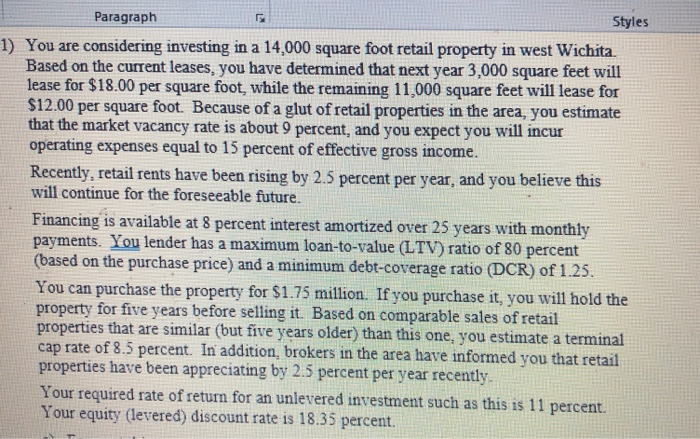

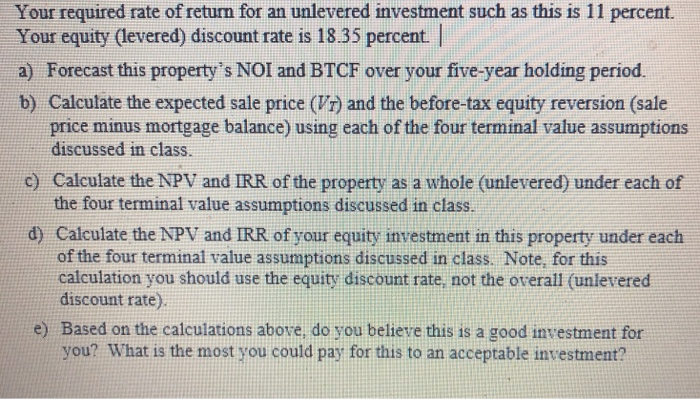

Paragraplh Styles 1) You are considering investing in a 14,000 square foot retail property in west Wichita Based on the current leases, you have determined that next year 3,000 square feet will lease for $18.00 per square foot, while the remaining 11,000 square feet will lease for $12.00 per square foot. Because of a glut of retail properties in the area, you estimate that the market vacancy rate is about 9 percent, and you expect you will incur operating expenses equal to 15 percent of effective gross income. Recently, retail rents have been rising by 2.5 percent per year, and you believe this will continue for the foreseeable future. Financing is available at 8 percent interest amortized over 25 years with monthly payments. You lender has a maximum loan-to-value (LTV) ratio of 80 percent (based on the purchase price) and a minimum debt-coverage ratio (DCR) of 125. You can purchase the property for $1.75 million. If you purchase it, you will hold the property for five years before selling it. Based on comparable sales of retail properties that are similar (but five years older) than this one, you estimate a terminal cap rate of 8.5 percent. In addition, brokers in the area have informed you that retail properties have been appreciating by 2.5 percent per year recently Your required rate of return for an unlevered investment such as this is 11 percent. Your equity (levered) discount rate is 18.35 percent. Your required rate of return for an unlevered investment such as this is 11 percent. Your equity (levered) discount rate is 18.35 percent. I a) Forecast this property's NOI and BTCF over your five-year holding period. b) Calculate the expected sale price (Vr) and the before-tax equity reversion (sale price minus mortgage balance) using each of the four terminal value assumptions discussed in class. Calculate the NPV and IRR of the property as a whole (unlevered) under each of the four terminal value assumptions discussed in class. c) d) Calculate the NPV and IRR of your equity investment in this property under each of the four terminal value assumptions discussed in class. Note, for this calculation you should use the equity discount rate, not the overall (unlevered discount rate). Based on the calculations above, do you believe this is a good investment for you? What is the most you could pay for this to an acceptable investment? e)