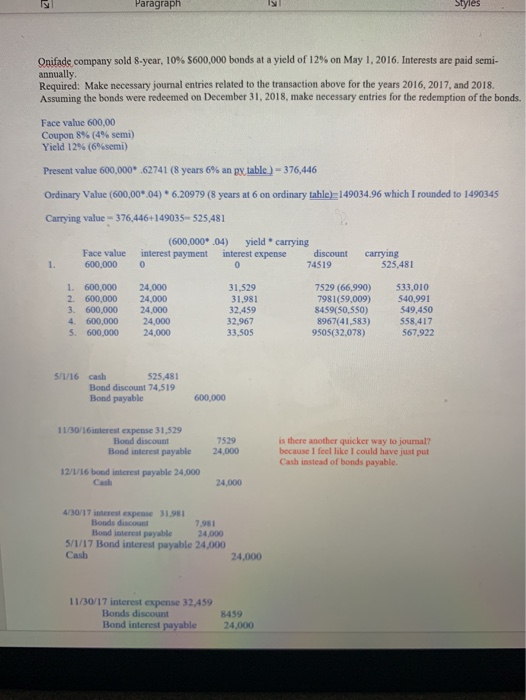

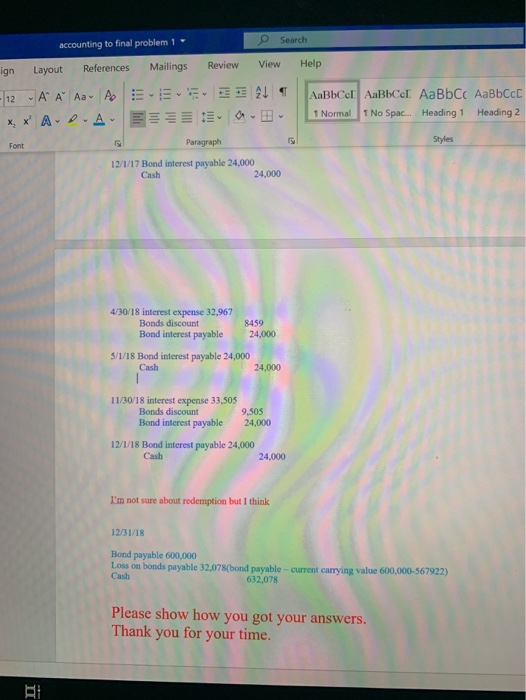

Paragraph Styles Onifade company sold 8-year, 10% 5600,000 bonds at a yield of 12% on May 1, 2016. Interests are paid semi- annually Required: Make necessary joumal entries related to the transaction above for the years 2016, 2017 and 2018. Assuming the bonds were redeemed on December 31, 2018, make necessary entries for the redemption of the bonds. Face value 600,00 Coupon 8% (4% semi) Yield 12% (6%semi) Present value 600,000* 62741 (8 years 6% an py table - 376,446 Ordinary Value (600,00*.04) * 6.20979 (8 years at 6 on ordinary table)149034.96 which I rounded to 1490345 Carrying value - 376,446+149035-525,481 Face value 600,0000 (600,000.04) yield carrying interest payment interest expense discount 74519 carrying 525,481 600.000 2 600,000 600.000 4 600.000 5.600.000 24,000 24,000 24,000 24,000 24,000 31,529 31.981 32.459 32.967 33,505 7529 (66,990) 7981(59,009) 8459(50.550) 8967(41,583) 9505(32,078) 533,010 540,991 549,450 558.417 567,922 5/1/16 cash 525,481 Bond discount 74,519 Bond payable 600,000 11/30/16 interest expense 31,529 Bond discount Bond interest payable 7529 24,000 is there another quicker way to journal? because I feel like I could have just put Cash instead of bonds payable 12/1/16 bond interest payable 24,000 24,000 4/30/17 interest expense 31.981 Bonds discount 7951 Bood interest payable 24.000 5/1/17 Bond interest payable 24,000 24,000 11/30/17 interest expense 32,459 Bonds discount Band interest payable 8459 24,000 accounting to final problem 1 Search Help AaBbce AaBbce[ AaBb C AaBbccc 1 Normal 1 No Spac... Heading 1 Heading 2 ign Layout References Mailings Review View -12 A A Aa A 21 X, * A-D A 1 - 1 Paragraph 12/1/17 Bond interest payable 24,000 24,000 Styles Font Cash 4/30/18 interest expense 32,967 Bonds discount Bond interest payable 8459 24,000 5/1/18 Bond interest payable 24,000 Cash 24,000 11/30/18 interest expense 33,505 Bonds discount Bond interest payable 9.505 24,000 12/1/18 Bond interest payable 24,000 Cash 24.000 I'm not sure about redemption but I think 12/31/18 Bond payable 600,000 Loss on bonds payable 32,078(bond payable - current carrying value 600,000-567922) Cash 632,078 Please show how you got your answers. Thank you for your time