Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paragraph Font 15 Marks Question 4 Brook is reviewing a project with an initial cash outflow of R250,000. An additional R100,000 will have to be

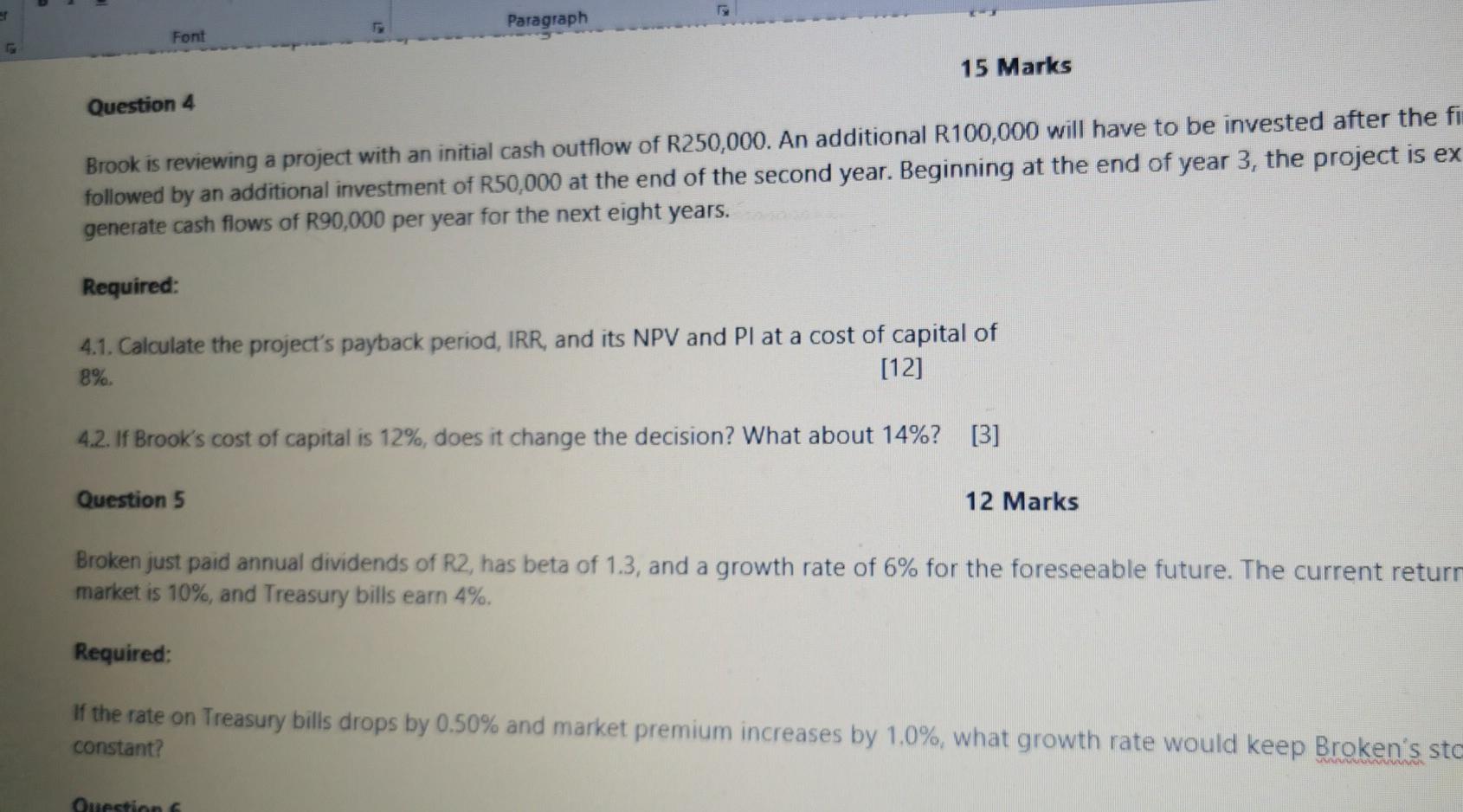

Paragraph Font 15 Marks Question 4 Brook is reviewing a project with an initial cash outflow of R250,000. An additional R100,000 will have to be invested after the fi followed by an additional investment of R50,000 at the end of the second year. Beginning at the end of year 3, the project is ex generate cash flows of R90,000 per year for the next eight years. Required: 4.1. Calculate the project's payback period, IRR, and its NPV and Pl at a cost of capital of 8% [12] 4.2. If Brook's cost of capital is 12%, does it change the decision? What about 14%? [3] Question 5 12 Marks Broken just paid annual dividends of R2, has beta of 1.3, and a growth rate of 6% for the foreseeable future. The current return market is 10%, and Treasury bills earn 4%. Required: If the rate on Treasury bills drops by 0.50% and market premium increases by 1.0%, what growth rate would keep Broken's stc constant? Question 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started