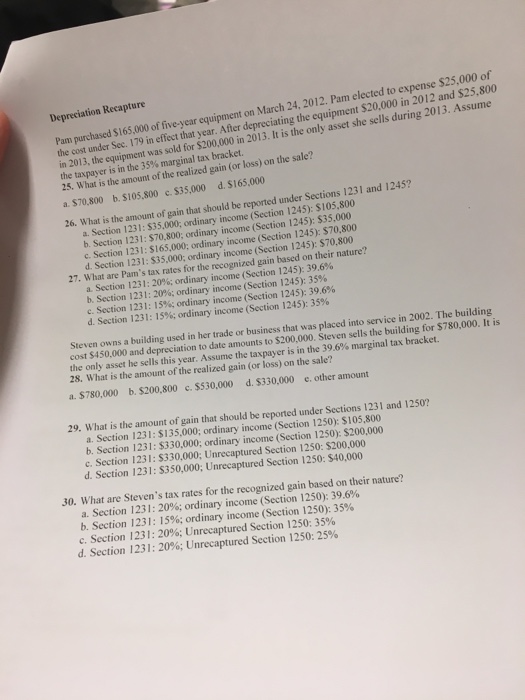

Pam purchased $165,000 of five-year equipment on March 24, 2012. Pam elected to expense $25,000 of the cost under Sec. 179 in effect that year. After depreciating the equipment $20,000 in 2012 and $25, 800 in 2013, the equipment was sold for $200,000 in 2013. It is the only asset she sells during 2013. Assume the taxpayer is in the 35% marginal tax bracket. 25. What is the amount of the realized gain (or loss) on the sale? a $70, 800 b. $105, 800 c. $35,000 d. $165,000 26. What is the amount of gain that should be reported under Sections 1231 and 1245? a. Section 1231: $35,000; ordinary income (Section 1245): $105, 800 b. Section 1231: $70, 800; ordinary income (Section 1245): $35,000 c. Section 1231: $165,000; ordinary income (Section 1245): $70, 800 d. Section 1231. $35,000; ordinary income (Section 1245): $70, 800 What are Pam's tax rates for the recognized gain based on their nature? a. Section 1231: 20%; ordinary income (Section 1245): 39.6% b. Section 1231: 20%; ordinary income (Section 1245): 35% c. Section 1231: 15%; ordinary income (Section 1245): 39.6% d. Section 1231: 15%; ordinary income (Section 1245): 35% Steven owns a building used in her trade or business that was placed into service in 2002. The building cost $450,000 and depreciation to date amounts to $200,000 Steven sells the building for $780,000. It is the only asset he sells this year. Assume the taxpayer is in the 39.6% marginal tax bracket. 28. What is the amount of the realized gain (or loss) on the sale? a. $780,000 b $200, 800 c. $530,000 d. $330,000 c. other amount What is the amount of gain that should be reported under Sections 1231 and 1250? a. Section 1231: $135,000; ordinary income (Section 1250): $105, 800 b. Section 1231: $330,000; ordinary income (Section 1250): $200,000 c. Section 1231: $330,000; Unrecaptured Section 1250: $200,000 d. Section 1231: $350,000; Unrecaptured Section 1250: $40,000 What are Steven's tax rates for the recognized gain based on their nature? a. Section 1231: 20%: ordinary income (Section 1250): 39.6% b. Section 1231: 15%: ordinary income (Section 1250): 35% c. Section 1231: 20%: Unrecaptured Section 1250: 35% d. Section 1231: 20%; Unrecaptured Section 1250:25%