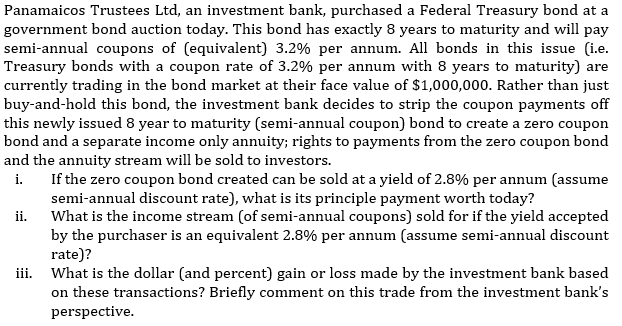

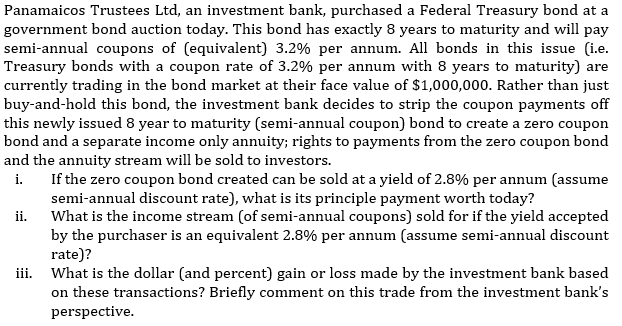

Panamaicos Trustees Ltd, an investment bank, purchased a Federal Treasury bond at a government bond auction today. This bond has exactly 8 years to maturity and will pay semi-annual coupons of (equivalent) 3.2% per annum. All bonds in this issue (i.e. Treasury bonds with a coupon rate of 3.2% per annum with 8 years to maturity) are currently trading in the bond market at their face value of $1,000,000. Rather than just buy-and-hold this bond, the investment bank decides to strip the coupon payments off this newly issued 8 year to maturity (semi-annual coupon) bond to create a zero coupon bond and a separate income only annuity; rights to payments from the zero coupon bond and the annuity stream will be sold to investors. i. ii. If the zero coupon bond created can be sold at a yield of 2.8% per annum (assume semi-annual discount rate), what is its principle payment worth today? What is the income stream (of semi-annual coupons) sold for if the yield accepted by the purchaser is an equivalent 2.8% per annum (assume semi-annual discount rate)? iii. What is the dollar (and percent) gain or loss made by the investment bank based on these transactions? Briefly comment on this trade from the investment bank's perspective. Panamaicos Trustees Ltd, an investment bank, purchased a Federal Treasury bond at a government bond auction today. This bond has exactly 8 years to maturity and will pay semi-annual coupons of (equivalent) 3.2% per annum. All bonds in this issue (i.e. Treasury bonds with a coupon rate of 3.2% per annum with 8 years to maturity) are currently trading in the bond market at their face value of $1,000,000. Rather than just buy-and-hold this bond, the investment bank decides to strip the coupon payments off this newly issued 8 year to maturity (semi-annual coupon) bond to create a zero coupon bond and a separate income only annuity; rights to payments from the zero coupon bond and the annuity stream will be sold to investors. i. ii. If the zero coupon bond created can be sold at a yield of 2.8% per annum (assume semi-annual discount rate), what is its principle payment worth today? What is the income stream (of semi-annual coupons) sold for if the yield accepted by the purchaser is an equivalent 2.8% per annum (assume semi-annual discount rate)? iii. What is the dollar (and percent) gain or loss made by the investment bank based on these transactions? Briefly comment on this trade from the investment bank's perspective