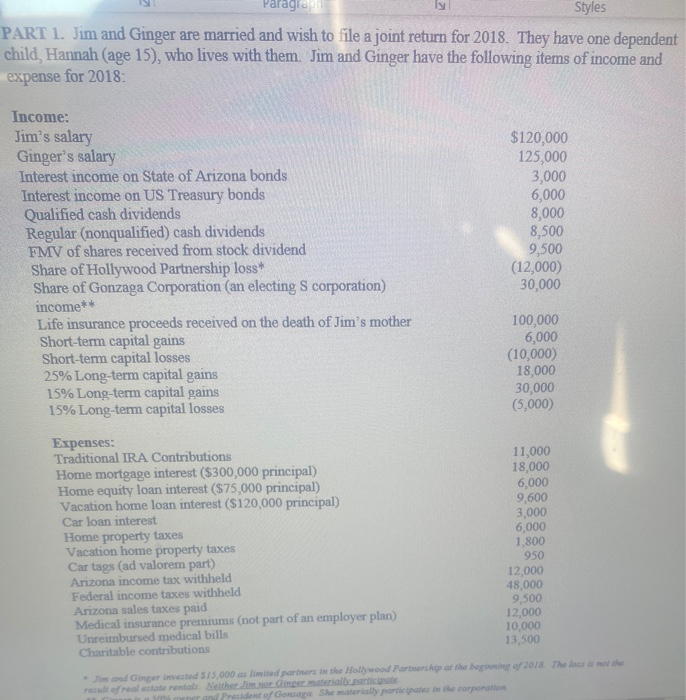

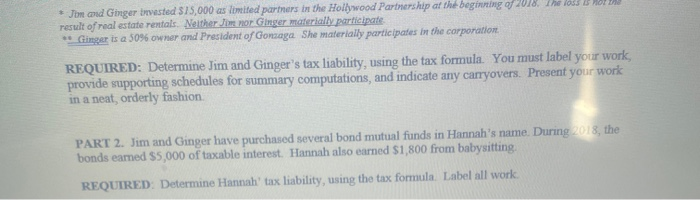

Paragia Styles PART 1. Jim and Ginger are married and wish to file a joint return for 2018. They have one dependent child, Hannah (age 15), who lives with them. Jim and Ginger have the following items of income and expense for 2018 Income: Jim's salary Ginger's salary Interest income on State of Arizona bonds Interest income on US Treasury bonds Qualified cash dividends Regular (nonqualified) cash dividends FMV of shares received from stock dividend Share of Hollywood Partnership loss* Share of Gonzaga Corporation (an electing S corporation) income** Life insurance proceeds received on the death of Jim's mother Short-term capital gains Short-term capital losses 25% Long-term capital gains 15% Long-term capital gains 15% Long-term capital losses $120,000 125,000 3,000 6,000 8,000 8,500 9,500 (12,000) 30,000 100,000 6,000 (10,000) 18,000 30,000 (5,000) Expenses: Traditional IRA Contributions Home mortgage interest ($300,000 principal) Home equity loan interest ($75,000 principal) Vacation home loan interest ($120,000 principal) Car loan interest Home property taxes Vacation home property taxes Car tags (ad valorem part) Arizona income tax withheld Federal income taxes withheld Arizona sales taxes paid Medical insurance premiums (not part of an employer plan) Unreimbursed medical bills Charitable contributions 11,000 18,000 6,000 9,600 3,000 6,000 1,800 950 12,000 48,000 9.500 12.000 10,000 13,500 2018The lour is not the and Gingeriested 515,000 as limited partners in the Hollywood Partnership at the begin of real estate rentals Nether Or Ginger material e and President of Gorraga She materially participate in the corporation o * Jood Ginger invested $75,000 as limited partners in the Hollywood Partnership of the beginning of 2018. The loss result of real estate rentals. Neither Jonor Ginger materially participate * Ginger is a 50% owner and President of Gonzaga She materially participates in the corporation REQUIRED: Determine Jim and Ginger's tax liability, using the tax formula. You must label your work, provide supporting schedules for summary computations, and indicate any carryovers. Present your work in a neat, orderly fashion PART 2. Jim and Ginger have purchased several bond mutual funds in Hannah's name. During 2018, the bonds earned $5,000 of taxable interest. Hannah also earned $1,800 from babysitting REQUIRED: Determine Hannah' tax liability, using the tax formula Label all work. Paragia Styles PART 1. Jim and Ginger are married and wish to file a joint return for 2018. They have one dependent child, Hannah (age 15), who lives with them. Jim and Ginger have the following items of income and expense for 2018 Income: Jim's salary Ginger's salary Interest income on State of Arizona bonds Interest income on US Treasury bonds Qualified cash dividends Regular (nonqualified) cash dividends FMV of shares received from stock dividend Share of Hollywood Partnership loss* Share of Gonzaga Corporation (an electing S corporation) income** Life insurance proceeds received on the death of Jim's mother Short-term capital gains Short-term capital losses 25% Long-term capital gains 15% Long-term capital gains 15% Long-term capital losses $120,000 125,000 3,000 6,000 8,000 8,500 9,500 (12,000) 30,000 100,000 6,000 (10,000) 18,000 30,000 (5,000) Expenses: Traditional IRA Contributions Home mortgage interest ($300,000 principal) Home equity loan interest ($75,000 principal) Vacation home loan interest ($120,000 principal) Car loan interest Home property taxes Vacation home property taxes Car tags (ad valorem part) Arizona income tax withheld Federal income taxes withheld Arizona sales taxes paid Medical insurance premiums (not part of an employer plan) Unreimbursed medical bills Charitable contributions 11,000 18,000 6,000 9,600 3,000 6,000 1,800 950 12,000 48,000 9.500 12.000 10,000 13,500 2018The lour is not the and Gingeriested 515,000 as limited partners in the Hollywood Partnership at the begin of real estate rentals Nether Or Ginger material e and President of Gorraga She materially participate in the corporation o * Jood Ginger invested $75,000 as limited partners in the Hollywood Partnership of the beginning of 2018. The loss result of real estate rentals. Neither Jonor Ginger materially participate * Ginger is a 50% owner and President of Gonzaga She materially participates in the corporation REQUIRED: Determine Jim and Ginger's tax liability, using the tax formula. You must label your work, provide supporting schedules for summary computations, and indicate any carryovers. Present your work in a neat, orderly fashion PART 2. Jim and Ginger have purchased several bond mutual funds in Hannah's name. During 2018, the bonds earned $5,000 of taxable interest. Hannah also earned $1,800 from babysitting REQUIRED: Determine Hannah' tax liability, using the tax formula Label all work