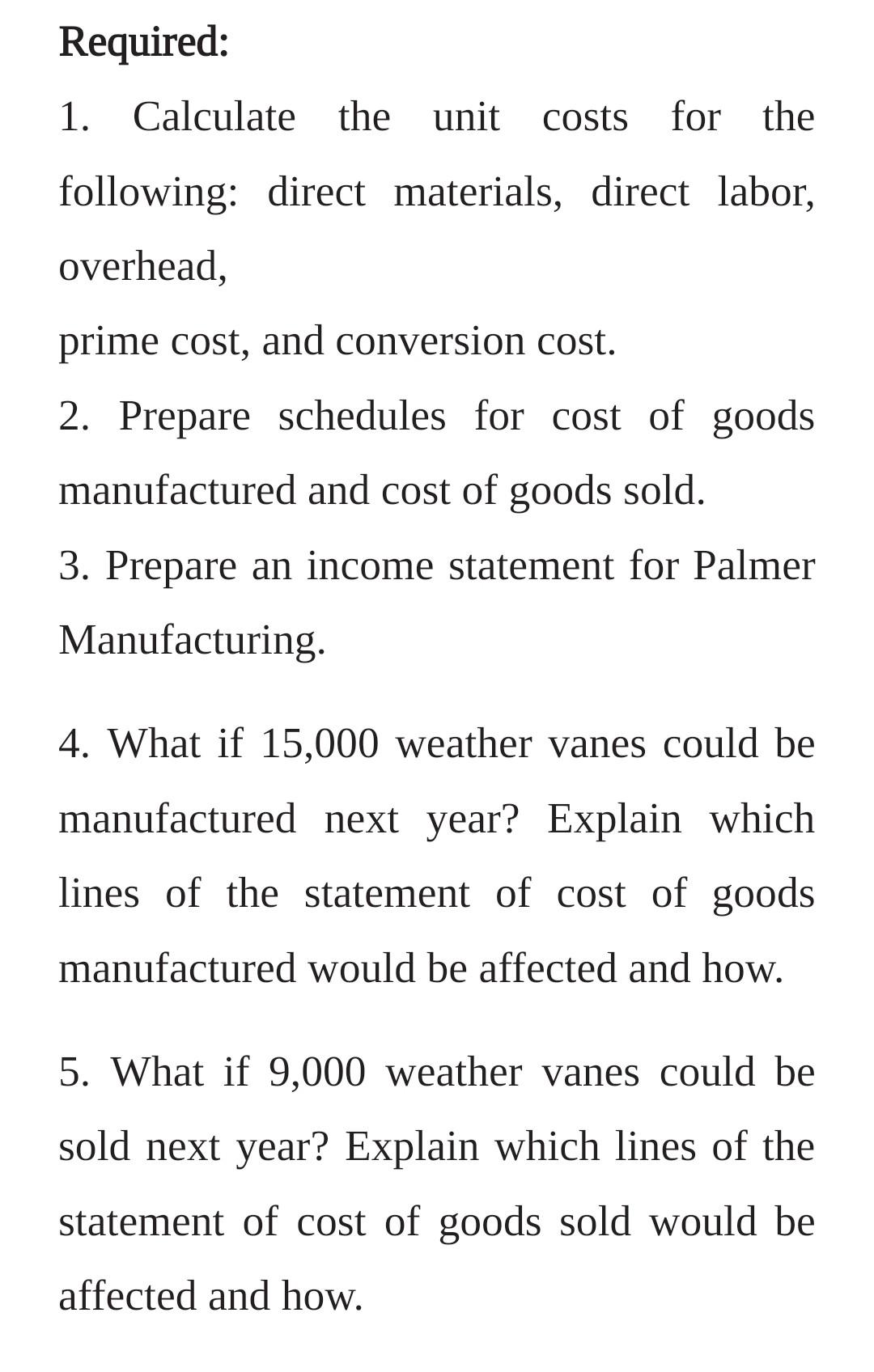

Palmer Manufacturing produces weather vanes. For the year just ended, Palmer produced 10,000 weather vanes with the following total costs: Direct materials $20,000 Direct labor 35,000 Overhead 10,000 Selling expenses 6,250 Administrative expenses 14,400 During the year, Palmer sold 9,800 units for $12 each. Beginning finished goods inventory consisted of 630 units with a total cost of $4,095. There were no beginning or ending inventories of work in process. Required: Required: 1. Calculate the unit costs for the following: direct materials, direct labor, overhead, prime cost, and conversion cost. 2. Prepare schedules for cost of goods manufactured and cost of goods sold. 3. Prepare an income statement for Palmer Manufacturing. 4. What if 15,000 weather vanes could be manufactured next year? Explain which lines of the statement of cost of goods manufactured would be affected and how. 5. What if 9,000 weather vanes could be sold next year? Explain which lines of the statement of cost of goods sold would be affected and how.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 direct material cost Per unit 2000010000 200 direct Labor cost Per unit 3500010000 350 overhead cost Per unit 1000010000 100 Prime cost Per unit 2 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started