Answered step by step

Verified Expert Solution

Question

1 Approved Answer

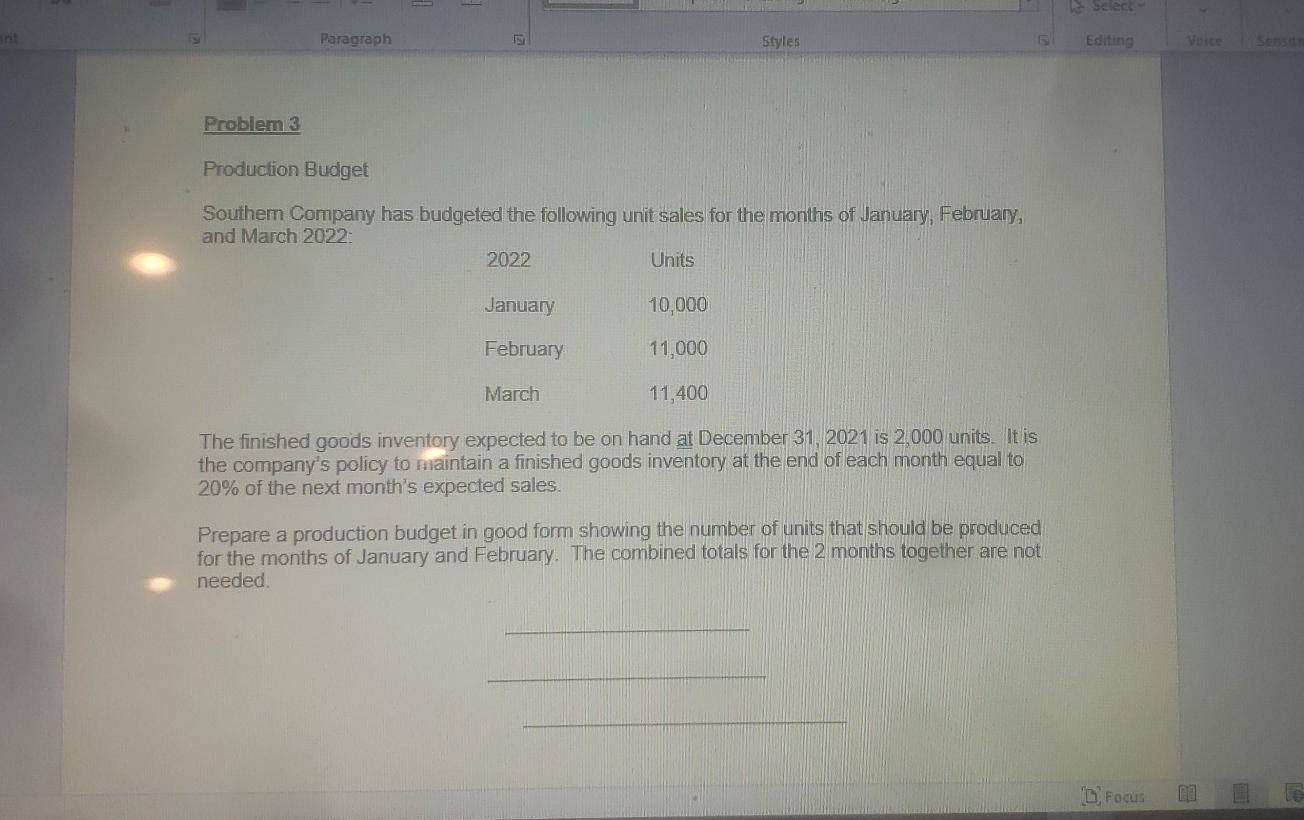

Paragraph Styles Editing Problem 3 Production Budget Southern Company has budgeted the following unit sales for the months of January, February, and March 2022- 2022

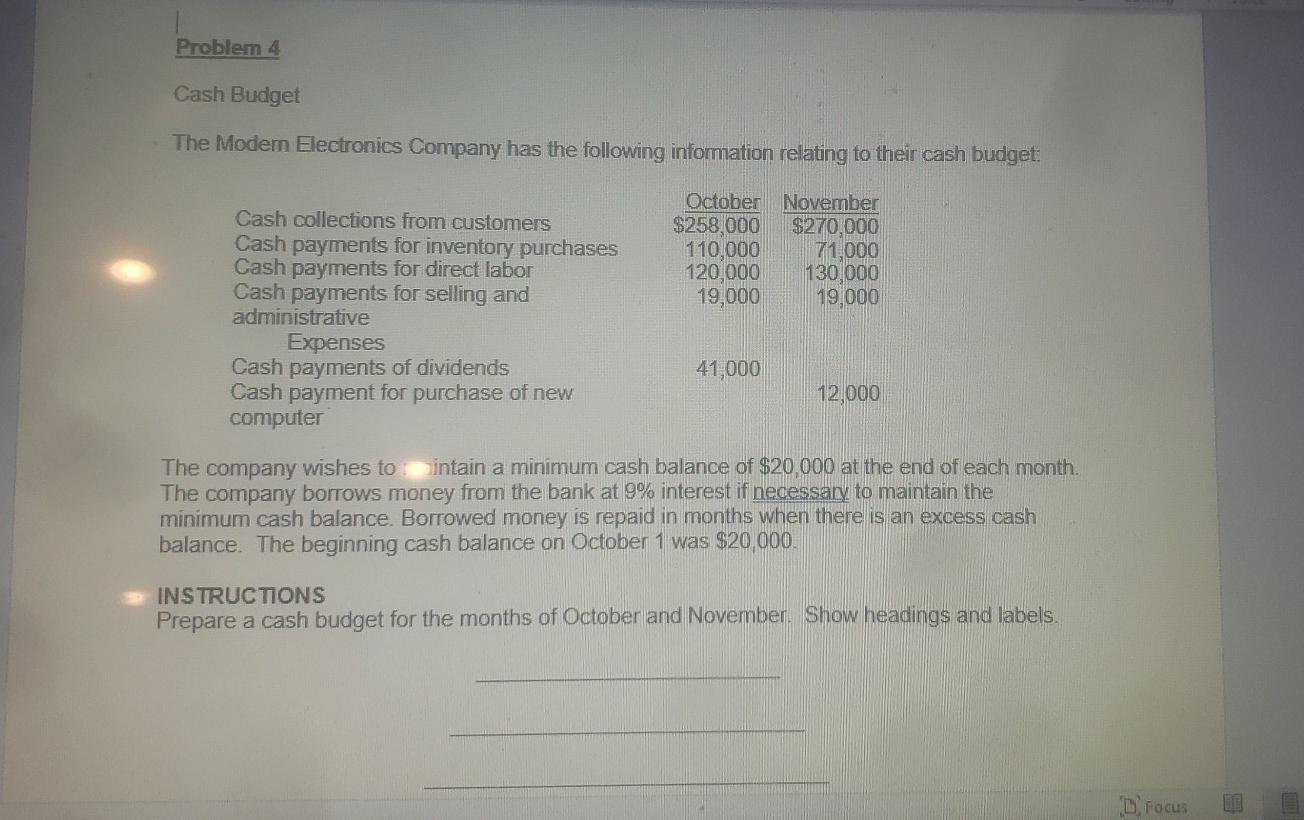

Paragraph Styles Editing Problem 3 Production Budget Southern Company has budgeted the following unit sales for the months of January, February, and March 2022- 2022 Units January 10,000 February 11,000 March 11,400 The finished goods inventory expected to be on hand at December 31, 2021 is 2,000 units. It is the company's policy to niaintain a finished goods iny at the end of each month equal to 20% of the next month's expected sales. Prepare a production budget in good form showing the number of units that should be produced for the months of January and February. The combined totals for the 2 months together are not needed. D Focus Problem 4 Cash Budget The Modem Electronics Company has the following information relating to their cash budget: October November $258,000 $270,000 110,000 71,000 120,000 130,000 19,000 19,000 Cash collections from customers Cash payments for inventory purchases Cash payments for direct labor Cash payments for selling and administrative Expenses Cash payments of dividends Cash payment for purchase of new computer 41,000 12,000 The company wishes to intain a minimum cash balance of $20.000 at the end of each month. The company borrows money from the bank at 9% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on October 1 was $20,000. INSTRUCTIONS Prepare a cash budget for the months of October and November. Show headings and labels D. Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started