Answered step by step

Verified Expert Solution

Question

1 Approved Answer

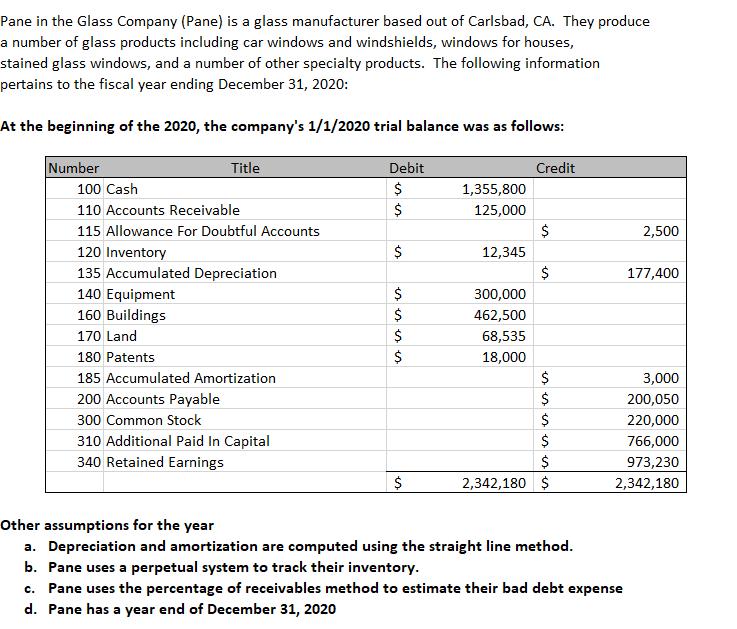

Pane in the Glass Company (Pane) is a glass manufacturer based out of Carlsbad, CA. They produce a number of glass products including car

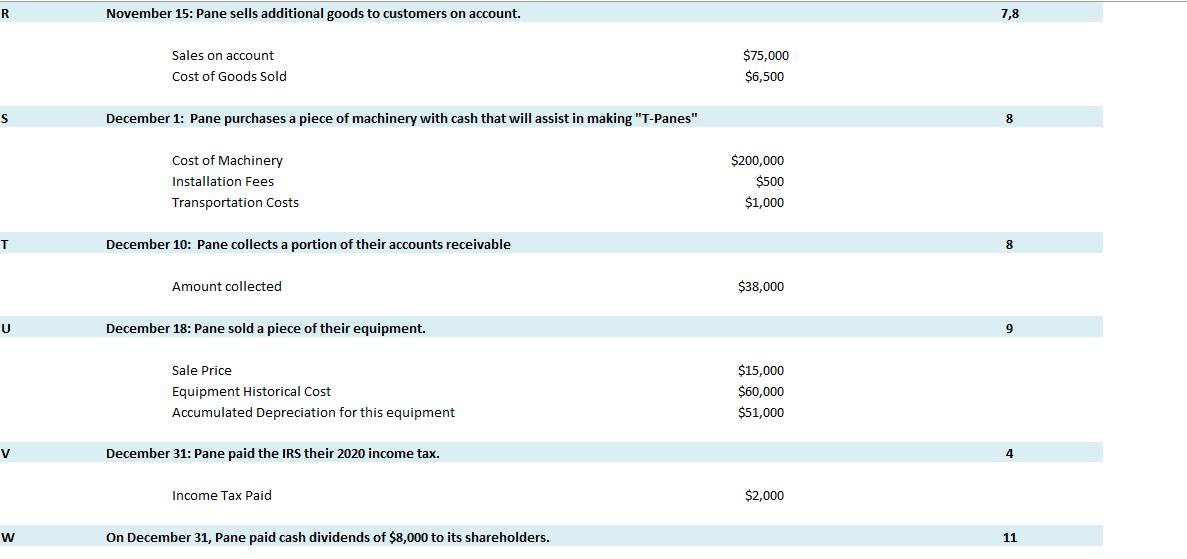

Pane in the Glass Company (Pane) is a glass manufacturer based out of Carlsbad, CA. They produce a number of glass products including car windows and windshields, windows for houses, stained glass windows, and a number of other specialty products. The following information pertains to the fiscal year ending December 31, 2020: At the beginning of the 2020, the company's 1/1/2020 trial balance was as follows: Number Title 100 Cash 110 Accounts Receivable 115 Allowance For Doubtful Accounts 120 Inventory 135 Accumulated Depreciation 140 Equipment 160 Buildings 170 Land 180 Patents 185 Accumulated Amortization 200 Accounts Payable 300 Common Stock 310 Additional Paid In Capital 340 Retained Earnings Debit $ $ es $ ssssssssss $ $ $ $ 1,355,800 125,000 12,345 300,000 462,500 68,535 18,000 Credit $ $ $ sssssssssssss $ $ $ $ 2,342,180 $ Other assumptions for the year a. Depreciation and amortization are computed using the straight line method. 2,500 b. Pane uses a perpetual system to track their inventory. c. Pane uses the percentage of receivables method to estimate their bad debt expense d. Pane has a year end of December 31, 2020 177,400 3,000 200,050 220,000 766,000 973,230 2,342,180 R S T U V W November 15: Pane sells additional goods to customers on account. Sales on account Cost of Goods Sold December 1: Pane purchases a piece of machinery with cash that will assist in making "T-Panes" Cost of Machinery Installation Fees Transportation Costs December 10: Pane collects a portion of their accounts receivable Amount collected December 18: Pane sold a piece of their equipment. Sale Price Equipment Historical Cost Accumulated Depreciation for this equipment December 31: Pane paid the IRS their 2020 income tax. Income Tax Paid On December 31, Pane paid cash dividends of $8,000 to its shareholders. $75,000 $6,500 $200,000 $500 $1,000 $38,000 $15,000 $60,000 $51,000 $2,000 7,8 8 8 9 4 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

All the entries have been done in accordance with the que...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started