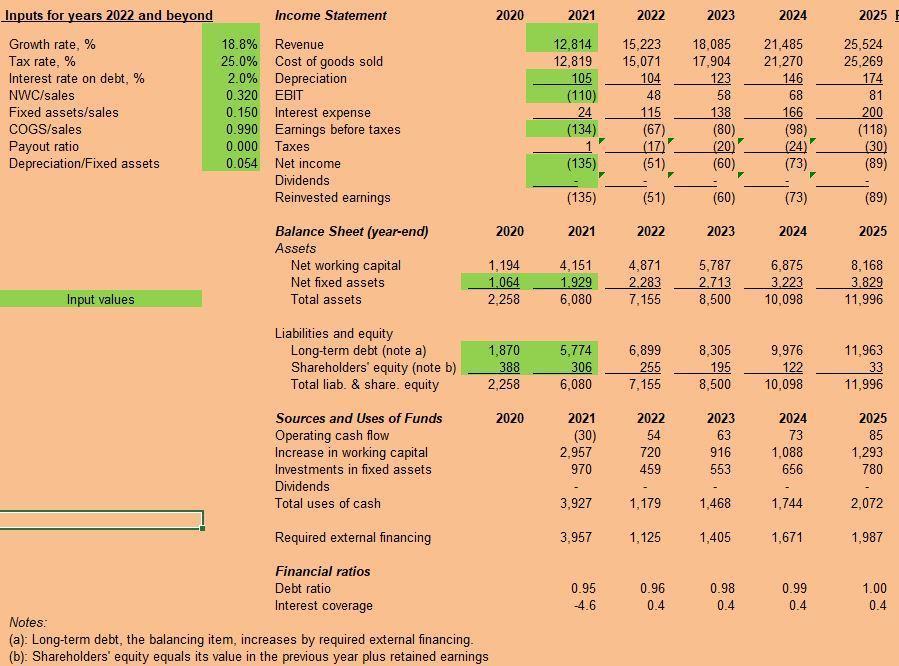

Based on the given income statement for 2021: 1. Based on recent fiscal year financials use a percentage of sales model to estimate your

Based on the given income statement for 2021:

1. Based on recent fiscal year financials use a percentage of sales model to estimate your firm's sales, net income, debt and equity in the next fiscal year.

2. Calculate an internal growth rate for your firm.

3. Calculate a sustainable growth rate for your firm.

4. Based on your analysis recommend a short- and long-term financing plan for your firm in the next fiscal year.

Inputs for years 2022 and beyond Growth rate, % Tax rate, % Interest rate on debt, % NWC/sales Fixed assets/sales COGS/sales Payout ratio Depreciation/Fixed assets Input values Income Statement Revenue Cost of goods sold 18.8% 25.0% 2.0% Depreciation 0.320 0.150 0.990 0.000 Taxes 0.054 EBIT Interest expense Earnings before taxes Net income Dividends Reinvested earnings Balance Sheet (year-end) Assets Net working capital Net fixed assets Total assets Liabilities and equity Long-term debt (note a) Shareholders' equity (note b) Total liab. & share. equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets Dividends Total uses of cash Required external financing Financial ratios Debt ratio Interest coverage 2020 2020 1,194 1,064 2,258 Notes: (a): Long-term debt, the balancing item, increases by required external financing. (b): Shareholders' equity equals its value in the previous year plus retained earnings 1,870 388 2,258 2020 2021 2022 12,814 15,223 12,819 15,071 105 104 (110) 48 24 115 (134) (135) (135) 2021 4,151 1,929 6,080 5,774 306 6,080 2021 (30) 2,957 970 3,927 3,957 0.95 -4.6 A (67) (17) (51) (51) 2022 4,871 2,283 7,155 6,899 255 7,155 2022 54 720 459 1,179 1,125 0.96 0.4 2023 18,085 17,904 123 58 138 (80) (20) (60) (60) 2023 8,305 195 8,500 2023 63 916 553 1,468 5,787 6,875 2,713 3,223 8,500 10,098 1,405 4 0.98 0.4 2024 21,485 21,270 146 68 166 (98) (24) (73) (73) 2024 9,976 122 10,098 2024 73 1,088 656 1,744 1,671 0.99 0.4 NE 2025 F 25,524 25,269 174 81 200 (118) (30) (89) (89) 2025 8,168 3.829 11,996 11,963 33 11,996 2025 85 1,293 780 2,072 1,987 1.00 0.4

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The image you provided contains financial information for a hypothetical company which includes an income statement and a balance sheet for the years 2020 through 2025 as well as certain assumptions f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started