Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pamplona Ltd had share capital of one million $1 shares, fully paid. As it needed finance for certain construction projects, the company's management decided

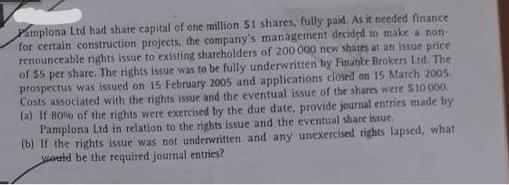

Pamplona Ltd had share capital of one million $1 shares, fully paid. As it needed finance for certain construction projects, the company's management decided to make a non- renounceable rights issue to existing shareholders of 200 000 new shares at an issue price of 55 per share. The rights issue was to be fully underwritten by Finance Brokers Ltd. The prospectus was issued on 15 February 2005 and applications closed on 15 March 2005 Costs associated with the rights issue and the eventual issue of the shares were $10 000. (a) If 80% of the rights were exercised by the due date, provide journal entries made by Pamplona Ltd in relation to the rights issue and the eventual share issue. (b) If the rights issue was not underwritten and any unexercised rights lapsed, what would be the required journal entries?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a If 80 of the rights were exercised by the due date the journal entries made by Pamplona Ltd would be as follows On the date of the rights issue anno...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started