Answered step by step

Verified Expert Solution

Question

1 Approved Answer

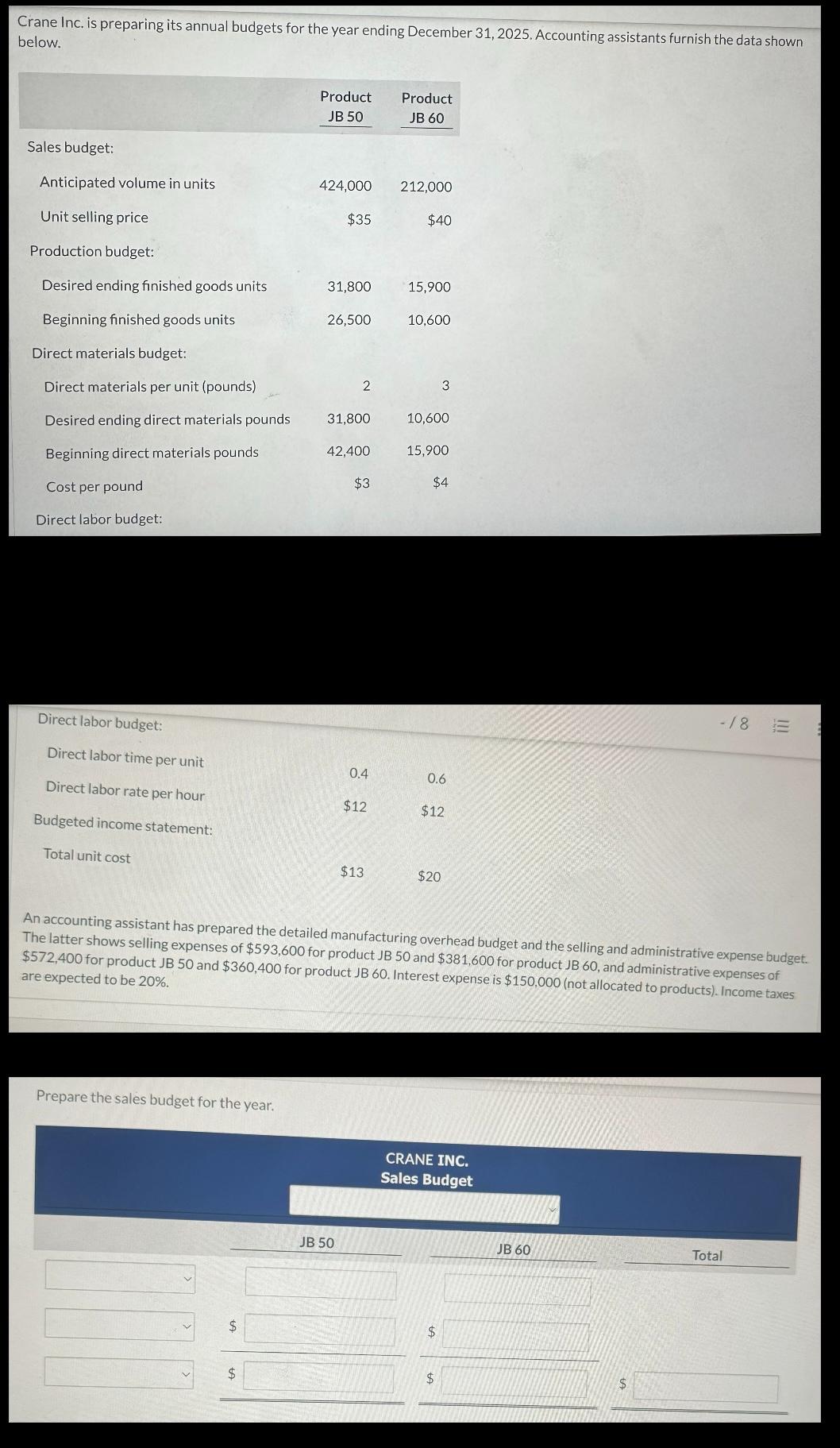

Crane Inc. is preparing its annual budgets for the year ending December 31, 2025. Accounting assistants furnish the data shown below. Product JB 50

Crane Inc. is preparing its annual budgets for the year ending December 31, 2025. Accounting assistants furnish the data shown below. Product JB 50 Product JB 60 Sales budget: Anticipated volume in units 424,000 212,000 Unit selling price $35 $40 Production budget: Desired ending finished goods units 31,800 15,900 Beginning finished goods units 26,500 10,600 Direct materials budget: Direct materials per unit (pounds) 2 3 Desired ending direct materials pounds 31,800 10,600 Beginning direct materials pounds 42,400 15,900 Cost per pound $3 $4 Direct labor budget: Direct labor budget: Direct labor time per unit 0.4 0.6 Direct labor rate per hour $12 $12 Budgeted income statement: Total unit cost $13 $20 -18 = An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $593,600 for product JB 50 and $381,600 for product JB 60, and administrative expenses of $572,400 for product JB 50 and $360,400 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 20%. Prepare the sales budget for the year. $ JB 50 CRANE INC. Sales Budget $ $ $ JB 60 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Entiendo que necesitas dos resmenes por cada ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started