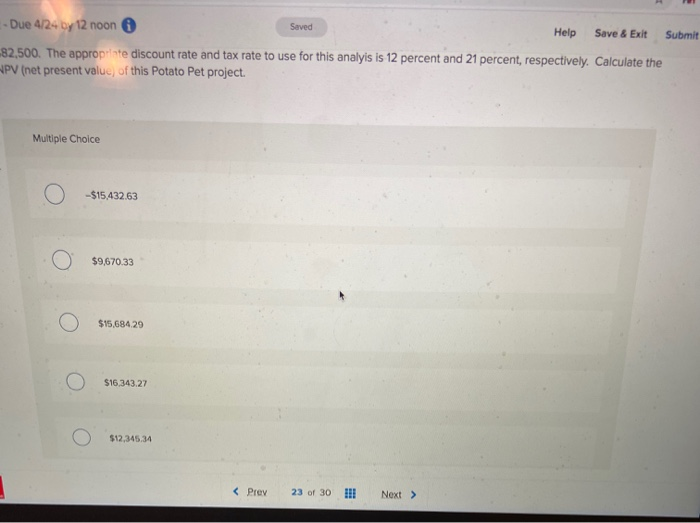

Pappy's Potato has come up with a new product, the Potato Pet that they are considering launching. The company has determined they will need a fixed asset investment at the beginning of the project of $260,000. This asset will last for four years which is the life of the project. Also, they will need to have more net working capital (NWC) of which they have estmated an amount of $16,500 for this purpose. The NWC will be recovered when the project is over. The Accounting Department has indicated that the depreciation method to be used for the fixed asset is the straight-line method over the life of the project and the asset is depreciated to a zero book value. Even though the asset is depreciated to a zero book value, the company estimates it will have a salvage value at the end of the project of $50,000. The OCF (operating cash flow) for each year of the project is estimated to be $82,500. The appropriate discount rate and tax rate to use for this analyis is 12 percent and 21 percent, respectively. Calculate the NPV (net present value) of this Potato Pet project. Multiple Choice O -515,43263 O $9679.33 $15.684.29 Saved - Due 4/24 by 12 noon 6 Help Save & Exit Submit 32,500. The appropriate discount rate and tax rate to use for this analysis 12 percent and 21 percent, respectively. Calculate the PV (net present value of this Potato Pet project. Multiple Choice -$15,43263 O $9,670.33 $15,684 29 0 O $16.343.27 $12,345.34 0 Pappy's Potato has come up with a new product, the Potato Pet that they are considering launching. The company has determined they will need a fixed asset investment at the beginning of the project of $260,000. This asset will last for four years which is the life of the project. Also, they will need to have more net working capital (NWC) of which they have estmated an amount of $16,500 for this purpose. The NWC will be recovered when the project is over. The Accounting Department has indicated that the depreciation method to be used for the fixed asset is the straight-line method over the life of the project and the asset is depreciated to a zero book value. Even though the asset is depreciated to a zero book value, the company estimates it will have a salvage value at the end of the project of $50,000. The OCF (operating cash flow) for each year of the project is estimated to be $82,500. The appropriate discount rate and tax rate to use for this analyis is 12 percent and 21 percent, respectively. Calculate the NPV (net present value) of this Potato Pet project. Multiple Choice O -515,43263 O $9679.33 $15.684.29 Saved - Due 4/24 by 12 noon 6 Help Save & Exit Submit 32,500. The appropriate discount rate and tax rate to use for this analysis 12 percent and 21 percent, respectively. Calculate the PV (net present value of this Potato Pet project. Multiple Choice -$15,43263 O $9,670.33 $15,684 29 0 O $16.343.27 $12,345.34 0