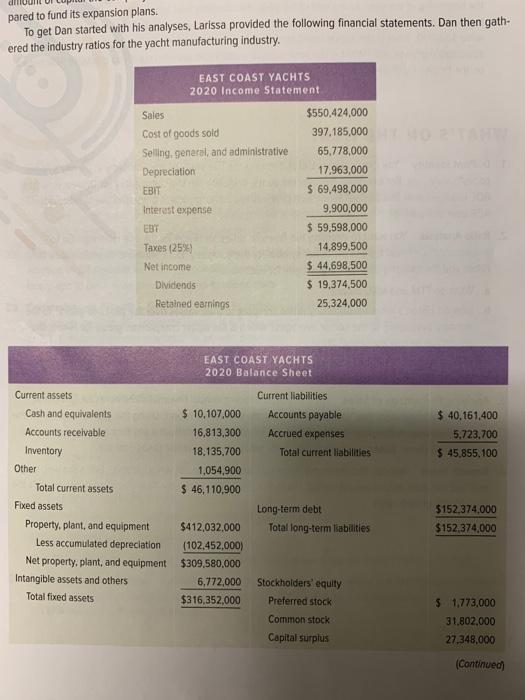

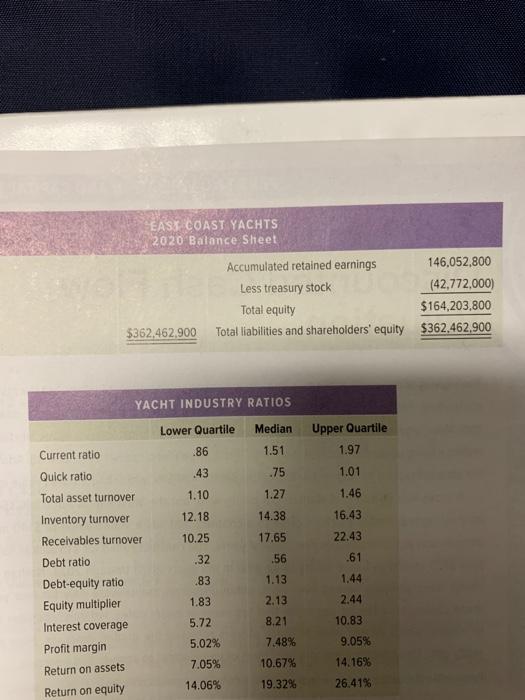

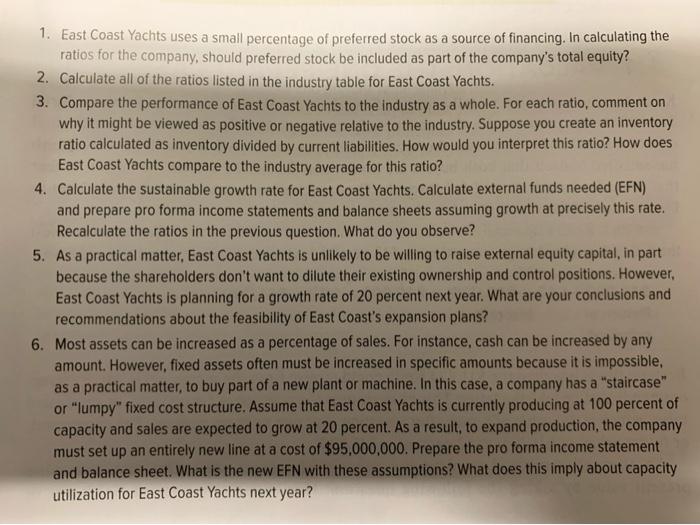

pared to fund its expansion plans. To get Dan started with his analyses, Larissa provided the following financial statements. Dan then gath- ered the industry ratios for the yacht manufacturing industry. EAST COAST YACHTS 2020 Income Statement Sales $550,424,000 Cost of goods sold 397,185,000 Selling, general, and administrative 65,778,000 Depreciation 17.963,000 EBIT $ 69,498,000 Interest expense 9.900,000 $ 59,598,000 Taxes (254) 14,899,500 Net income $ 44,698,500 Dividends $ 19,374,500 Retained earnings 25,324,000 EAST COAST YACHTS 2020 Balance Sheet Current liabilities Accounts payable Accrued expenses $ 40,161,400 5,723.700 $ 45,855,100 Total current liabilities Current assets Cash and equivalents $ 10,107.000 Accounts receivable 16,813,300 Inventory 18,135,700 Other 1,054,900 Total current assets $ 46,110,900 Fixed assets Property, plant, and equipment $412,032.000 Less accumulated depreciation (102.452,000) Net property, plant, and equipment $309,580,000 Intangible assets and others 6,772,000 Total fixed assets $316,352,000 Long-term debt Total long-term isabalties $152,374,000 $152,374,000 Stockholders' equity Preferred stock Common stock Capital surplus $ 1.773.000 31,802,000 27,348,000 (Continued) EAST COAST YACHTS 2020 Balance Sheet Accumulated retained earnings 146.052,800 Less treasury stock (42,772,000) Total equity $164,203,800 $362.462.900 Total liabilities and shareholders' equity $362,462,900 YACHT INDUSTRY RATIOS Median Lower Quartile .86 Upper Quartile 1.97 Current ratio 1.51 .43 .75 1.01 1.10 1.27 12.18 14.38 1.46 16.43 22.43 10.25 17.65 .32 .56 .61 .83 1.13 1.44 Quick ratio Total asset turnover Inventory turnover Receivables turnover Debt ratio Debt-equity ratio Equity multiplier Interest coverage Profit margin Return on assets Return on equity 1.83 2.13 2.44 5.72 8.21 10.83 5.02% 7.48% 9.05% 7.05% 10.67% 14.16% 26.41% 14.06% 19.32% 1. East Coast Yachts uses a small percentage of preferred stock as a source of financing. In calculating the ratios for the company, should preferred stock be included as part of the company's total equity? 2. Calculate all of the ratios listed in the industry table for East Coast Yachts. 3. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How would you interpret this ratio? How does East Coast Yachts compare to the industry average for this ratio? 4. Calculate the sustainable growth rate for East Coast Yachts. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe? 5. As a practical matter, East Coast Yachts is unlikely to be willing to raise external equity capital, in part because the shareholders don't want to dilute their existing ownership and control positions. However, East Coast Yachts is planning for a growth rate of 20 percent next year. What are your conclusions and recommendations about the feasibility of East Coast's expansion plans? 6. Most assets can be increased as a percentage of sales. For instance, cash can be increased by any amount. However, fixed assets often must be increased in specific amounts because it is impossible, as a practical matter, to buy part of a new plant or machine. In this case, a company has a "staircase" or "lumpy" fixed cost structure. Assume that East Coast Yachts is currently producing at 100 percent of capacity and sales are expected to grow at 20 percent. As a result, to expand production, the company must set up an entirely new line at a cost of $95,000,000. Prepare the pro forma income statement and balance sheet. What is the new EFN with these assumptions? What does this imply about capacity utilization for East Coast Yachts next year