Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PanicKingDoom Gamers (PKDM) expects to net ( $ 120 ) million in its forthcoming IPO, the direct costs of which are estimated to be (

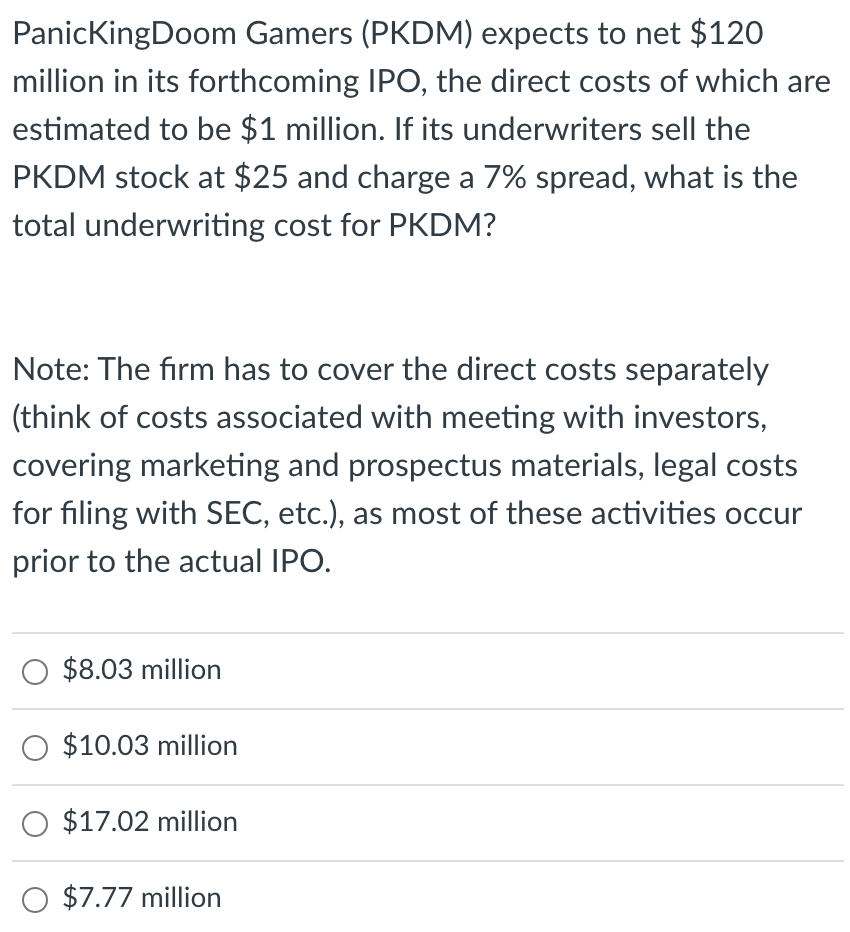

PanicKingDoom Gamers (PKDM) expects to net \\( \\$ 120 \\) million in its forthcoming IPO, the direct costs of which are estimated to be \\( \\$ 1 \\) million. If its underwriters sell the PKDM stock at \\( \\$ 25 \\) and charge a \7 spread, what is the total underwriting cost for PKDM? Note: The firm has to cover the direct costs separately (think of costs associated with meeting with investors, covering marketing and prospectus materials, legal costs for filing with SEC, etc.), as most of these activities occur prior to the actual IPO. \\( \\$ 8.03 \\) million \\$10.03 million \\$17.02 million \\( \\$ 7.77 \\) million

PanicKingDoom Gamers (PKDM) expects to net \\( \\$ 120 \\) million in its forthcoming IPO, the direct costs of which are estimated to be \\( \\$ 1 \\) million. If its underwriters sell the PKDM stock at \\( \\$ 25 \\) and charge a \7 spread, what is the total underwriting cost for PKDM? Note: The firm has to cover the direct costs separately (think of costs associated with meeting with investors, covering marketing and prospectus materials, legal costs for filing with SEC, etc.), as most of these activities occur prior to the actual IPO. \\( \\$ 8.03 \\) million \\$10.03 million \\$17.02 million \\( \\$ 7.77 \\) million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started