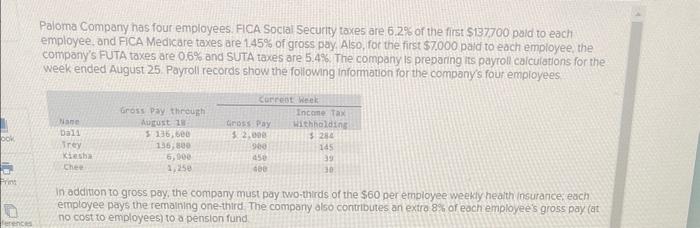

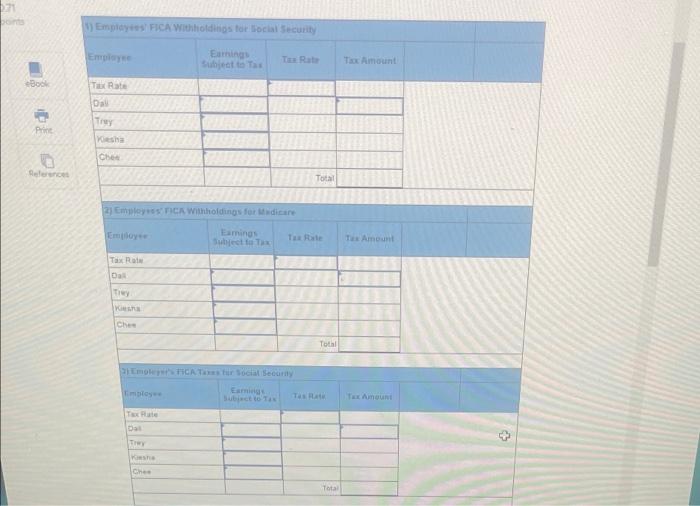

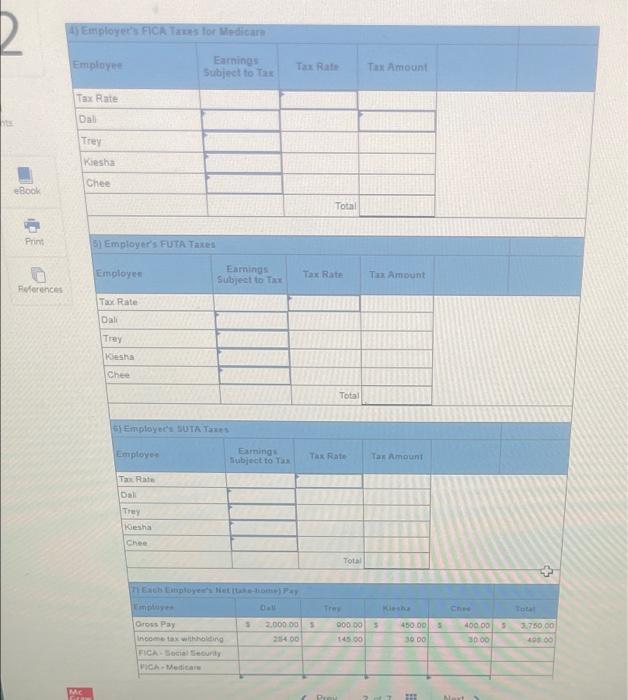

Paloma Company has four employees. FICA Soclal Securty taxes are 6.28 of the first $137700 pald to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first 57.000 patd to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4\%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the foliowng infomation for the company's four employees In addition to gross pay, the company must pay two-thirds of the $60 per empioyee weekly heath insurance, exch employee pays the remaining one-third The company also contributes an extro 8% of eoch employees gross pay (at no cost to employees) to a pension fund (1) Empidyies' FICA Withliotdings for locial Secunity (4) Cmbley is s' rich Withioddinos foi la dicare Timiteses * Tine Plaie. Dat Trer Fax Ameuni Cinen: (B) Employer's FutA Taked \begin{tabular}{|l|l|l|l|} \hline Employef & \multicolumn{1}{|c|}{ Earnings } & Tax Rate & Tax Almount \\ Subjest to Tax & & & \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kesha & & & \\ \hline Chee & & & \\ \hline & & & \\ \hline \end{tabular} wif Employeci surA Taxes Tar Amount Paloma Company has four employees. FICA Soclal Securty taxes are 6.28 of the first $137700 pald to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first 57.000 patd to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4\%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the foliowng infomation for the company's four employees In addition to gross pay, the company must pay two-thirds of the $60 per empioyee weekly heath insurance, exch employee pays the remaining one-third The company also contributes an extro 8% of eoch employees gross pay (at no cost to employees) to a pension fund (1) Empidyies' FICA Withliotdings for locial Secunity (4) Cmbley is s' rich Withioddinos foi la dicare Timiteses * Tine Plaie. Dat Trer Fax Ameuni Cinen: (B) Employer's FutA Taked \begin{tabular}{|l|l|l|l|} \hline Employef & \multicolumn{1}{|c|}{ Earnings } & Tax Rate & Tax Almount \\ Subjest to Tax & & & \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kesha & & & \\ \hline Chee & & & \\ \hline & & & \\ \hline \end{tabular} wif Employeci surA Taxes Tar Amount