Answered step by step

Verified Expert Solution

Question

1 Approved Answer

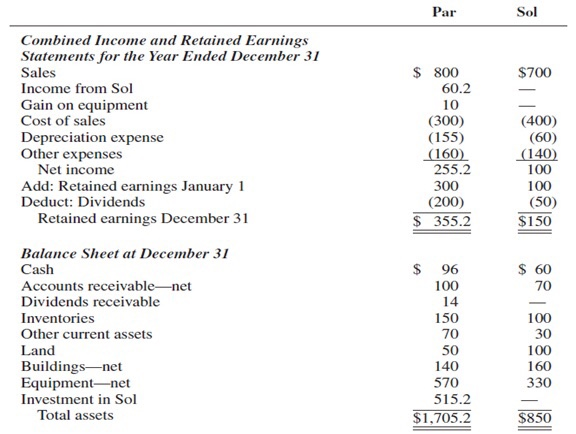

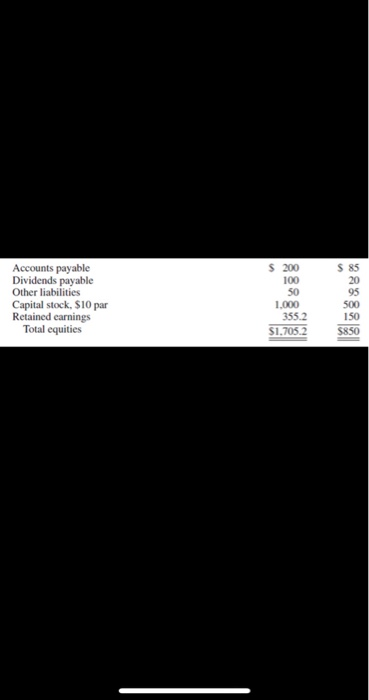

Par Corporation acquired a 70 percent interest in Sol Corporations common stock on January 1, 2011, for $490,000 cash. The stockholders equity of Sol on

Par Corporation acquired a 70 percent interest in Sol Corporations common stock on January 1, 2011, for $490,000 cash. The stockholders equity of Sol on this date consisted of $500,000 capital stock and $100,000 retained earnings. The difference between the fair value of Sol and the underlying equity acquired in Sol was assigned $5,000 to Sols undervalued inventory, $14,000 to overvalued buildings, $21,000 to undervalued equipment, and remaining amount to goodwill.

The undervalued inventory items were sold during 2011, and the overvalued buildings and undervalued equipment had remaining useful lives of seven years and three years, respectively. Depreciation is straight line. At December 31, 2011, Sols accounts payable include $10,000 owed to Par. Separate financial statements for Par and Sol for 2011 are summarized as follows (in thousands):

Required:

Using equity method, Prepare the required elimination entries on December 31, 2011. Show your computations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started