Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Panhandle Industries Inc. currently pays an annual common stock dividend of $1.00 per share. The company's dividend has grown steadily over the past 9 years

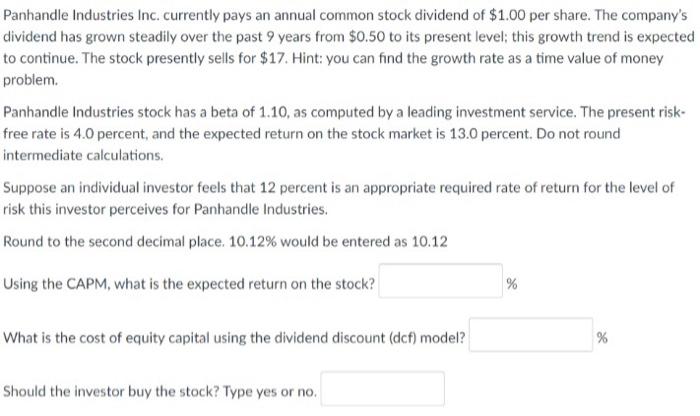

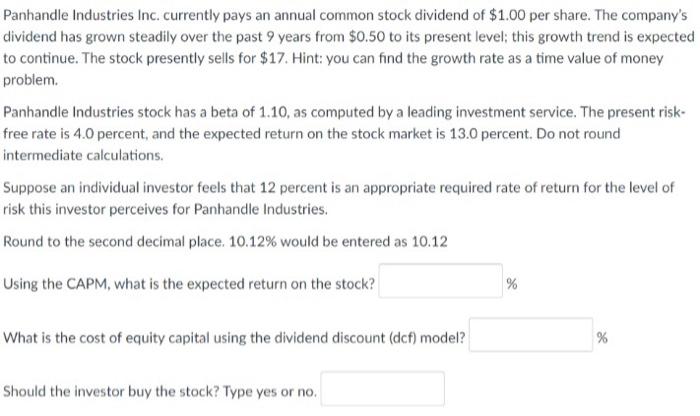

Panhandle Industries Inc. currently pays an annual common stock dividend of $1.00 per share. The company's dividend has grown steadily over the past 9 years from $0.50 to its present level; this growth trend is expected to continue. The stock presently sells for $17. Hint: you can find the growth rate as a time value of money problem. Panhandle Industries stock has a beta of 1.10, as computed by a leading investment service. The present risk- free rate is 4.0 percent, and the expected return on the stock market is 13.0 percent. Do not round intermediate calculations. Suppose an individual investor feels that 12 percent is an appropriate required rate of return for the level of risk this investor perceives for Panhandle Industries. Round to the second decimal place. 10.12% would be entered as 10.12 Using the CAPM, what is the expected return on the stock? What is the cost of equity capital using the dividend discount (dcf) model? Should the investor buy the stock? Type yes or no. % %

Panhandle Industries Inc. currently pays an annual common stock dividend of $1.00 per share. The company's dividend has grown steadily over the past 9 years from $0.50 to its present level; this growth trend is expected to continue. The stock presently sells for $17. Hint: you can find the growth rate as a time value of money problem. Panhandle Industries stock has a beta of 1.10, as computed by a leading investment service. The present risk- free rate is 4.0 percent, and the expected return on the stock market is 13.0 percent. Do not round intermediate calculations. Suppose an individual investor feels that 12 percent is an appropriate required rate of return for the level of risk this investor perceives for Panhandle Industries. Round to the second decimal place. 10.12% would be entered as 10.12 Using the CAPM, what is the expected return on the stock? What is the cost of equity capital using the dividend discount (dcf) model? Should the investor buy the stock? Type yes or no. % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started