Question

Papa Inc. acquired the net assets of Fafa Inc. on June 30, 2018 in a business combination. The cost of acquisition is P2,000,000 more

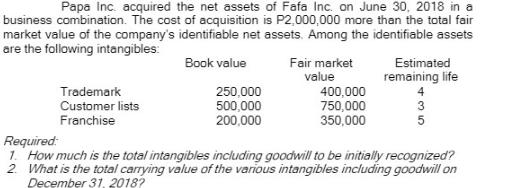

Papa Inc. acquired the net assets of Fafa Inc. on June 30, 2018 in a business combination. The cost of acquisition is P2,000,000 more than the total fair market value of the company's identifiable net assets. Among the identifiable assets are the following intangibles: Book value Trademark Customer lists Franchise 250,000 500,000 200,000 Fair market value 400,000 750,000 350,000 Estimated remaining life 3 5 Required: 1. How much is the total intangibles including goodwill to be initially recognized? 2. What is the total carrying value of the various intangibles including goodwill on December 31, 2018?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the total intangibles including goodwill to be initially recognized we need to determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra Jeter, Paul Chaney

6th edition

978-1118742945, 111874294X, 978-1119045946, 1119045940, 978-1119119364

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App