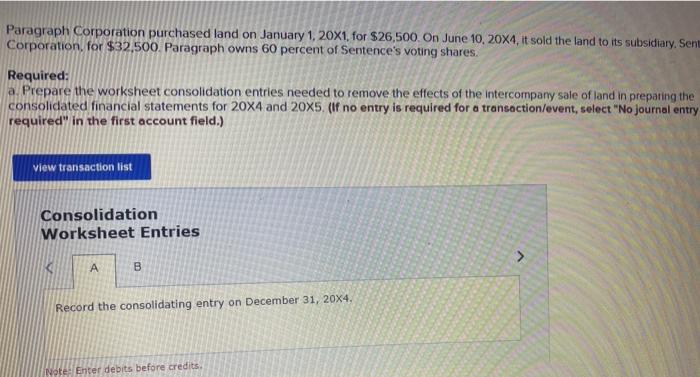

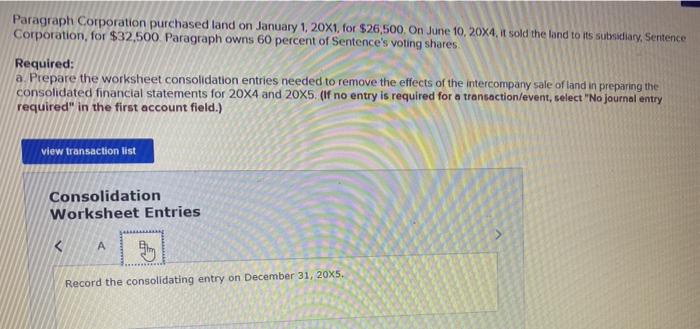

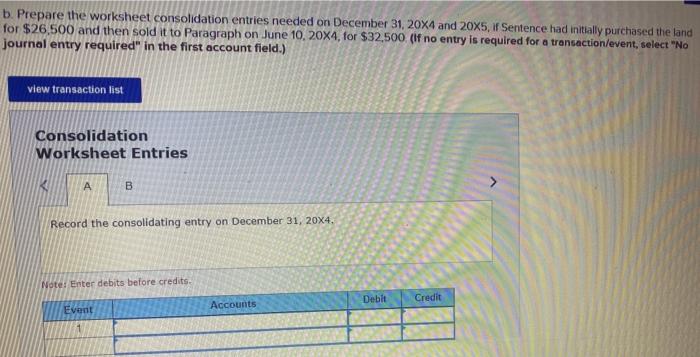

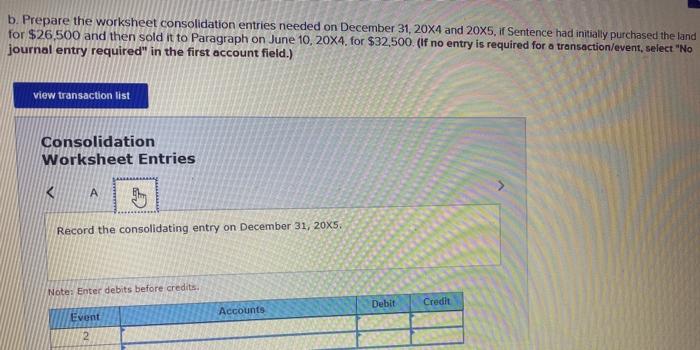

Paragraph Corporation purchased land on January 1, 20x1, for $26,500. On June 10, 20X4, it sold the land to its subsidiary, Senu Corporation, for $32,500. Paragraph owns 60 percent of Sentence's voting shares. Required: a. Prepare the worksheet consolidation entries needed to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X4 and 20X5. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries B Record the consolidating entry on December 31, 20X4. Note Enter debits before credits Paragraph Corporation purchased land on January 1, 20x1, for $26,500. On June 10, 20X4, it sold the land to its subsidiary, Sentence Corporation, for $32,500 Paragraph owns 60 percent of Sentence's voting shares Required: a Prepare the worksheet consolidation entries needed to remove the effects of the intercompany sale of tand in preparing the consolidated financial statements for 20x4 and 20x5 (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries A Record the consolidating entry on December 31, 20X5. b. Prepare the worksheet consolidation entries needed on December 31, 20X4 and 20X5, If Sentence had initially purchased the land for $26.500 and then sold it to Paragraph on June 10, 20X4, for $32,500 (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries A B Record the consolidating entry on December 31, 20X4. Note: Enter debits before credits Debit Credit Event Accounts 1 b. Prepare the worksheet consolidation entries needed on December 31, 20X4 and 20x5, if Sentence had initially purchased the land for $26.500 and then sold it to Paragraph on June 10, 20X4. for $32,500. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) view transaction list Consolidation Worksheet Entries A Record the consolidating entry on December 31, 20X5. Note: Enter debits before credits Debit Credit Accounts Event 2