Answered step by step

Verified Expert Solution

Question

1 Approved Answer

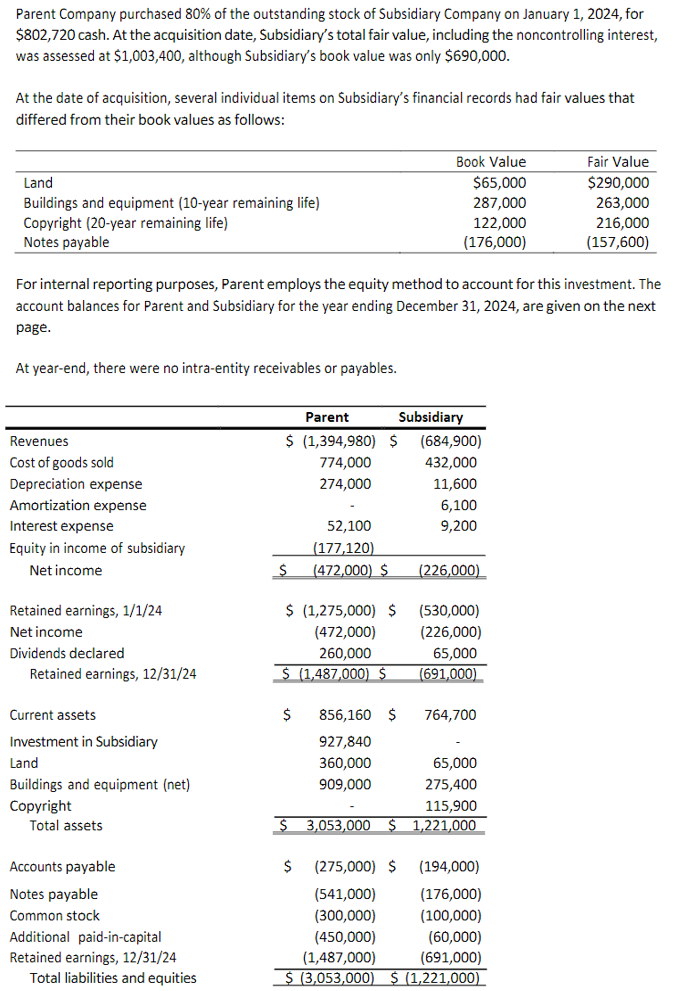

Parent Company purchased 80% of the outstanding stock of Subsidiary Company on January 1,2024 , for $802,720 cash. At the acquisition date, Subsidiary's total fair

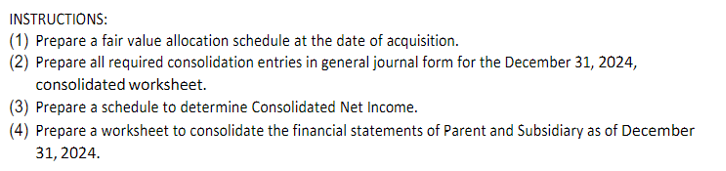

Parent Company purchased 80% of the outstanding stock of Subsidiary Company on January 1,2024 , for $802,720 cash. At the acquisition date, Subsidiary's total fair value, including the noncontrolling interest, was assessed at $1,003,400, although Subsidiary's book value was only $690,000. At the date of acquisition, several individual items on Subsidiary's financial records had fair values that differed from their book values as follows: For internal reporting purposes, Parent employs the equity method to account for this investment. The account balances for Parent and Subsidiary for the year ending December 31, 2024, are given on the next page. At year-end, there were no intra-entity receivables or payables. INSTRUCTIONS: (1) Prepare a fair value allocation schedule at the date of acquisition. (2) Prepare all required consolidation entries in general journal form for the December 31, 2024, consolidated worksheet. (3) Prepare a schedule to determine Consolidated Net Income. (4) Prepare a worksheet to consolidate the financial statements of Parent and Subsidiary as of December 31, 2024. Parent Company purchased 80% of the outstanding stock of Subsidiary Company on January 1,2024 , for $802,720 cash. At the acquisition date, Subsidiary's total fair value, including the noncontrolling interest, was assessed at $1,003,400, although Subsidiary's book value was only $690,000. At the date of acquisition, several individual items on Subsidiary's financial records had fair values that differed from their book values as follows: For internal reporting purposes, Parent employs the equity method to account for this investment. The account balances for Parent and Subsidiary for the year ending December 31, 2024, are given on the next page. At year-end, there were no intra-entity receivables or payables. INSTRUCTIONS: (1) Prepare a fair value allocation schedule at the date of acquisition. (2) Prepare all required consolidation entries in general journal form for the December 31, 2024, consolidated worksheet. (3) Prepare a schedule to determine Consolidated Net Income. (4) Prepare a worksheet to consolidate the financial statements of Parent and Subsidiary as of December 31, 2024

Parent Company purchased 80% of the outstanding stock of Subsidiary Company on January 1,2024 , for $802,720 cash. At the acquisition date, Subsidiary's total fair value, including the noncontrolling interest, was assessed at $1,003,400, although Subsidiary's book value was only $690,000. At the date of acquisition, several individual items on Subsidiary's financial records had fair values that differed from their book values as follows: For internal reporting purposes, Parent employs the equity method to account for this investment. The account balances for Parent and Subsidiary for the year ending December 31, 2024, are given on the next page. At year-end, there were no intra-entity receivables or payables. INSTRUCTIONS: (1) Prepare a fair value allocation schedule at the date of acquisition. (2) Prepare all required consolidation entries in general journal form for the December 31, 2024, consolidated worksheet. (3) Prepare a schedule to determine Consolidated Net Income. (4) Prepare a worksheet to consolidate the financial statements of Parent and Subsidiary as of December 31, 2024. Parent Company purchased 80% of the outstanding stock of Subsidiary Company on January 1,2024 , for $802,720 cash. At the acquisition date, Subsidiary's total fair value, including the noncontrolling interest, was assessed at $1,003,400, although Subsidiary's book value was only $690,000. At the date of acquisition, several individual items on Subsidiary's financial records had fair values that differed from their book values as follows: For internal reporting purposes, Parent employs the equity method to account for this investment. The account balances for Parent and Subsidiary for the year ending December 31, 2024, are given on the next page. At year-end, there were no intra-entity receivables or payables. INSTRUCTIONS: (1) Prepare a fair value allocation schedule at the date of acquisition. (2) Prepare all required consolidation entries in general journal form for the December 31, 2024, consolidated worksheet. (3) Prepare a schedule to determine Consolidated Net Income. (4) Prepare a worksheet to consolidate the financial statements of Parent and Subsidiary as of December 31, 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started