Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paramount Investments has one million shares outstanding. The Board of Directors want to change the company's policy of a paying of E 4 000 000

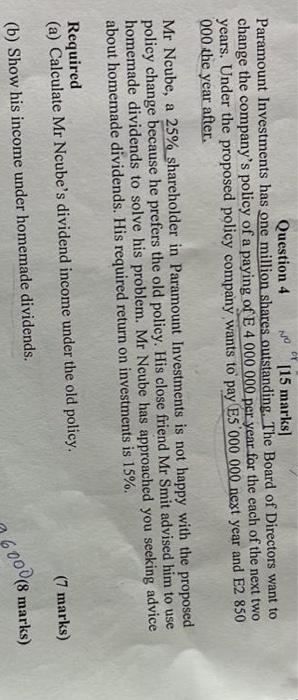

Paramount Investments has one million shares outstanding. The Board of Directors want to change the company's policy of a paying of E 4 000 000 per year for the each of the next two years. Under the proposed policy company wants to pay E5 000 000 next year and E2 850 000 the year after. NO Mr Ncube, a 25% shareholder in Paramount Investments is not happy with the proposed policy change because he prefers the old policy. His close friend Mr Smit advised him to use homemade dividends to solve his problem. Mr Ncube has approached you seeking advice about homemade dividends. His required return on investments is 15%. Required (a) Calculate Mr Ncube's dividend income under the old policy. (b) Show his income under homemade dividends. 1 (7 marks) 600 (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started