Question: Par Two: 4 questions ((Please round up your answer to the nearest two decimals) 1. (20 points) : Your credit card's annual interest rate is

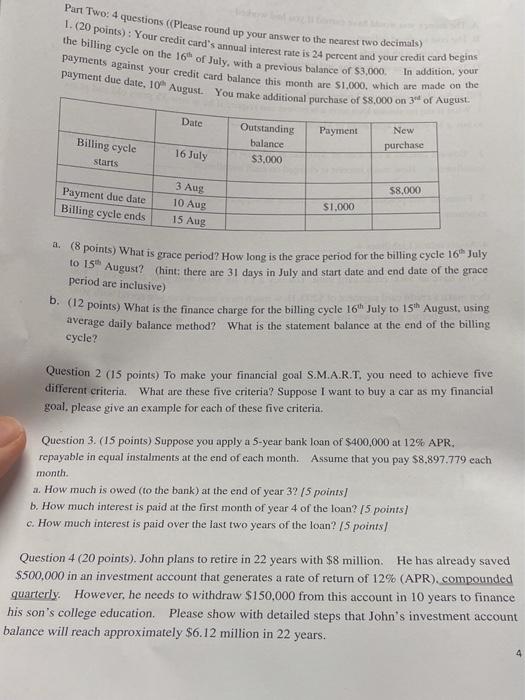

Par Two: 4 questions ((Please round up your answer to the nearest two decimals) 1. (20 points) : Your credit card's annual interest rate is 24 pereent and your credit card begins the billing cycle on the 16th of July, with a previous balance of $3,000. In addition, your payments against your credit card balance this month are $1,000, which are made on the a. (8 points) What is grace period? How long is the grace period for the billing cycle 16t July to 15th August? (hint: there are 31 days in July and start date and end date of the grace period are inclusive) b. ( 12 points) What is the finance charge for the billing cycle 16th July to 15th August, using average daily balance method? What is the statement balance at the end of the billing cycle? Question 2 (15 points) To make your financial goal S.M.A.R.T, you need to achieve five different criteria. What are these five criteria? Suppose I want to buy a car as my financial goal, please give an example for each of these five criteria. Question 3. (15 points) Suppose you apply a 5-year bank loan of $400.000 at 12% APR, repayable in equal instalments at the end of each month. Assume that you pay $8,897.779each month. a. How much is owed (to the bank) at the end of year 32 [5 points] b. How much interest is paid at the first month of year 4 of the loan? [5 points] c. How much interest is paid over the last two years of the loan? [5 points] Question 4 (20 points). John plans to retire in 22 years with $8 million. He has already saved $500,000 in an investment account that generates a rate of return of 12% (APR). compounded quartedy. However, he needs to withdraw $150,000 from this account in 10 years to finance his son's college education. Please show with detailed steps that John's investment account balance will reach approximately $6.12 million in 22 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts