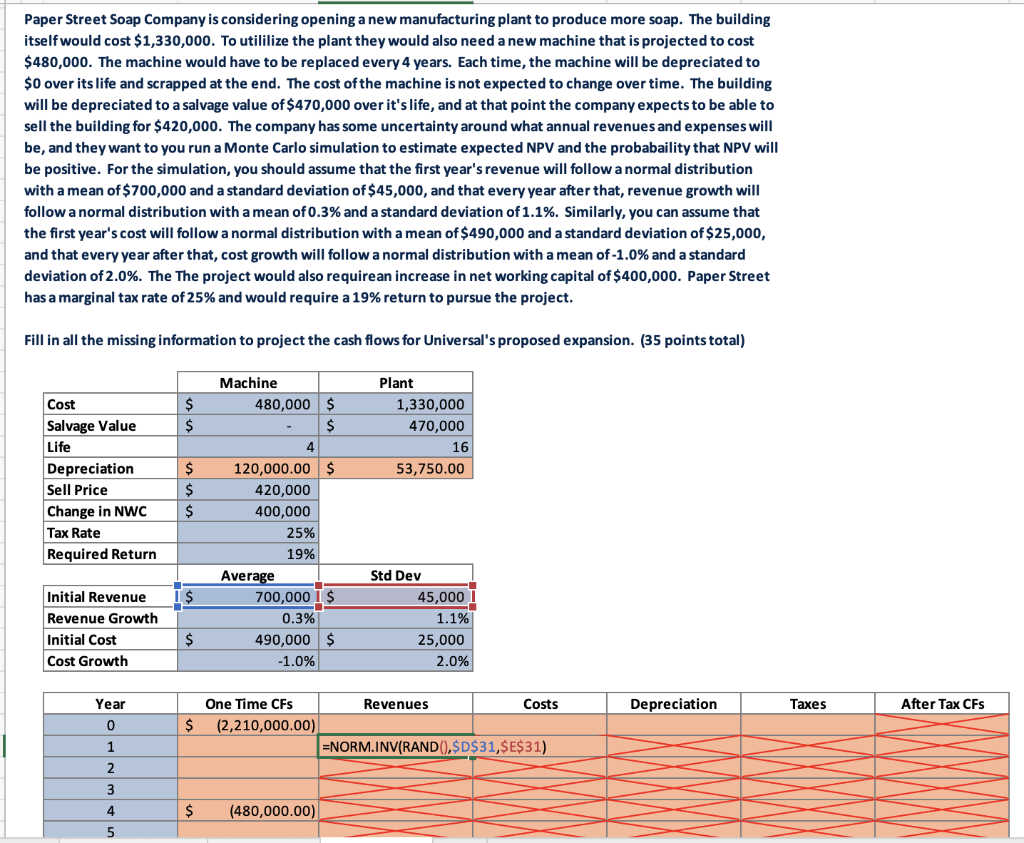

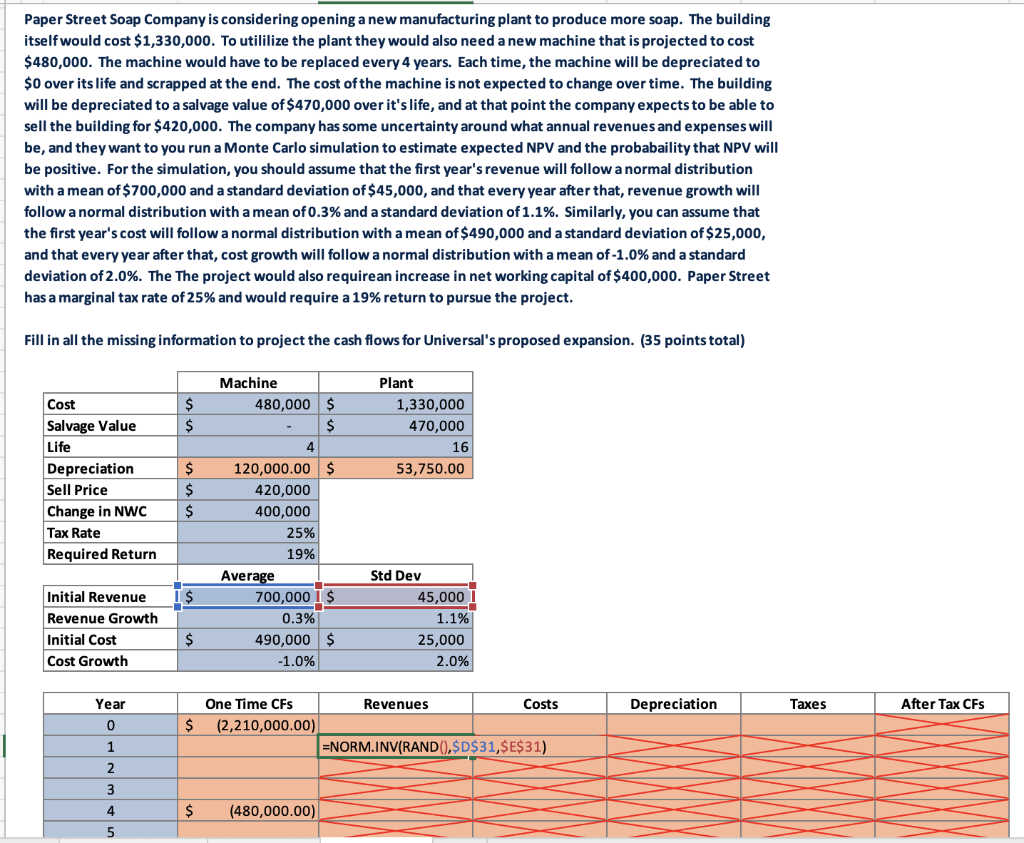

Paper Street Soap Company is considering opening a new manufacturing plant to produce more soap. The building itself would cost $1,330,000. To utililize the plant they would also need a new machine that is projected to cost $480,000. The machine would have to be replaced every 4 years. Each time, the machine will be depreciated to $0 over its life and scrapped at the end. The cost of the machine is not expected to change over time. The building will be depreciated to a salvage value of $470,000 over it's life, and at that point the company expects to be able to sell the building for $420,000. The company has some uncertainty around what annual revenues and expenses will be, and they want to you run a Monte Carlo simulation to estimate expected NPV and the probabaility that NPV will be positive. For the simulation, you should assume that the first year's revenue will follow a normal distribution with a mean of $700,000 and a standard deviation of $45,000, and that every year after that, revenue growth will follow a normal distribution with a mean of 0.3% and a standard deviation of 1.1%. Similarly, you can assume that the first year's cost will follow a normal distribution with a mean of $490,000 and a standard deviation of $25,000, and that every year after that, cost growth will follow a normal distribution with a mean of -1.0% and a standard deviation of 2.0%. The The project would also require an increase in net working capital of $400,000. Paper Street has a marginal tax rate of 25% and would require a 19% return to pursue the project. Fill in all the missing information to project the cash flows for Universal's proposed expansion. (35 points total) Machine Plant Cost $ 480,000 $ 1,330,000 470,000 $ - $ Salvage Value Life 4 16 Depreciation $ 120,000.00 $ 53,750.00 Sell Price $ 420,000 Change in NWC $ 400,000 Tax Rate 25% Required Return 19% Initial Revenue 700,000 $ Revenue Growth Initial Cost 0.3% 490,000 $ -1.0% Cost Growth Depreciation Year 0 1 2 3 4 5 $ $ Average One Time CFs $ (2,210,000.00) $ (480,000.00) Std Dev 45,000 1.1% 25,000 2.0% Revenues Costs =NORM.INV(RAND(), $D$31,$E$31) Taxes After Tax CFs Paper Street Soap Company is considering opening a new manufacturing plant to produce more soap. The building itself would cost $1,330,000. To utililize the plant they would also need a new machine that is projected to cost $480,000. The machine would have to be replaced every 4 years. Each time, the machine will be depreciated to $0 over its life and scrapped at the end. The cost of the machine is not expected to change over time. The building will be depreciated to a salvage value of $470,000 over it's life, and at that point the company expects to be able to sell the building for $420,000. The company has some uncertainty around what annual revenues and expenses will be, and they want to you run a Monte Carlo simulation to estimate expected NPV and the probabaility that NPV will be positive. For the simulation, you should assume that the first year's revenue will follow a normal distribution with a mean of $700,000 and a standard deviation of $45,000, and that every year after that, revenue growth will follow a normal distribution with a mean of 0.3% and a standard deviation of 1.1%. Similarly, you can assume that the first year's cost will follow a normal distribution with a mean of $490,000 and a standard deviation of $25,000, and that every year after that, cost growth will follow a normal distribution with a mean of -1.0% and a standard deviation of 2.0%. The The project would also require an increase in net working capital of $400,000. Paper Street has a marginal tax rate of 25% and would require a 19% return to pursue the project. Fill in all the missing information to project the cash flows for Universal's proposed expansion. (35 points total) Machine Plant Cost $ 480,000 $ 1,330,000 470,000 $ - $ Salvage Value Life 4 16 Depreciation $ 120,000.00 $ 53,750.00 Sell Price $ 420,000 Change in NWC $ 400,000 Tax Rate 25% Required Return 19% Initial Revenue 700,000 $ Revenue Growth Initial Cost 0.3% 490,000 $ -1.0% Cost Growth Depreciation Year 0 1 2 3 4 5 $ $ Average One Time CFs $ (2,210,000.00) $ (480,000.00) Std Dev 45,000 1.1% 25,000 2.0% Revenues Costs =NORM.INV(RAND(), $D$31,$E$31) Taxes After Tax CFs