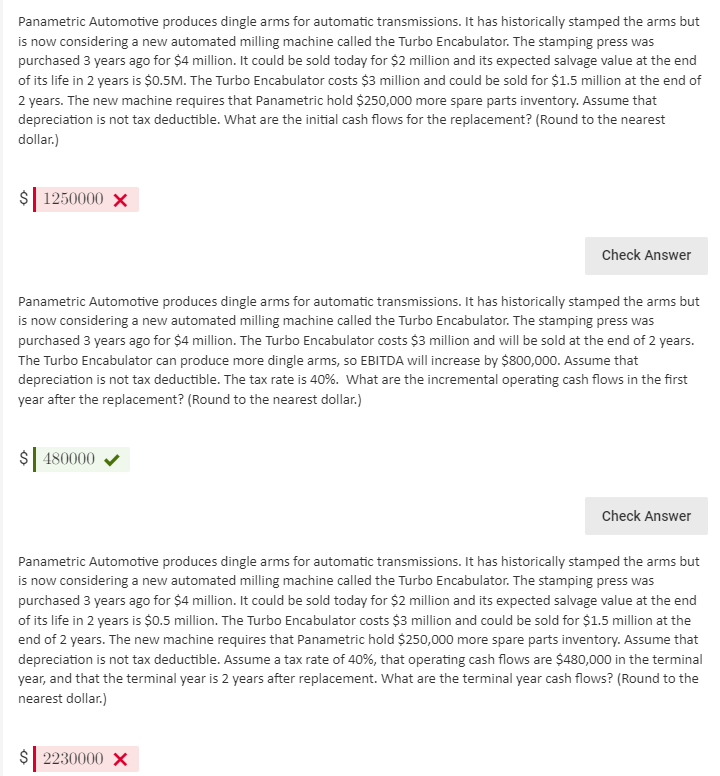

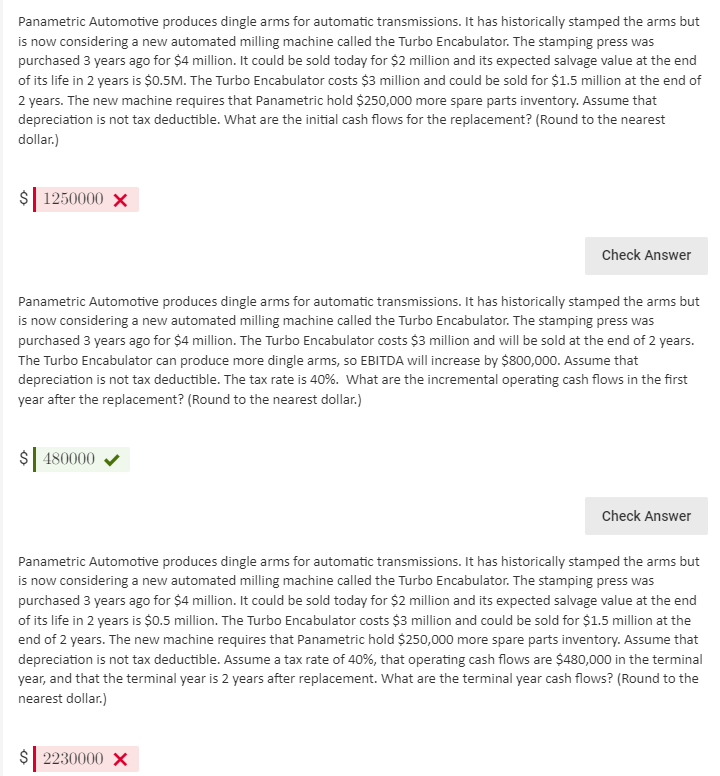

Panametric Automotive produces dingle arms for automatic transmissions. It has historically stamped the arms but is now considering a new automated milling machine called the Turbo Encabulator. The stamping press was purchased 3 years ago for $4 million. It could be sold today for $2 million and its expected salvage value at the end of its life in 2 years is $0.5M. The Turbo Encabulator costs $3 million and could be sold for $1.5 million at the end of 2 years. The new machine requires that Panametric hold $250,000 more spare parts inventory. Assume that depreciation is not tax deductible. What are the initial cash flows for the replacement? (Round to the nearest dollar.) $|1250000 x Check Answer Panametric Automotive produces dingle arms for automatic transmissions. It has historically stamped the arms but is now considering a new automated milling machine called the Turbo Encabulator. The stamping press was purchased 3 years ago for $4 million. The Turbo Encabulator costs $3 million and will be sold at the end of 2 years. The Turbo Encabulator can produce more dingle arms, so EBITDA will increase by $800,000. Assume that depreciation is not tax deductible. The tax rate is 40%. What are the incremental operating cash flows in the first year after the replacement? (Round to the nearest dollar.) $| 480000 Check Answer Panametric Automotive produces dingle arms for automatic transmissions. It has historically stamped the arms but is now considering a new automated milling machine called the Turbo Encabulator. The stamping press was purchased 3 years ago for $4 million. It could be sold today for $2 million and its expected salvage value at the end of its life in 2 years is $0.5 million. The Turbo Encabulator costs $3 million and could be sold for $1.5 million at the end of 2 years. The new machine requires that Panametric hold $250,000 more spare parts inventory. Assume that depreciation is not tax deductible. Assume a tax rate of 40%, that operating cash flows are $480,000 in the terminal year, and that the terminal year is 2 years after replacement. What are the terminal year cash flows? (Round to the nearest dollar.) $| 2230000 x