Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 Parent acquired 35,000 shares of Sub stock on January 1, 2017 at a price of $34 per share. At the date of

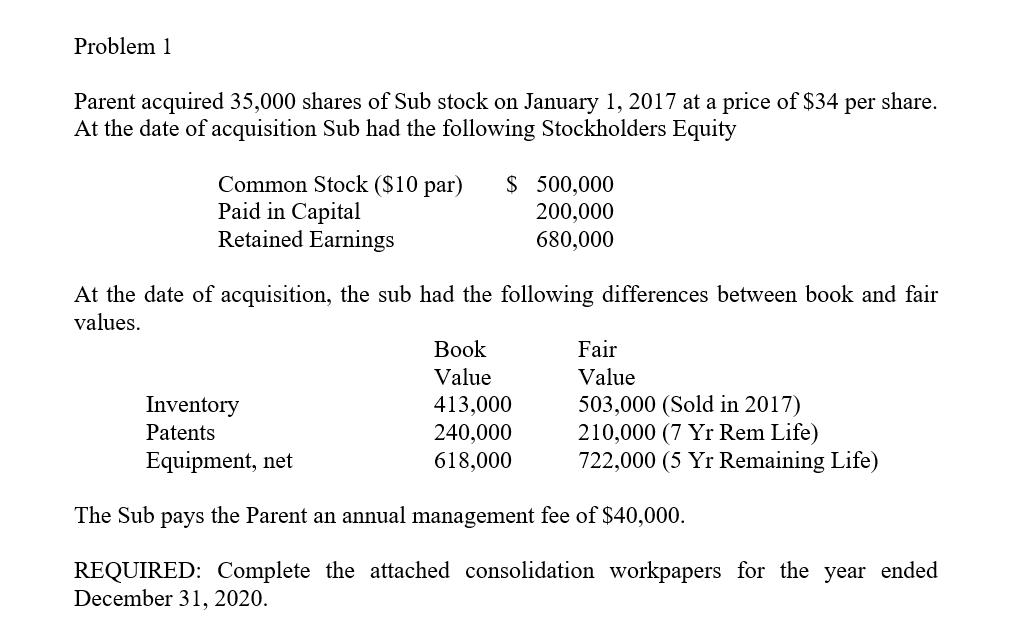

Problem 1 Parent acquired 35,000 shares of Sub stock on January 1, 2017 at a price of $34 per share. At the date of acquisition Sub had the following Stockholders Equity Common Stock ($10 par) Paid in Capital Retained Earnings At the date of acquisition, the sub had the following differences between book and fair values. Inventory Patents Equipment, net The Sub $ 500,000 200,000 680,000 Book Value 413,000 240,000 618,000 Fair Value 503,000 (Sold in 2017) 210,000 (7 Yr Rem Life) 722,000 (5 Yr Remaining Life) pays the Parent an annual management fee of $40,000. REQUIRED: Complete the attached consolidation workpapers for the year ended December 31, 2020.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Consolidation Workpapers for the Year Ended December 31 2020 Parent Subsidiary S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started