Answered step by step

Verified Expert Solution

Question

1 Approved Answer

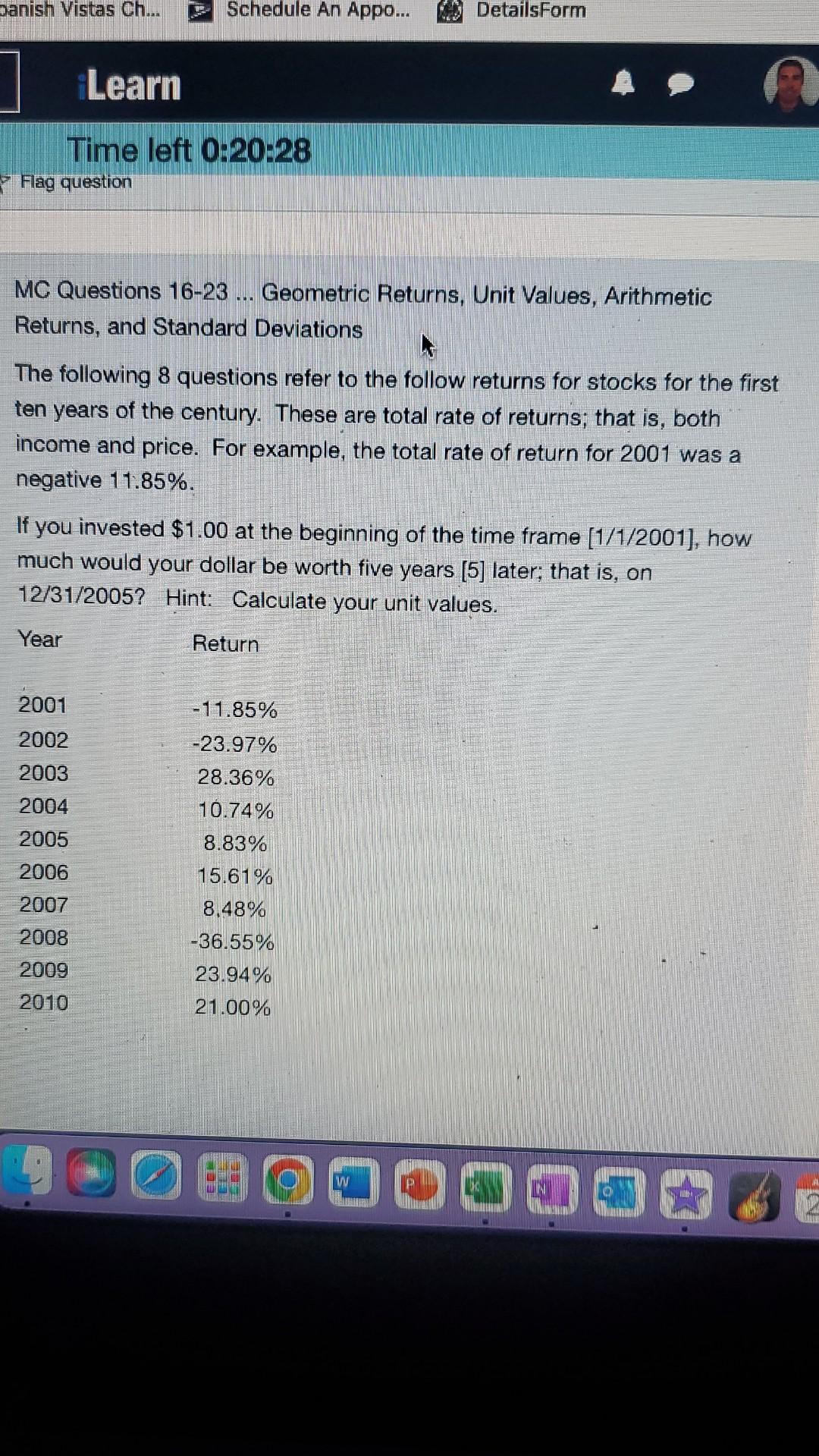

panish Vistas Ch... Schedule An Appo... DetailsForm Learn Time left 0:20:28 Flag question MC Questions 16-23 ... Geometric Returns, Unit Values, Arithmetic Returns, and Standard

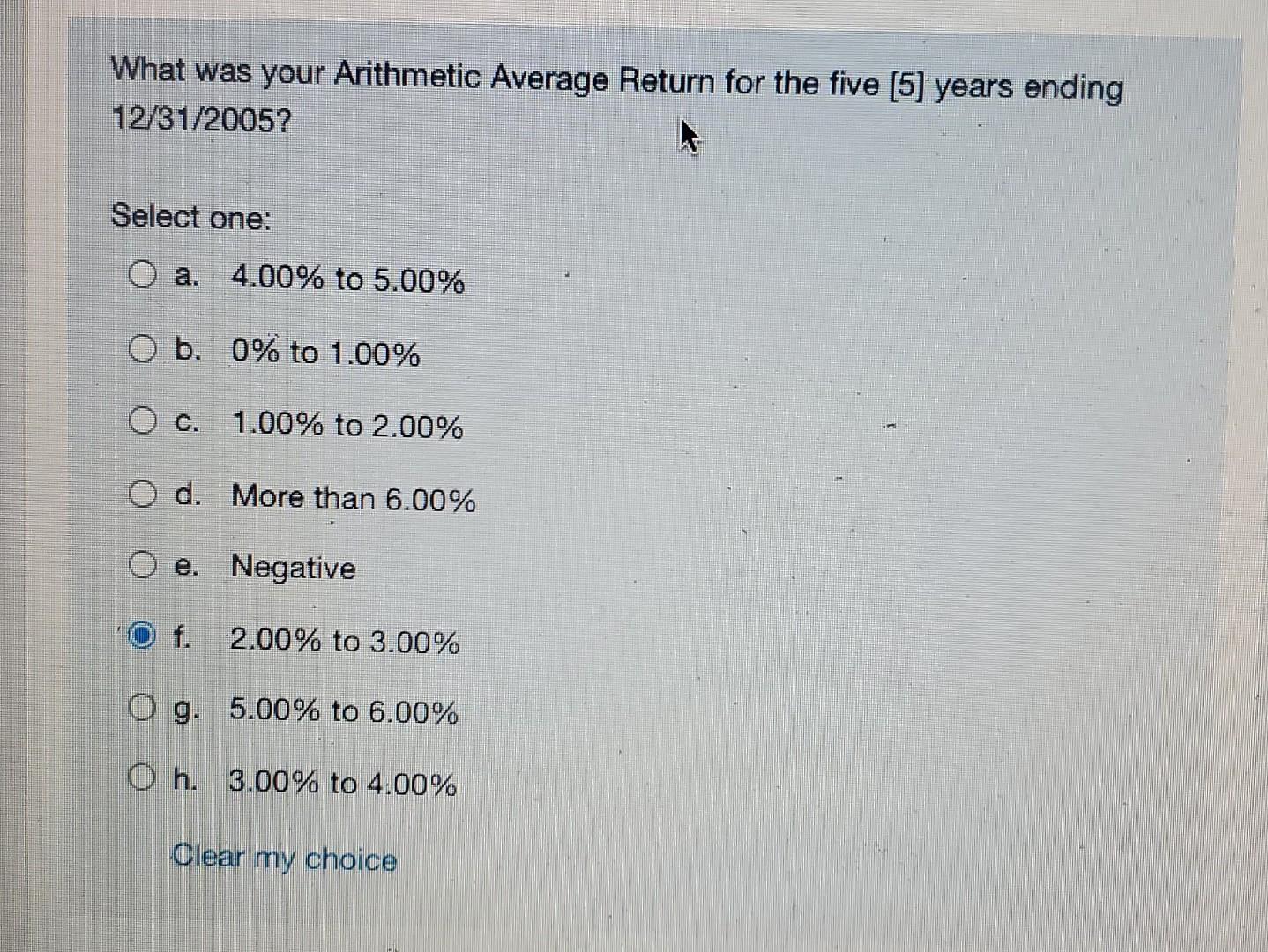

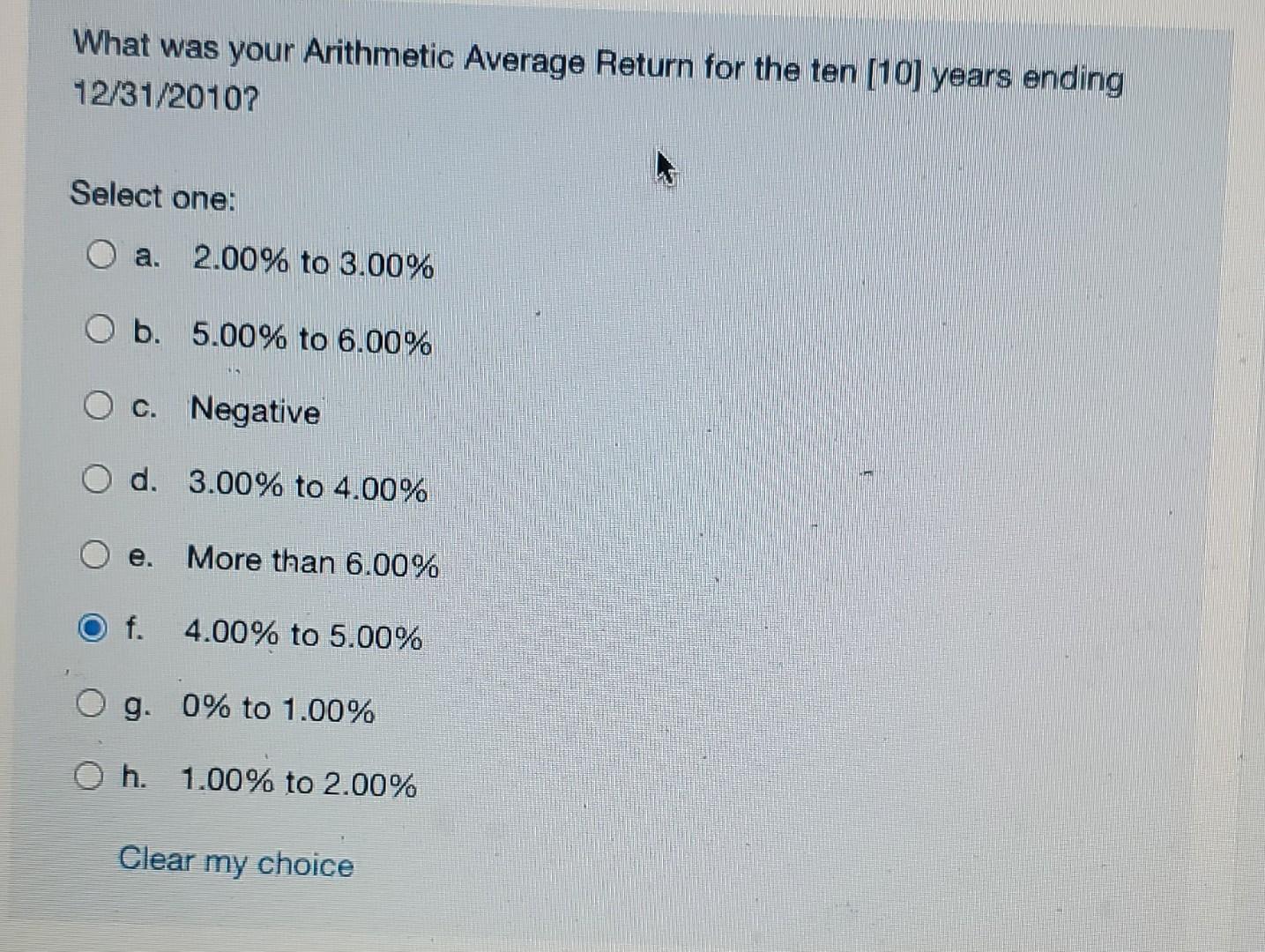

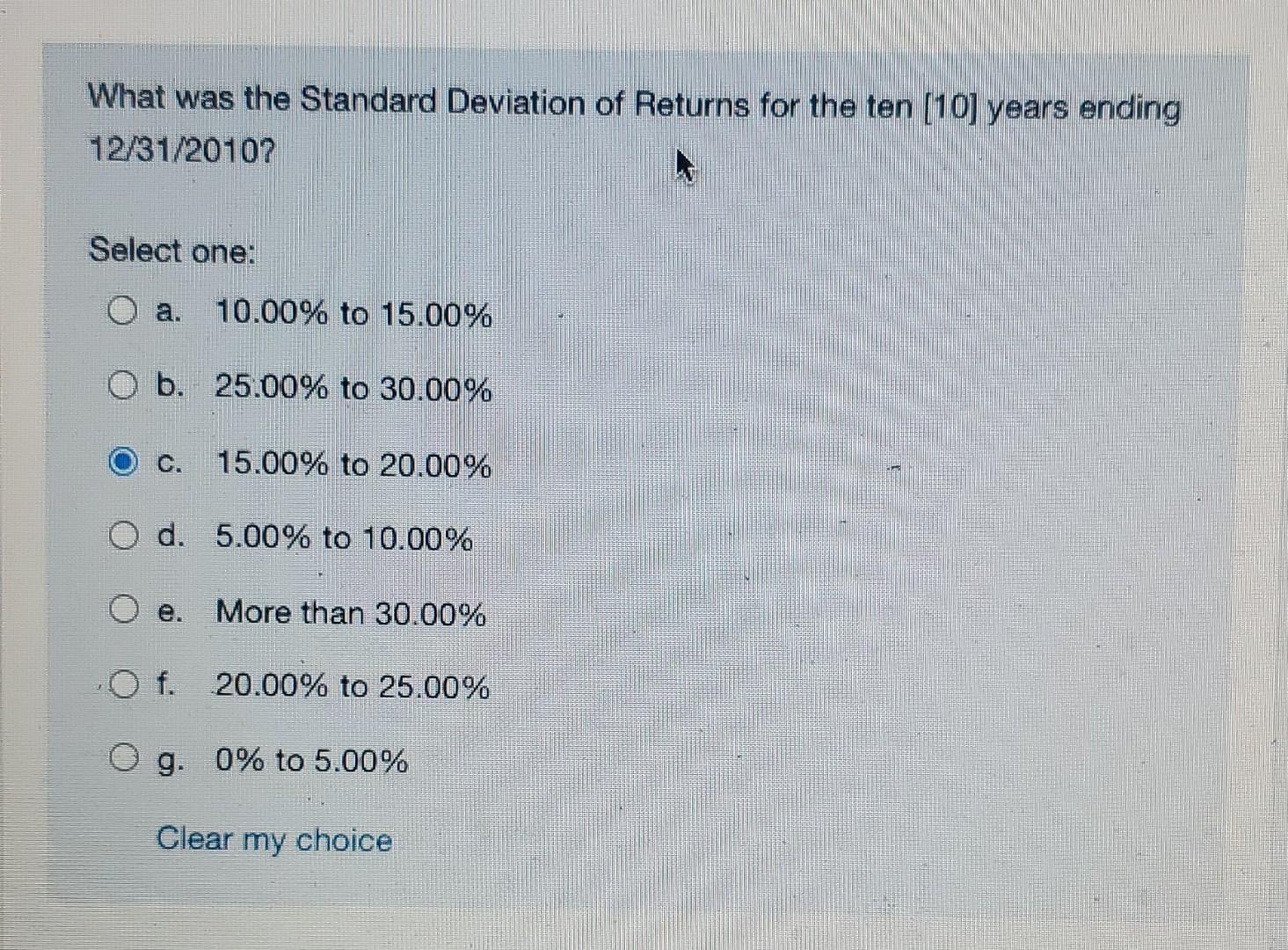

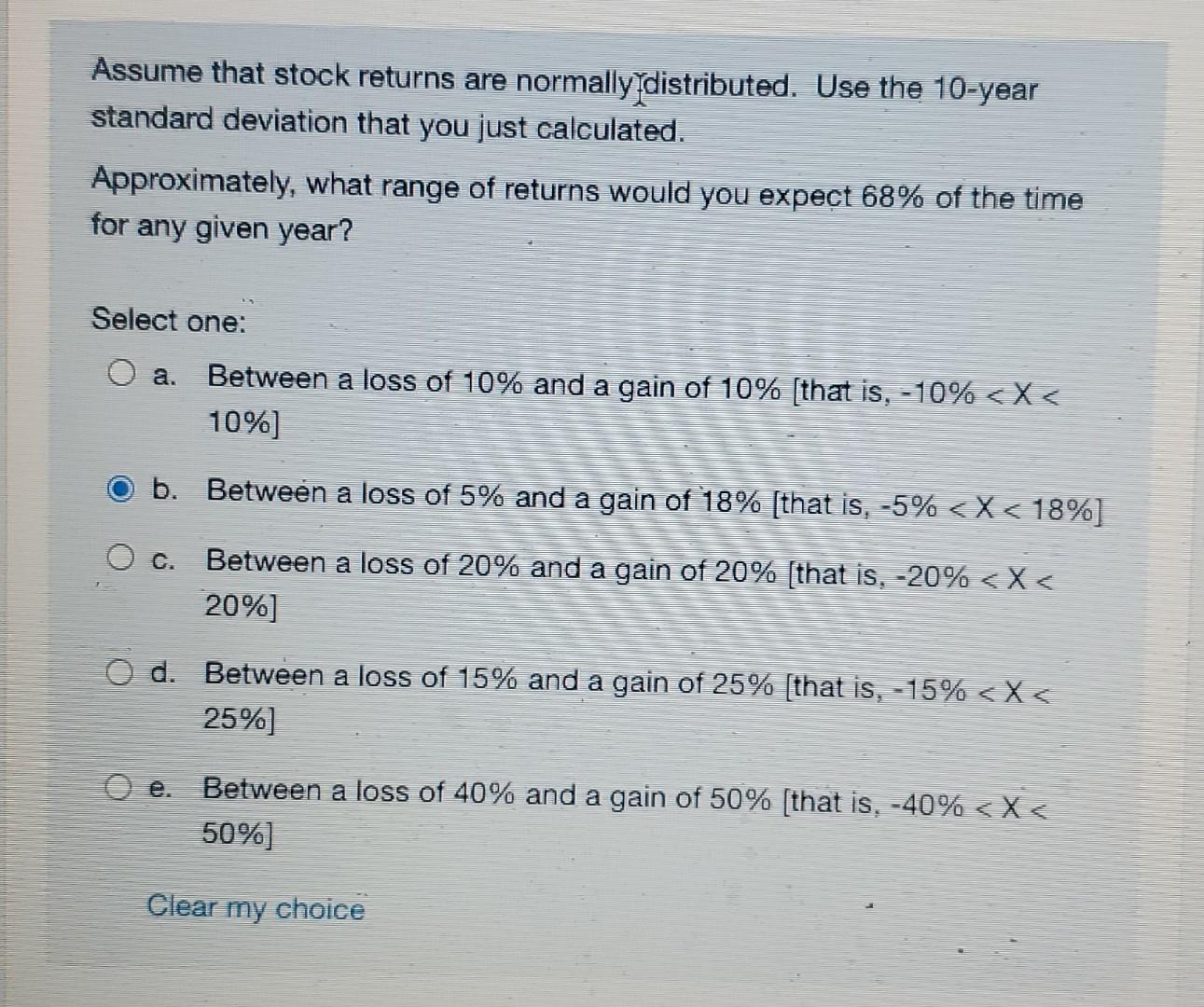

panish Vistas Ch... Schedule An Appo... DetailsForm Learn Time left 0:20:28 Flag question MC Questions 16-23 ... Geometric Returns, Unit Values, Arithmetic Returns, and Standard Deviations The following 8 questions refer to the follow returns for stocks for the first ten years of the century. These are total rate of returns; that is, both income and price. For example, the total rate of return for 2001 was a negative 11.85%. If you invested $1.00 at the beginning of the time frame (1/1/2001), how much would your dollar be worth five years (5) later; that is, on 12/31/2005? Hint: Calculate your unit values. Year Return 2001 -11.85% 2002 2003 2004 2005 2006 -23.97% 28.36% 10.74% 8.83% 15.61% 8.48% -36.55% 23.94% 21.00% 2007 2008 2009 2010 09 W What was your Arithmetic Average Return for the five (5) years ending 12/31/2005? Select one: O a. 4.00% to 5.00% O b. 0% to 1.00% O c. 1.00% to 2.00% O d. More than 6.00% O e. Negative O f. 2.00% to 3.00% O g. 5.00% to 6.00% O h. 3.00% to 4.00% Clear my choice What was your Arithmetic Average Return for the ten (10) years ending 12/31/20102 Select one: a. 2.00% to 3.00% O b. 5.00% to 6.00% O c. Negative O d. 3.00% to 4.00% e. More than 6.00% f. 4.00% to 5.00% g. 0% to 1.00% O h. 1.00% to 2.00% Clear my choice What was the Standard Deviation of Returns for the ten (10) years ending 12/31/20102 Select one: 10.00% to 15.00% b. 25.00% to 30.00% 15.00% to 20.00% d. 5.00% to 10.00% More than 30.00% , f. 20.00% to 25.00% g. 0% to 5.00% Clear my choice Assume that stock returns are normally distributed. Use the 10-year standard deviation that you just calculated. Approximately, what range of returns would you expect 68% of the time for any given year? Select one: a. Between a loss of 10% and a gain of 10% (that is, -10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started