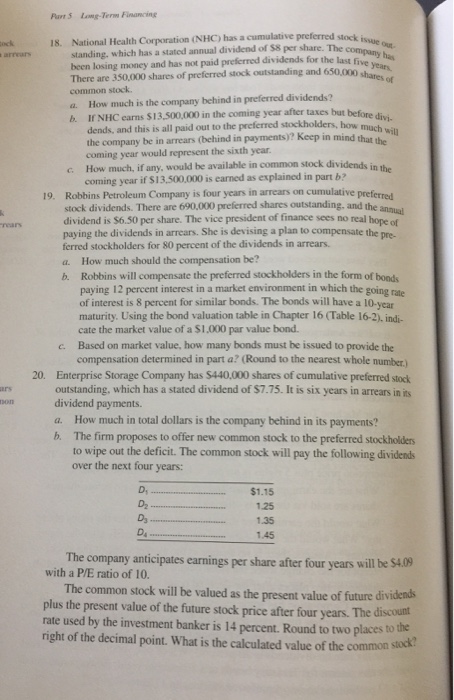

Pan 5 Lng Term Finamcing 18. National Health Corporation (NHC) has a cumulative preferred stock issue out- ock been losing money and has not paid preferred dividends for the last five ha There are 350,000 shares of preferred stock outstanding and 650,000 shares.s arrearsstanding. which has a stated annual dividend of $8 per share. Th five common stock a. How much is the company behind in preferred dividends? before divi- If NHC earns $13,500,000 in the coming year after taxes but dends, and this is all paid out to the preferred stockholders, how mu the company be in arrears (behind in payments)? Keep in mind that tw coming year would represent the sixth year. How much, if any, would be coming year if $13,500,000 is earned as explained in part b? available in common stock dividends i c. 19. Robbins Petroleum Company is four years in arrears on cumulative preferred stock dividends. There are 690,000 preferred shares outstanding, and the annual dividend is S6.50 per share. The vice president of finance sees no real hope of paying the dividends in arrears. She is devising a plan to compensate the pre rears ferred stockholders for 80 percent of the dividends in arrears. a. How much should the compensation be? b. Robbins will compensate the preferred stockholders in the form of bonds paying 12 percent interest in a market environment in which the going rate of interest is 8 percent for similar bonds. The bonds will have a 10-year maturity. Using the bond valuation table in Chapter 16 (Table 16-2), indi- cate the market value of a $1,000 par value bond. Based on market value, how many bonds must be issued to provide the compensation determined in part a? (Round to the nearest whole number.) c. 20. Enterprise Storage Company has $440,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $7.75. It is six years in arrears in its dividend payments. a. How much in total dollars is the company behind in its payments? b on The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D D2 Ds $1.15 1.35 1.45 The company anticipates earnings per share after four years will be $4.09 with a P/E ratio of 10. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. The discount rate used by the investment banker is 14 percent. Round to two places to right of the decimal point. What is the calculated value of the common Pan 5 Lng Term Finamcing 18. National Health Corporation (NHC) has a cumulative preferred stock issue out- ock been losing money and has not paid preferred dividends for the last five ha There are 350,000 shares of preferred stock outstanding and 650,000 shares.s arrearsstanding. which has a stated annual dividend of $8 per share. Th five common stock a. How much is the company behind in preferred dividends? before divi- If NHC earns $13,500,000 in the coming year after taxes but dends, and this is all paid out to the preferred stockholders, how mu the company be in arrears (behind in payments)? Keep in mind that tw coming year would represent the sixth year. How much, if any, would be coming year if $13,500,000 is earned as explained in part b? available in common stock dividends i c. 19. Robbins Petroleum Company is four years in arrears on cumulative preferred stock dividends. There are 690,000 preferred shares outstanding, and the annual dividend is S6.50 per share. The vice president of finance sees no real hope of paying the dividends in arrears. She is devising a plan to compensate the pre rears ferred stockholders for 80 percent of the dividends in arrears. a. How much should the compensation be? b. Robbins will compensate the preferred stockholders in the form of bonds paying 12 percent interest in a market environment in which the going rate of interest is 8 percent for similar bonds. The bonds will have a 10-year maturity. Using the bond valuation table in Chapter 16 (Table 16-2), indi- cate the market value of a $1,000 par value bond. Based on market value, how many bonds must be issued to provide the compensation determined in part a? (Round to the nearest whole number.) c. 20. Enterprise Storage Company has $440,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $7.75. It is six years in arrears in its dividend payments. a. How much in total dollars is the company behind in its payments? b on The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D D2 Ds $1.15 1.35 1.45 The company anticipates earnings per share after four years will be $4.09 with a P/E ratio of 10. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. The discount rate used by the investment banker is 14 percent. Round to two places to right of the decimal point. What is the calculated value of the common