Answered step by step

Verified Expert Solution

Question

1 Approved Answer

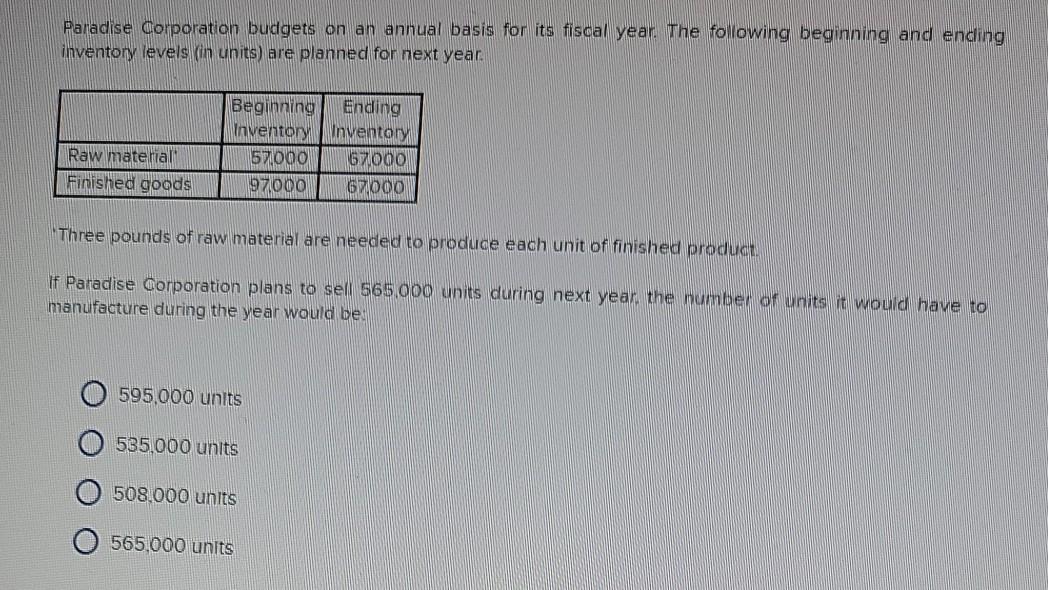

Paradise Corporation budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels in units) are planned for next year

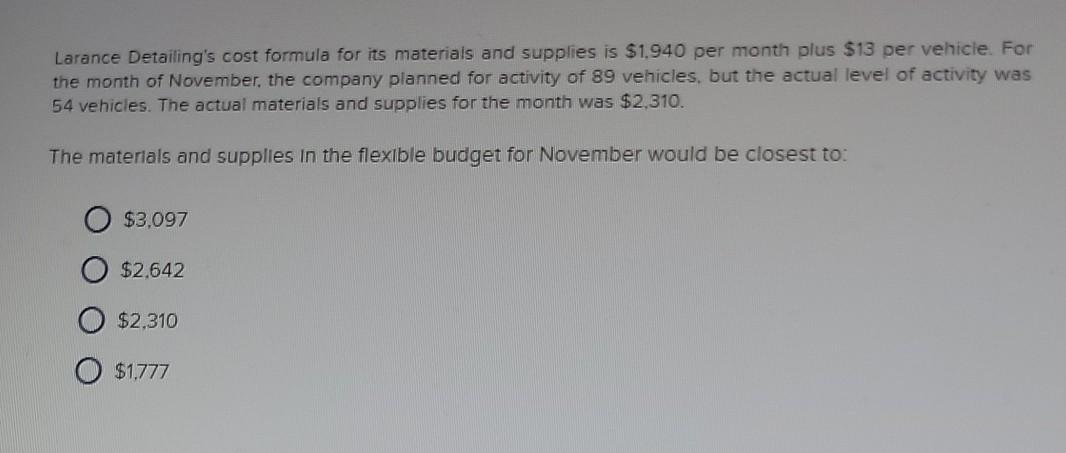

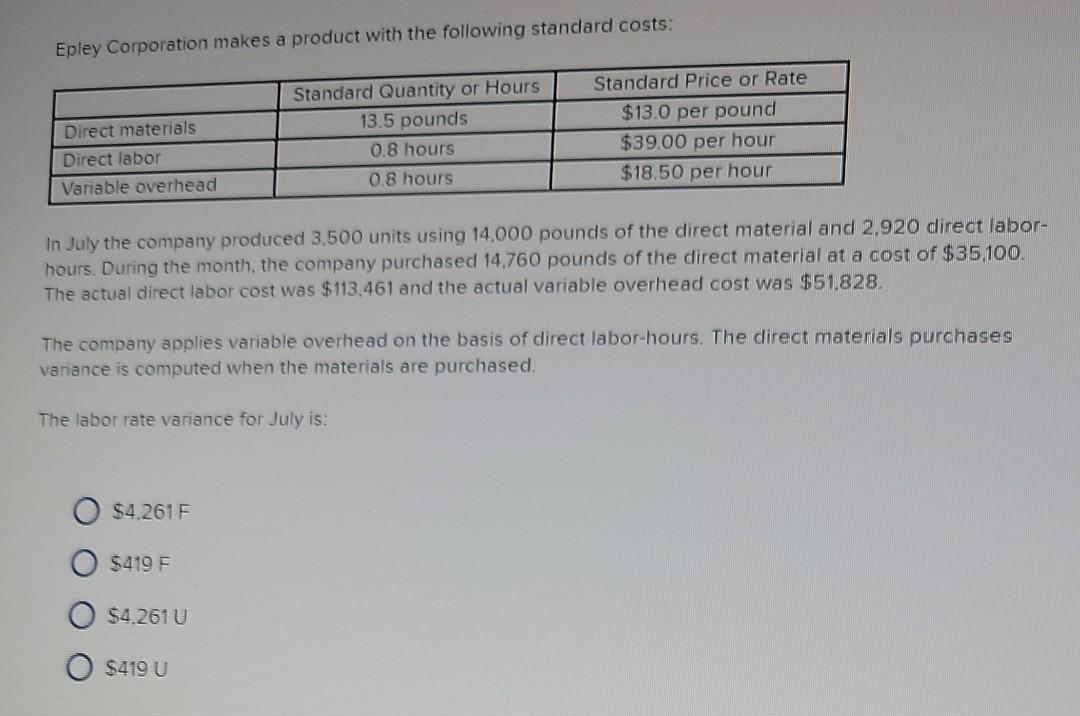

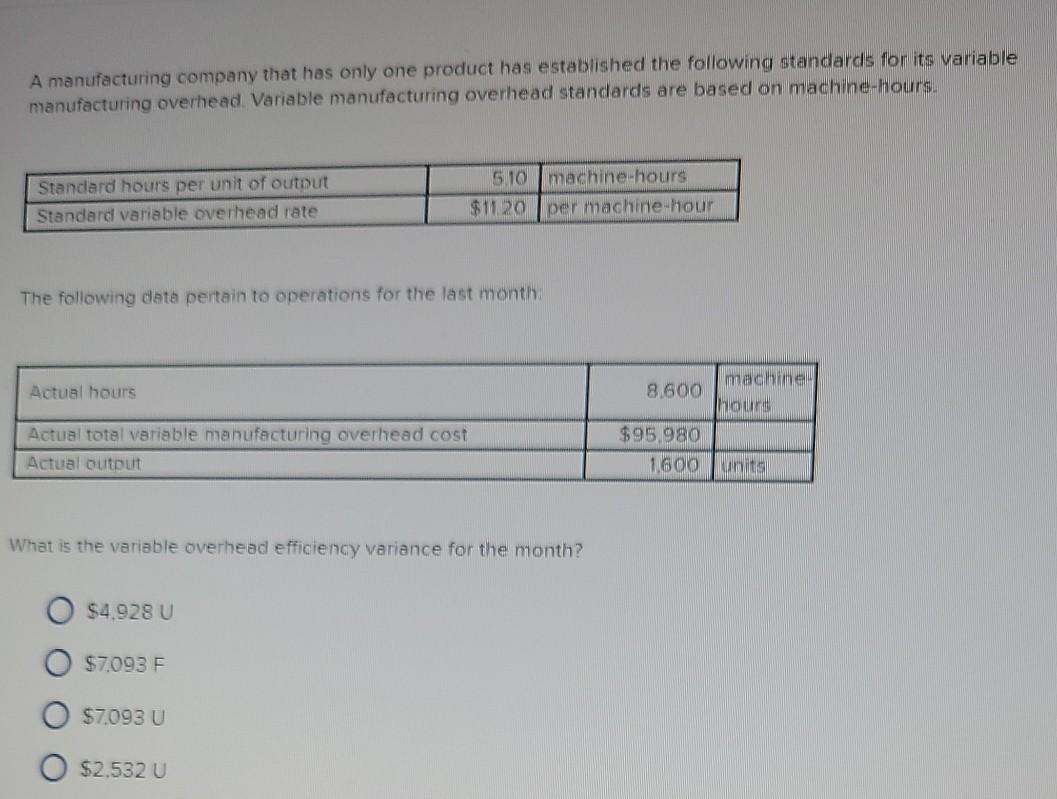

Paradise Corporation budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels in units) are planned for next year Beginning Ending Inventory Anventory 57.000 67000 97000 67000 Raw material Finished goods Three pounds of raw material are needed to produce each unit of finished product If Paradise Corporation plans to sell 565 000 units during next year the number of units it would have to manufacture during the year would be: 595,000 units 535,000 units 508,000 units 565.000 units Larance Detailing's cost formula for its materials and supplies is $1.940 per month plus $13 per vehicle. For the month of November, the company planned for activity of 89 vehicles, but the actual level of activity was 54 vehicles. The actual materials and supplies for the month was $2,310. The materials and supplies in the flexible budget for November would be closest to: $3,097 $2,642 $2.310 $1.777 Epley Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 13.5 pounds 0.8 hours 0.8 hours Standard Price or Rate $13.0 per pound $39.00 per hour $18.50 per hour In July the company produced 3.500 units using 14.000 pounds of the direct material and 2,920 direct labor- hours. During the month, the company purchased 14,760 pounds of the direct material at a cost of $35.100. The actual direct labor cost was $113,461 and the actual variable overhead cost was $51.828. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for July is: $4.261 F $419 F $4.261 U $419 U A manufacturing company that has only one product has established the following standards for its variable manufacturing overhead Variable manufacturing overhead standards are based on machine-hours. Standard hours per unit of output Standard variable overhead rate 5,10 machine-hours $1120 per machine-hour The following data pertain to operations for the last month Actual hours 8.600 machine MOU Actual total variable manufacturing overhead cost Actual output $95.980 1.600 MS What is the variable overhead efficiency variance for the month? $4.928 U $7,093 F $7093 U $2.532 U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started