Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parent Company acquired 100% of Subsidiary Company's voting stock on January 1,2019 , by issuing 10,000 shares of its $10 par value common stock having

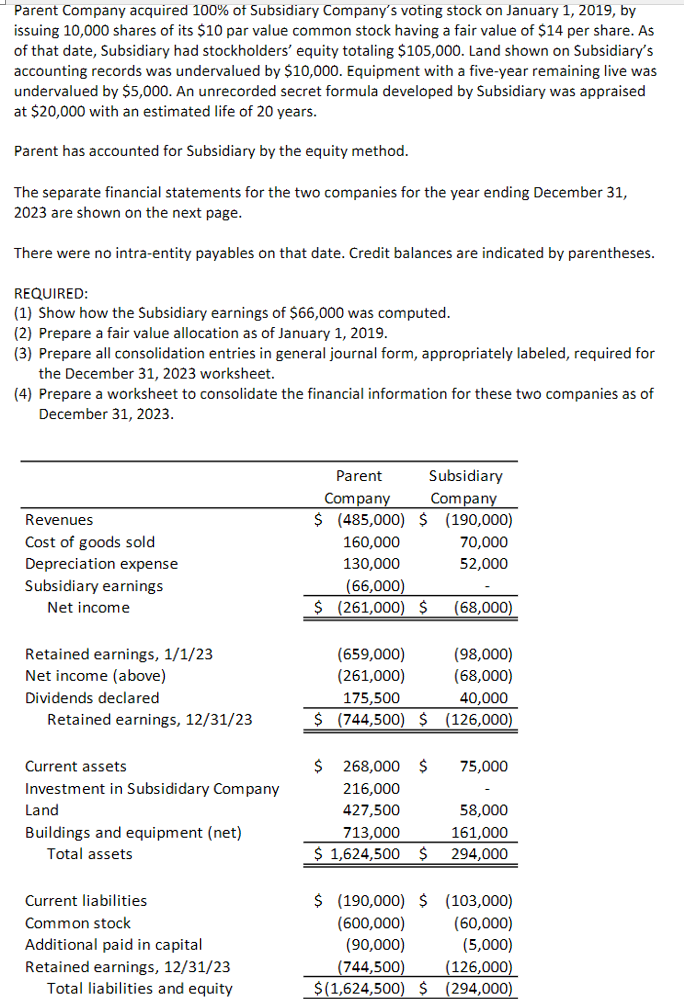

Parent Company acquired 100% of Subsidiary Company's voting stock on January 1,2019 , by issuing 10,000 shares of its $10 par value common stock having a fair value of $14 per share. As of that date, Subsidiary had stockholders' equity totaling $105,000. Land shown on Subsidiary's accounting records was undervalued by $10,000. Equipment with a five-year remaining live was undervalued by $5,000. An unrecorded secret formula developed by Subsidiary was appraised at $20,000 with an estimated life of 20 years. Parent has accounted for Subsidiary by the equity method. The separate financial statements for the two companies for the year ending December 31 , 2023 are shown on the next page. There were no intra-entity payables on that date. Credit balances are indicated by parentheses. REQUIRED: (1) Show how the Subsidiary earnings of $66,000 was computed. (2) Prepare a fair value allocation as of January 1, 2019. (3) Prepare all consolidation entries in general journal form, appropriately labeled, required for the December 31, 2023 worksheet. (4) Prepare a worksheet to consolidate the financial information for these two companies as of December 31, 2023

Parent Company acquired 100% of Subsidiary Company's voting stock on January 1,2019 , by issuing 10,000 shares of its $10 par value common stock having a fair value of $14 per share. As of that date, Subsidiary had stockholders' equity totaling $105,000. Land shown on Subsidiary's accounting records was undervalued by $10,000. Equipment with a five-year remaining live was undervalued by $5,000. An unrecorded secret formula developed by Subsidiary was appraised at $20,000 with an estimated life of 20 years. Parent has accounted for Subsidiary by the equity method. The separate financial statements for the two companies for the year ending December 31 , 2023 are shown on the next page. There were no intra-entity payables on that date. Credit balances are indicated by parentheses. REQUIRED: (1) Show how the Subsidiary earnings of $66,000 was computed. (2) Prepare a fair value allocation as of January 1, 2019. (3) Prepare all consolidation entries in general journal form, appropriately labeled, required for the December 31, 2023 worksheet. (4) Prepare a worksheet to consolidate the financial information for these two companies as of December 31, 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started