Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paragraph 1 - On January 1, 2021, Parent Company purchased 80% of the common stock of Subsidiary Company for $502,000. On this date Subsidiary

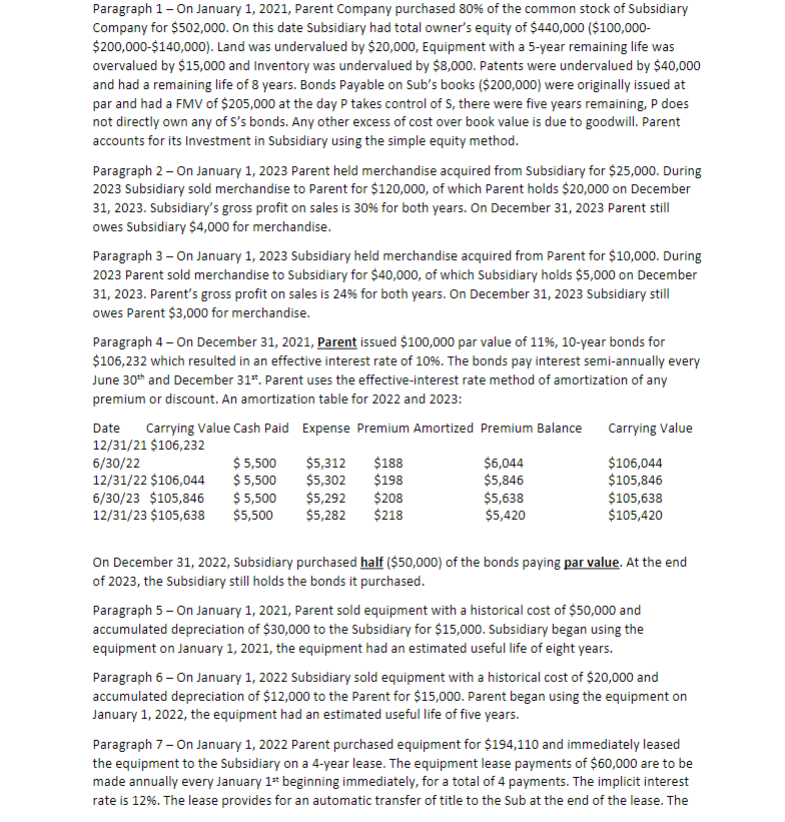

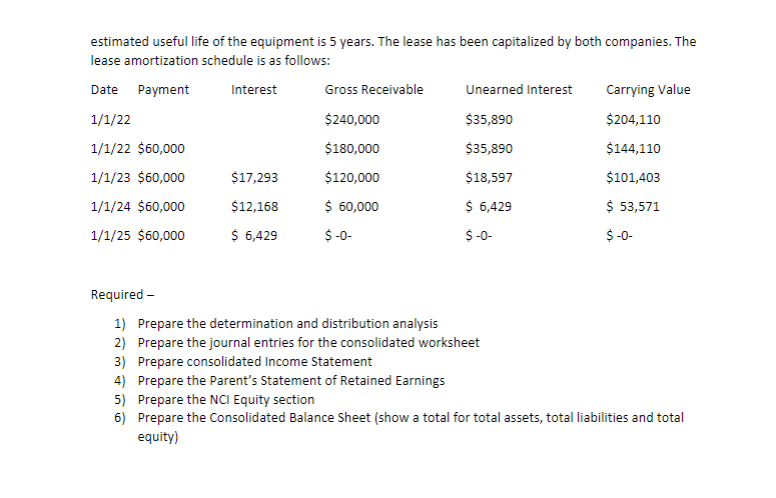

Paragraph 1 - On January 1, 2021, Parent Company purchased 80% of the common stock of Subsidiary Company for $502,000. On this date Subsidiary had total owner's equity of $440,000 ($100,000- $200,000-$140,000). Land was undervalued by $20,000, Equipment with a 5-year remaining life was overvalued by $15,000 and Inventory was undervalued by $8,000. Patents were undervalued by $40,000 and had a remaining life of 8 years. Bonds Payable on Sub's books ($200,000) were originally issued at par and had a FMV of $205,000 at the day P takes control of S, there were five years remaining, P does not directly own any of S's bonds. Any other excess of cost over book value is due to goodwill. Parent accounts for its Investment in Subsidiary using the simple equity method. Paragraph 2 - On January 1, 2023 Parent held merchandise acquired from Subsidiary for $25,000. During 2023 Subsidiary sold merchandise to Parent for $120,000, of which Parent holds $20,000 on December 31, 2023. Subsidiary's gross profit on sales is 30% for both years. On December 31, 2023 Parent still owes Subsidiary $4,000 for merchandise. Paragraph 3-On January 1, 2023 Subsidiary held merchandise acquired from Parent for $10,000. During 2023 Parent sold merchandise to Subsidiary for $40,000, of which Subsidiary holds $5,000 on December 31, 2023. Parent's gross profit on sales is 24% for both years. On December 31, 2023 Subsidiary still owes Parent $3,000 for merchandise. Paragraph 4-On December 31, 2021, Parent issued $100,000 par value of 11%, 10-year bonds for $106,232 which resulted in an effective interest rate of 10%. The bonds pay interest semi-annually every June 30th and December 31st. Parent uses the effective-interest rate method of amortization of any premium or discount. An amortization table for 2022 and 2023: Date Carrying Value Cash Paid Expense Premium Amortized Premium Balance Carrying Value 12/31/21 $106,232 6/30/22 $5,500 $5,312 $188 $6,044 12/31/22 $106,044 6/30/23 $105,846 $5,500 $5,500 $5,302 $198 $5,846 $5,292 $208 $5,638 12/31/23 $105,638 $5,500 $5,282 $218 $5,420 $106,044 $105,846 $105,638 $105,420 On December 31, 2022, Subsidiary purchased half ($50,000) of the bonds paying par value. At the end of 2023, the Subsidiary still holds the bonds it purchased. Paragraph 5-On January 1, 2021, Parent sold equipment with a historical cost of $50,000 and accumulated depreciation of $30,000 to the Subsidiary for $15,000. Subsidiary began using the equipment on January 1, 2021, the equipment had an estimated useful life of eight years. Paragraph 6-On January 1, 2022 Subsidiary sold equipment with a historical cost of $20,000 and accumulated depreciation of $12,000 to the Parent for $15,000. Parent began using the equipment on January 1, 2022, the equipment had an estimated useful life of five years. Paragraph 7 - On January 1, 2022 Parent purchased equipment for $194,110 and immediately leased the equipment to the Subsidiary on a 4-year lease. The equipment lease payments of $60,000 are to be made annually every January 1st beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title to the Sub at the end of the lease. The estimated useful life of the equipment is 5 years. The lease has been capitalized by both companies. The lease amortization schedule is as follows: Date Payment Interest Gross Receivable Unearned Interest Carrying Value 1/1/22 $240,000 $35,890 $204,110 1/1/22 $60,000 $180,000 $35,890 $144,110 1/1/23 $60,000 $17,293 $120,000 $18,597 $101,403 1/1/24 $60,000 $12,168 $ 60,000 $ 6,429 $ 53,571 1/1/25 $60,000 $ 6,429 $ -0- $ -0- $ -0- Required - 1) Prepare the determination and distribution analysis 2) Prepare the journal entries for the consolidated worksheet 3) Prepare consolidated Income Statement 4) Prepare the Parent's Statement of Retained Earnings 5) Prepare the NCI Equity section 6) Prepare the Consolidated Balance Sheet (show a total for total assets, total liabilities and total equity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started