Question

Panama Red Inc. is a North Carolina based tobacco grower. Selected financial information for Panama Red is provided in the table below. Panama Red

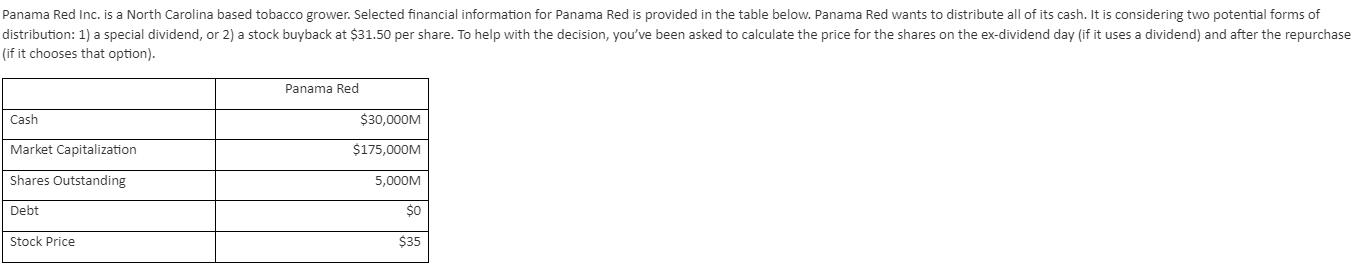

Panama Red Inc. is a North Carolina based tobacco grower. Selected financial information for Panama Red is provided in the table below. Panama Red wants to distribute all of its cash. It is considering two potential forms of distribution: 1) a special dividend, or 2) a stock buyback at $31.50 per share. To help with the decision, you've been asked to calculate the price for the shares on the ex-dividend day (if it uses a dividend) and after the repurchase (if it chooses that option). Cash Market Capitalization Shares Outstanding Debt Stock Price Panama Red $30,000M $175,000M 5,000M $0 $35

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the exdividend price we need to determine the amount of the special dividend and the nu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Regression Analysis And Other Multivariable Methods

Authors: David G. Kleinbaum, Lawrence L. Kupper, Azhar Nizam, Eli S. Rosenberg

5th Edition

1285051084, 978-1285963754, 128596375X, 978-1285051086

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App