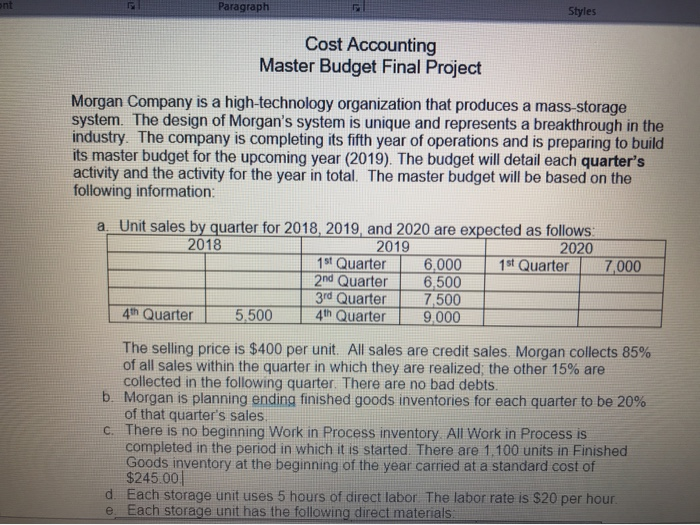

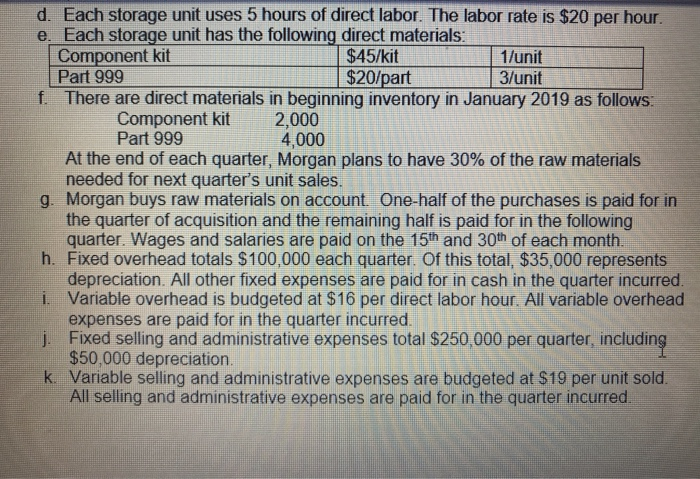

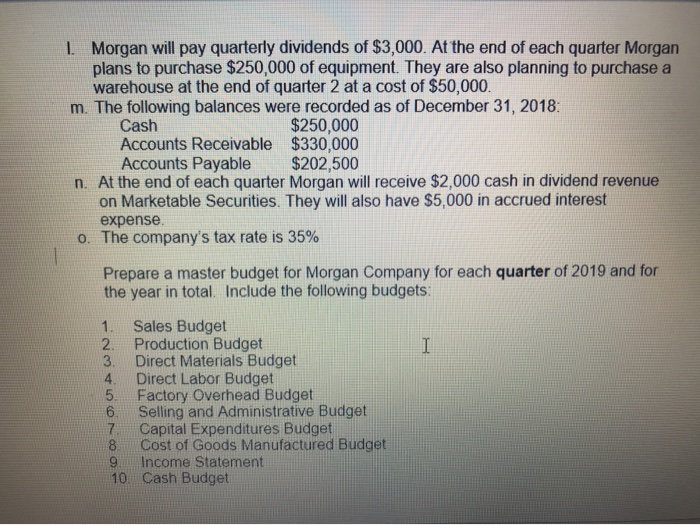

Paragraph Styles Cost Accounting Master Budget Final Project Morgan Company is a high-technology organization that produces a mass-storage system. The design of Morgan's system is unique and represents a breakthrough in the industry. The company is completing its fifth year of operations and is preparing to build its master budget for the upcoming year (2019). The budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: 7,000 a. Unit sales by quarter for 2018, 2019, and 2020 are expected as follows: 2018 2019 2020 151 Quarter 6,000 1st Quarter 2nd Quarter 6.500 3rd Quarter 7,500 4th Quarter 5.500 4th Quarter 9.000 The selling price is $400 per unit. All sales are credit sales. Morgan collects 85% of all sales within the quarter in which they are realized the other 15% are collected in the following quarter. There are no bad debts. b. Morgan is planning ending finished goods inventories for each quarter to be 20% of that quarter's sales C. There is no beginning Work in Process inventory. All Work in Process is completed in the period in which it is started. There are 1.100 units in Finished Goods inventory at the beginning of the year carried at a standard cost of $245,00 d. Each storage unit uses 5 hours of direct labor. The labor rate is $20 per hour e. Each storage unit has the following direct materials d. Each storage unit uses 5 hours of direct labor. The labor rate is $20 per hour. e. Each storage unit has the following direct materials: Component kit | $45/kit | 1/unit Part 999 $20/part 3/unit f. There are direct materials in beginning inventory in January 2019 as follows: Component kit 2,000 Part 999 4,000 At the end of each quarter, Morgan plans to have 30% of the raw materials needed for next quarter's unit sales. g. Morgan buys raw materials on account. One-half of the purchases is paid for in the quarter of acquisition and the remaining half is paid for in the following quarter. Wages and salaries are paid on the 15 and 30th of each month. h. Fixed overhead totals $100,000 each quarter. Of this total, $35,000 represents depreciation. All other fixed expenses are paid for in cash in the quarter incurred. 1 Variable overhead is budgeted at $16 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. Fixed selling and administrative expenses total $250,000 per quarter, including $50,000 depreciation. k. Variable selling and administrative expenses are budgeted at $19 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. I Morgan will pay quarterly dividends of $3,000. At the end of each quarter Morgan plans to purchase $250,000 of equipment. They are also planning to purchase a warehouse at the end of quarter 2 at a cost of $50,000. m. The following balances were recorded as of December 31, 2018: Cash $250,000 Accounts Receivable $330,000 Accounts Payable $202,500 n. At the end of each quarter Morgan will receive $2,000 cash in dividend revenue on Marketable Securities. They will also have $5,000 in accrued interest expense. 0. The company's tax rate is 35% Prepare a master budget for Morgan Company for each quarter of 2019 and for the year in total. Include the following budgets: I DOLAW Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Factory Overhead Budget Selling and Administrative Budget Capital Expenditures Budget Cost of Goods Manufactured Budget Income Statement 10. Cash Budget