Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pappu Limited with its head office in Kolkata invoiced goods to its branch at Mumbai at 20% less than the catalogue price which is

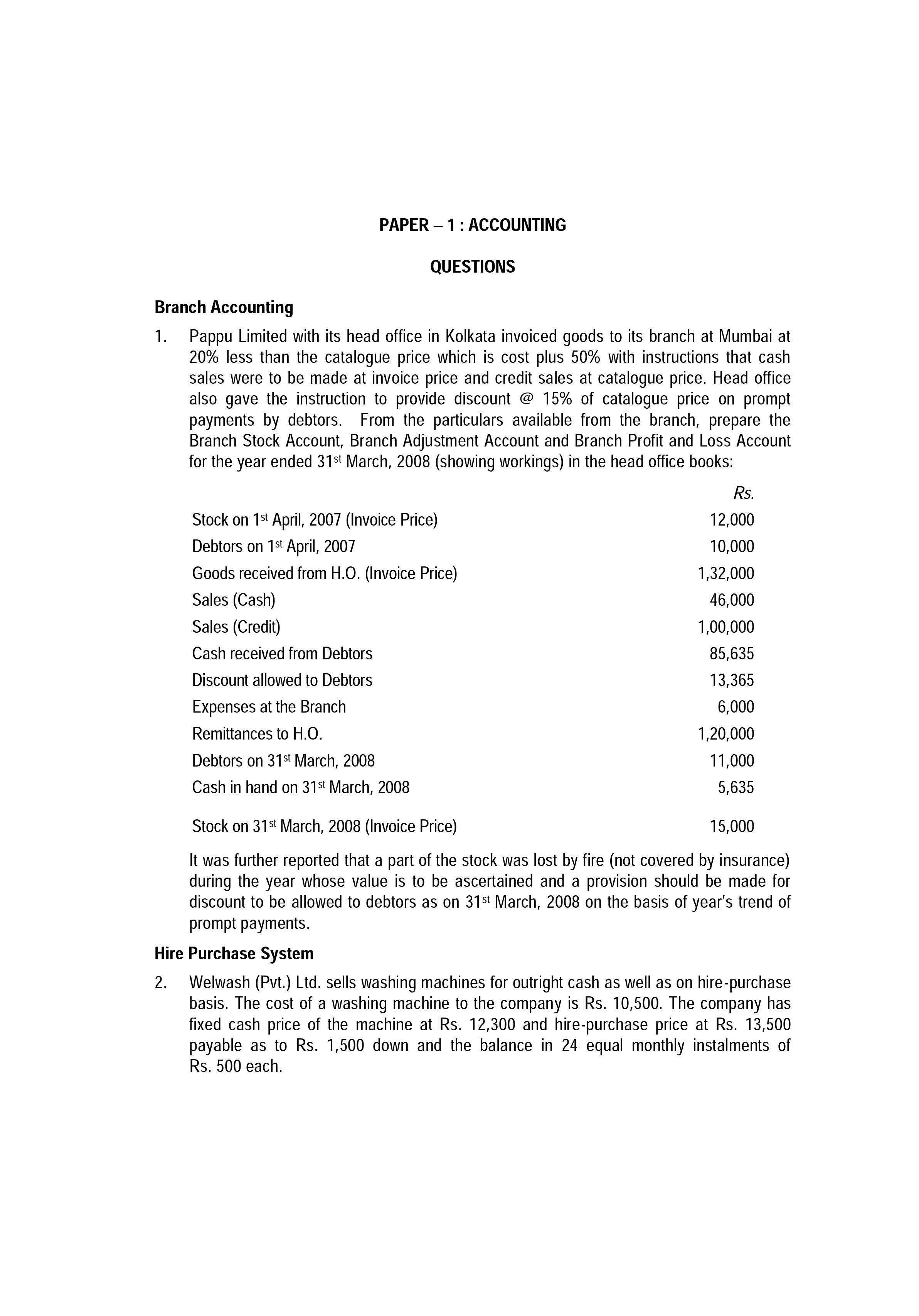

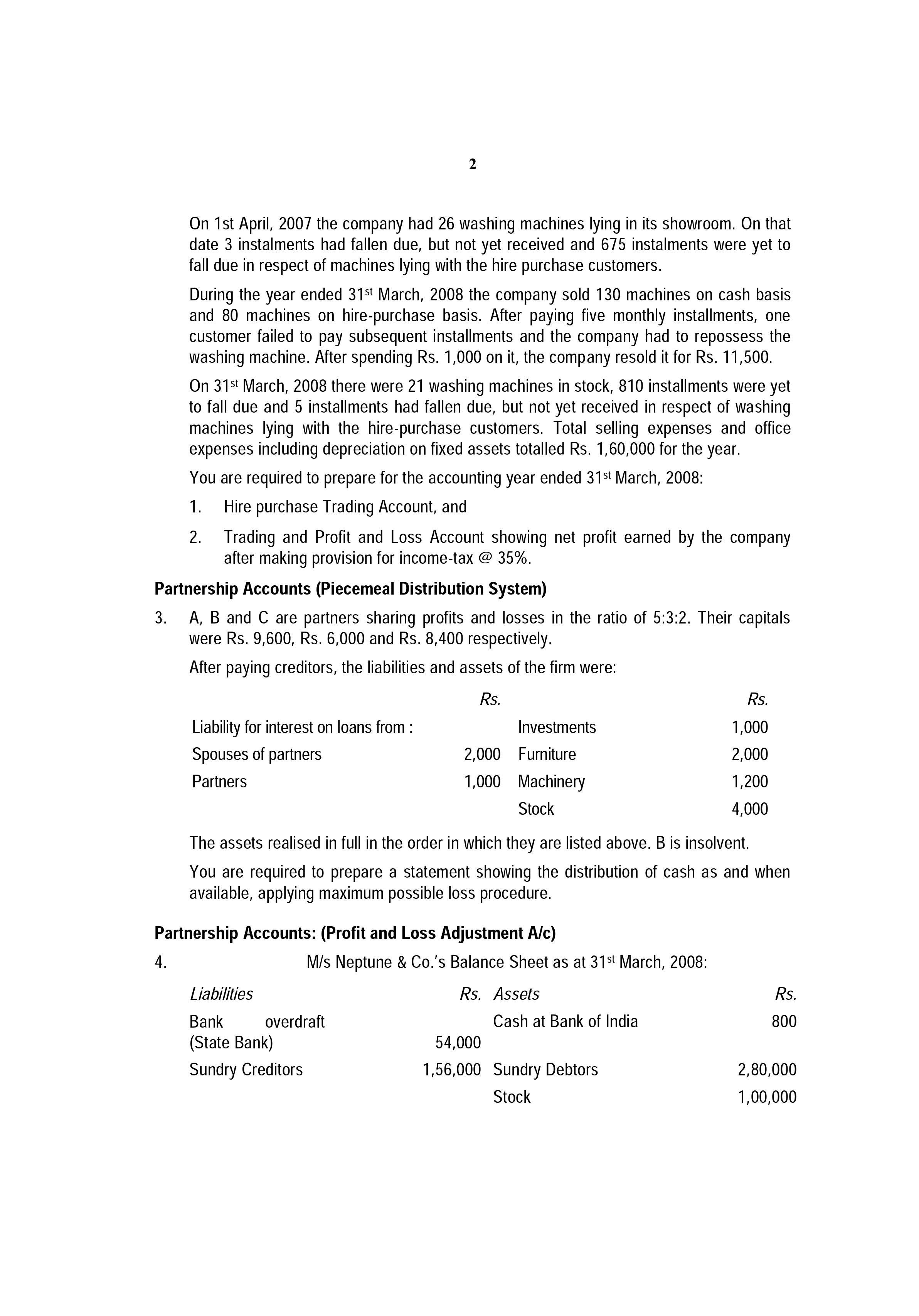

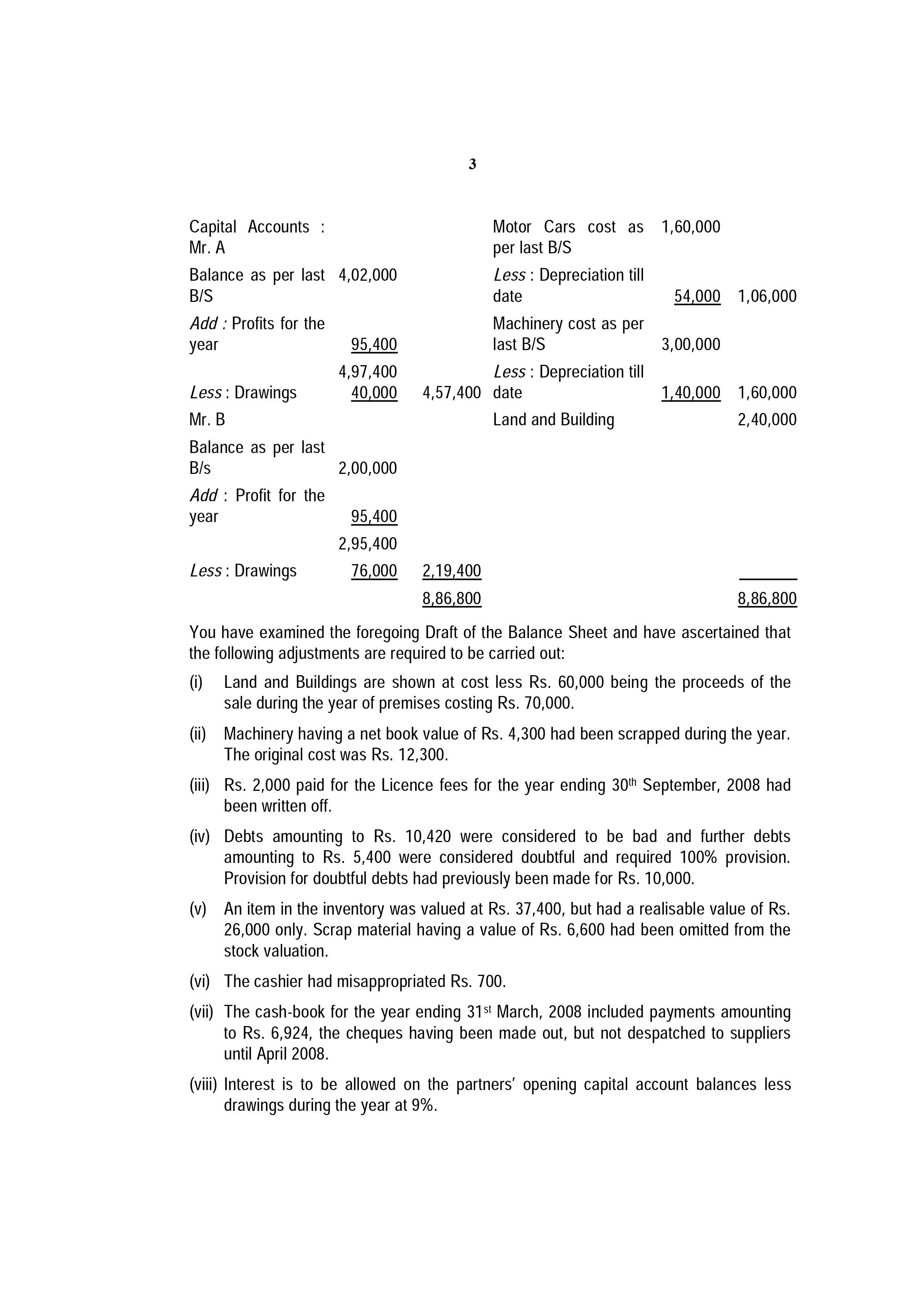

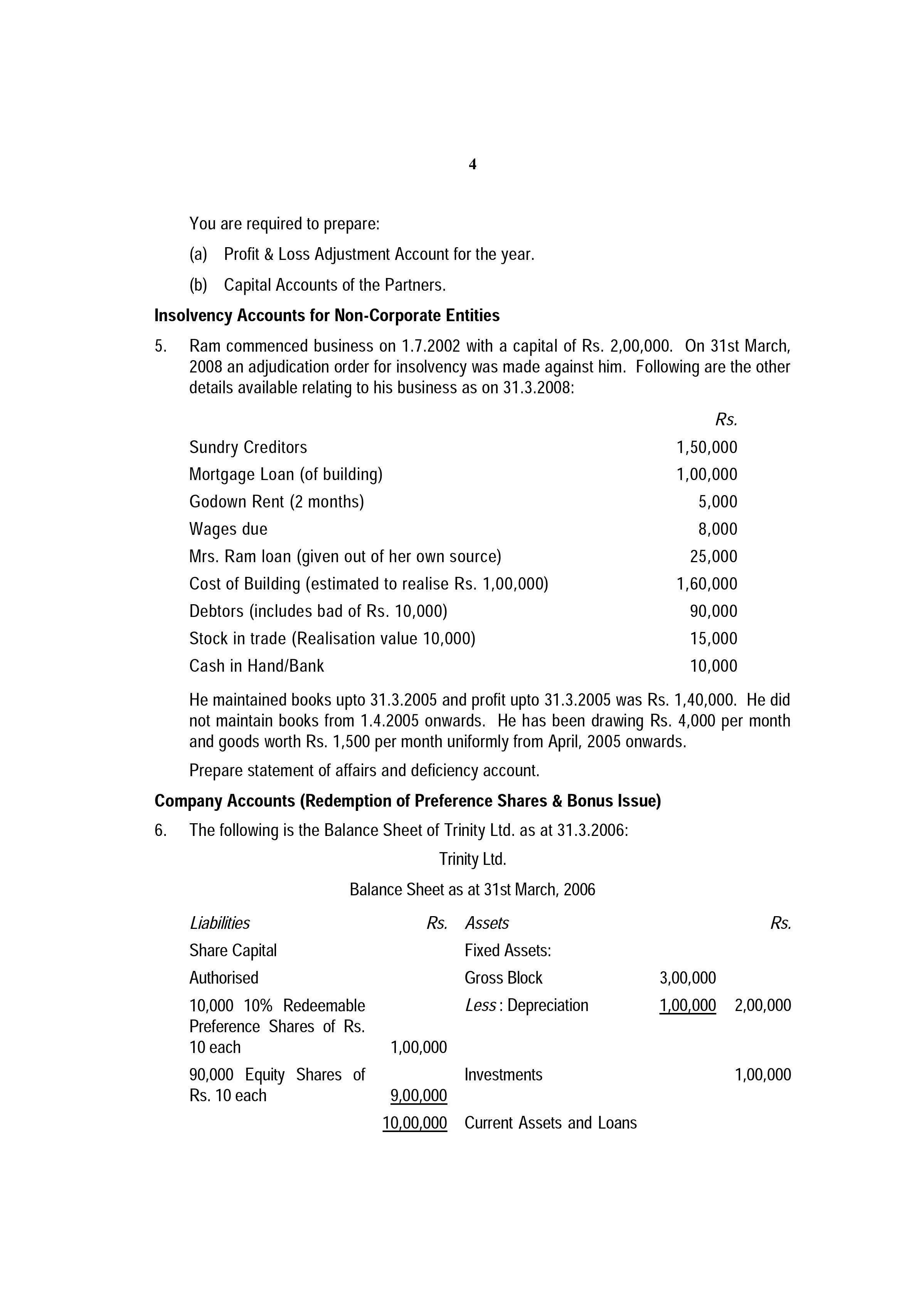

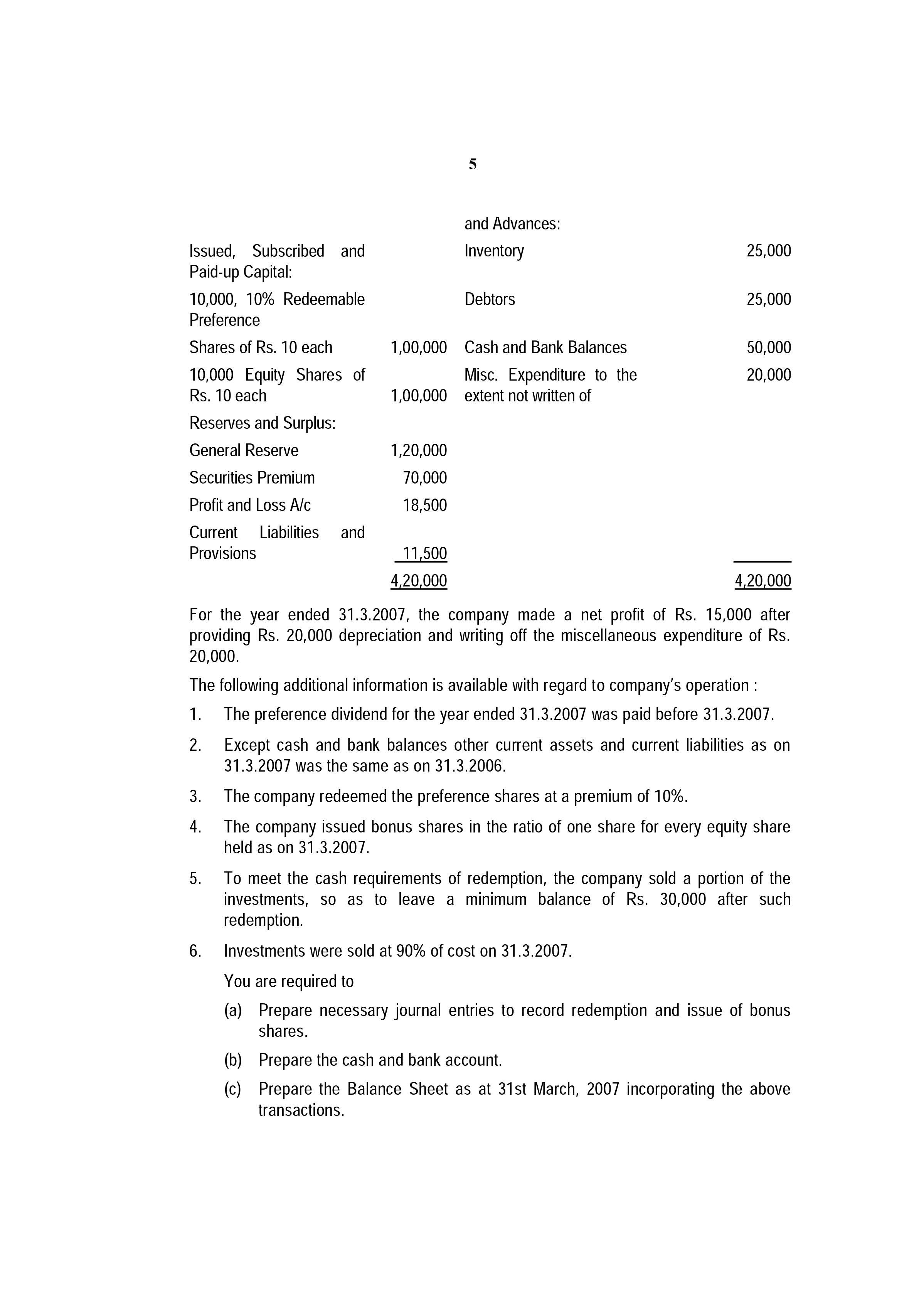

Pappu Limited with its head office in Kolkata invoiced goods to its branch at Mumbai at 20% less than the catalogue price which is cost plus 50% with instructions that cas sales were to be made at invoice price and credit sales at catalogue price. Head office also gave the instruction to provide discount @ 15% of catalogue price on prompt payments by debtors. From the particulars available from the branch, prepare the Branch Stock Account, Branch Adjustment Account and Branch Profit and Loss Account for the year ended 31st March, 2008 (showing workings) in the head office books: Stock on 1st April, 2007 (Invoice Price) Debtors on 1st April, 2007 Goods received from H.O. (Invoice Price) Sales (Cash) Sales (Credit) Cash received from Debtors Discount allowed to Debtors Expenses at the Branch Remittances to H.O. Debtors on 31st March, 2008 Cash in hand on 31st March, 2008 Rs. 12,000 10,000 1,32,000 46,000 1,00,000 85,635 13,365 6,000 1,20,000 11,000 5,635 Stock on 31st March, 2008 (Invoice Price) It was further reported that a part of the stock was lost by fire (not covered by insurance) during the year whose value is to be ascertained and a provision should be made for discount to be allowed to debtors as on 31st March, 2008 on the basis of year's trend of prompt payments. Hire Purchase System 15,000 2. Welwash (Pvt.) Ltd. sells washing machines for outright cash as well as on hire-purchase basis. The cost of a washing machine to the company is Rs. 10,500. The company has fixed cash price of the machine at Rs. 12,300 and hire-purchase price at Rs. 13,500 payable as to Rs. 1,500 down and the balance in 24 equal monthly instalments of Rs. 500 each. On 1st April, 2007 the company had 26 washing machines lying in its showroom. On that date 3 instalments had fallen due, but not yet received and 675 instalments were yet to fall due in respect of machines lying with the hire purchase customers. 4. During the year ended 31st March, 2008 the company sold 130 machines on cash basis and 80 machines on hire-purchase basis. After paying five monthly installments, one customer failed to pay subsequent installments and the company had to repossess the washing machine. After spending Rs. 1,000 on it, the company resold it for Rs. 11,500. 2 On 31st March, 2008 there were 21 washing machines in stock, 810 installments were yet to fall due and 5 installments had fallen due, but not yet received in respect of washing machines lying with the hire-purchase customers. Total selling expenses and office expenses including depreciation on fixed assets totalled Rs. 1,60,000 for the year. You are required to prepare for the accounting year ended 31st March, 2008: 1. Hire purchase Trading Account, and 2. Trading and Profit and Loss Account showing net profit earned by the company after making provision for income-tax @ 35%. Partnership Accounts (Piecemeal Distribution System) 3. A, B and C are partners sharing profits and losses in the ratio of 5:3:2. Their capitals were Rs. 9,600, Rs. 6,000 and Rs. 8,400 respectively. After paying creditors, the liabilities and assets of the firm were: Rs. Liability for interest on loans from : Spouses of partners Partners Liabilities Bank (State Bank) Sundry Creditors 2,000 1,000 Partnership Accounts: (Profit and Loss Adjustment A/c) Investments Furniture Machinery Stock The assets realised in full in the order in which they are listed above. B is insolvent. You are required to prepare a statement showing the distribution of cash as and when available, applying maximum possible loss procedure. overdraft M/s Neptune & Co.'s Balance Sheet as at 31st March, 2008: Rs. Assets Cash at Bank of India Rs. 1,000 2,000 1,200 4,000 54,000 1,56,000 Sundry Debtors Stock Rs. 800 2,80,000 1,00,000 Capital Accounts : Mr. A Balance as per last 4,02,000 B/S Add: Profits for the year Less: Drawings Mr. B Balance as per last B/s Add Profit for the year Less: Drawings 95,400 4,97,400 40,000 2,00,000 95,400 2,95,400 76,000 3 Motor Cars cost as per last B/S 2,19,400 8,86,800 Less: Depreciation till date Machinery cost as per last B/S Less: Depreciation till 4,57,400 date Land and Building 1,60,000 54,000 1,06,000 3,00,000 1,40,000 1,60,000 2,40,000 8,86,800 You have examined the foregoing Draft of the Balance Sheet and have ascertained that the following adjustments are required to be carried out: (i) Land and Buildings are shown at cost less Rs. 60,000 being the proceeds of the sale during the year of premises costing Rs. 70,000. (ii) Machinery having a net book value of Rs. 4,300 had been scrapped during the year. The original cost was Rs. 12,300. (iii) Rs. 2,000 paid for the Licence fees for the year ending 30th September, 2008 had been written off. (iv) Debts amounting to Rs. 10,420 were considered to be bad and further debts amounting to Rs. 5,400 were considered doubtful and required 100% provision. Provision for doubtful debts had previously been made for Rs. 10,000. (v) An item in the inventory was valued at Rs. 37,400, but had a realisable value of Rs. 26,000 only. Scrap material having a value of Rs. 6,600 had been omitted from the stock valuation. (vi) The cashier had misappropriated Rs. 700. (vii) The cash-book for the year ending 31st March, 2008 included payments amounting to Rs. 6,924, the cheques having been made out, but not despatched to suppliers until April 2008. (viii) Interest is to be allowed on the partners' opening capital account balances less drawings during the year at 9%. You are required to prepare: (a) Profit & Loss Adjustment Account for the year. (b) Capital Accounts of the Partners. Insolvency Accounts for Non-Corporate Entities Ram commenced business on 1.7.2002 with a capital of Rs. 2,00,000. On 31st March, 2008 an adjudication order for insolvency was made against him. Following are the other details available relating to his business as on 31.3.2008: 5. Sundry Creditors Mortgage Loan (of building) Godown Rent (2 months) Wages due Mrs. Ram loan (given out of her own source) Cost of Building (estimated to realise Rs. 1,00,000) Debtors (includes bad of Rs. 10,000) Stock in trade (Realisation value 10,000) Cash in Hand/Bank He maintained books upto 31.3.2005 and profit upto 31.3.2005 was Rs. 1,40,000. He did not maintain books from 1.4.2005 onwards. He has been drawing Rs. 4,000 per month and goods worth Rs. 1,500 per month uniformly from April, 2005 onwards. Prepare statement of affairs and deficiency account. Company Accounts (Redemption of Preference Shares & Bonus Issue) 6. The following is the Balance Sheet of Trinity Ltd. as at 31.3.2006: Trinity Ltd. Balance Sheet as at 31st March, 2006 Liabilities Share Capital Authorised 10,000 10% Redeemable Preference Shares of Rs. 10 each 90,000 Equity Shares of Rs. 10 each Rs. Assets 1,00,000 Fixed Assets: Gross Block Less: Depreciation Investments Rs. 1,50,000 1,00,000 5,000 8,000 25,000 1,60,000 90,000 15,000 10,000 9,00,000 10,00,000 Current Assets and Loans Rs. 3,00,000 1,00,000 2,00,000 1,00,000 Issued, Subscribed and Paid-up Capital: 10,000, 10% Redeemable Preference Shares of Rs. 10 each 10,000 Equity Shares of Rs. 10 each Reserves and Surplus: General Reserve Securities Premium Profit and Loss A/c Current Liabilities Provisions 3. 4. 5. and 6. 5 1,20,000 70,000 18,500 (b) (c) and Advances: Inventory 1,00,000 Cash and Bank Balances Misc. Expenditure to the 11,500 4,20,000 Debtors 1,00,000 extent not written of 4,20,000 For the year ended 31.3.2007, the company made a net profit of Rs. 15,000 after providing Rs. 20,000 depreciation and writing off the miscellaneous expenditure of Rs. 20,000. 25,000 The following additional information is available with regard to company's operation : 1. 2. The preference dividend for the year ended 31.3.2007 was paid before 31.3.2007. Except cash and bank balances other current assets and current liabilities as on 31.3.2007 was the same as on 31.3.2006. 25,000 50,000 20,000 The company redeemed the preference shares at a premium of 10%. The company issued bonus shares in the ratio of one share for every equity share held as on 31.3.2007. To meet the cash requirements of redemption, the company sold a portion of the investments, so as to leave a minimum balance of Rs. 30,000 after such redemption. Investments were sold at 90% of cost on 31.3.2007. You are required to (a) Prepare necessary journal entries to record redemption and issue of bonus shares. Prepare the cash and bank account. Prepare the Balance Sheet as at 31st March, 2007 incorporating the above transactions.

Step by Step Solution

★★★★★

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started