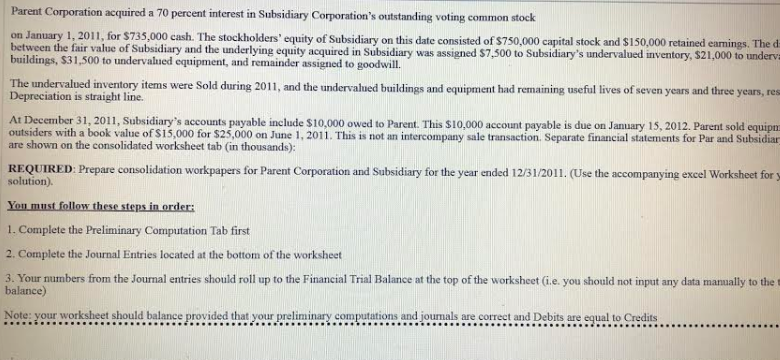

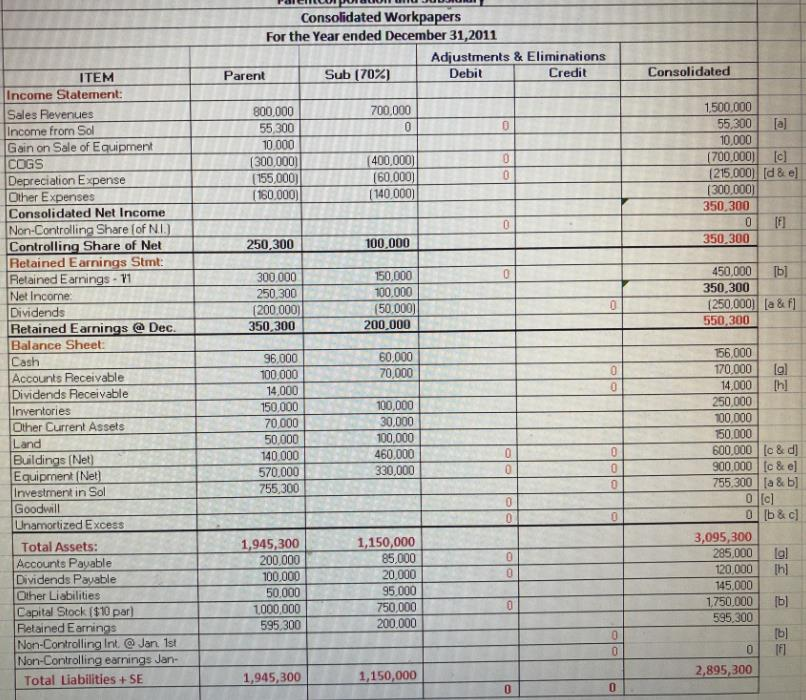

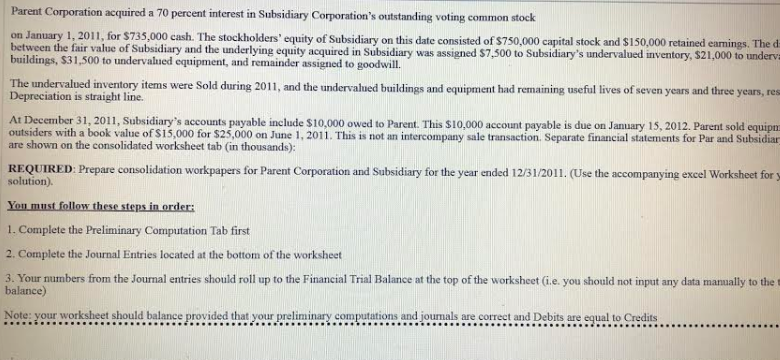

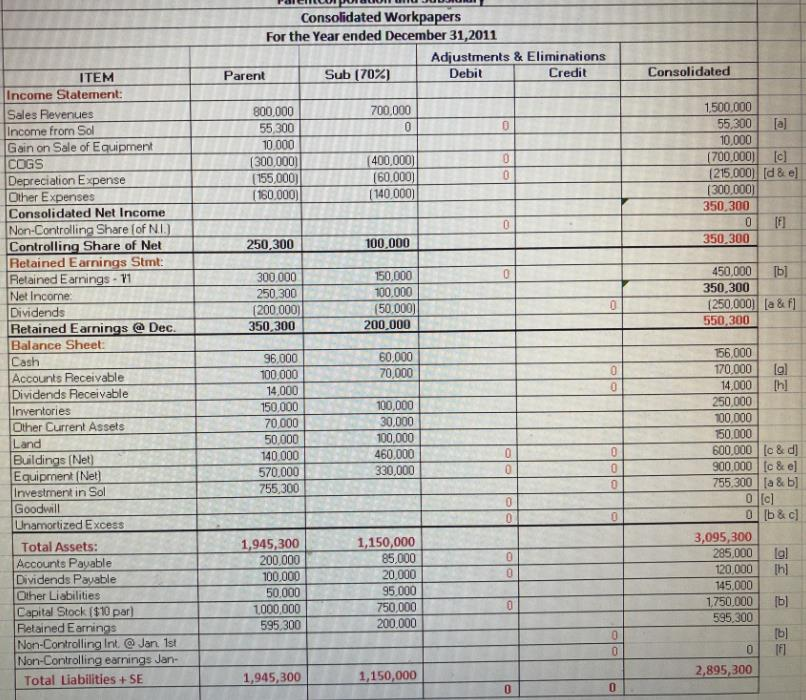

Parent Corporation acquired a 70 percent interest in Subsidiary Corporation's outstanding voting common stock on January 1, 2011, for $735,000 cash. The stockholders' equity of Subsidiary on this date consisted of $750,000 capital stock and $150,000 retained earnings. The d between the fair value of Subsidiary and the underlying equity acquired in Subsidiary was assigned $7,500 to Subsidiary's undervalued inventory. 521.000 to under buildings, 531,500 to undervalued equipment, and remainder assigned to goodwill. The undervalued inventory items were Sold during 2011, and the undervalued buildings and equipment had remaining useful lives of seven years and three years, res Depreciation is straight line. Al December 31, 2011, Subsidiary's accounts payable include $10,000 owed to Parent. This $10,000 account payable is due on January 15, 2012. Parent sold equipo outsiders with a book value of $15,000 for $25,000 on June 1, 2011. This is not an intercompany sale transaction Separate financial statements for Par and Subsidiar are shown on the consolidated worksheet tab (in thousands): REQUIRED: Prepare consolidation workpapers for Parent Corporation and Subsidiary for the year ended 12/31/2011. (Use the accompanying excel Worksheet for solution) You must follow these steps in order: 1. Complete the Preliminary Computation Tab first 2. Complete the Journal Entries located at the bottom of the worksheet 3. Your numbers from the Journal entries should roll up to the Financial Trial Balance at the top of the worksheet (i.e. you should not input any data manually to the balance) Note: your worksheet should balance provided that your preliminary computations and journals are correct and Debits are equal to Credits.. Consolidated Workpapers For the Year ended December 31, 2011 Adjustments & Eliminations Parent Sub (70%) Debil Credit Consolidated 700,000 800,000 55,300 10.000 (300,000) (155,000) [160.000) (400,000) (60.000) (140.000) 1.500.000 55,300 [a] 10.000 (700.000) (c) (215,000) [d & el 1300.000) 350,300 0 350.300 250,300 100,000 300 000 250.300 (200.000 350,300 150.000 100.000 (50.000 200.000 450,000 [b] 350.300 (250,000] [a & f] 550,300 ITEM Income Statement: Sales Revenues Income from Sol Gain on Sale of Equipment COGS Depreciation Expense Other Expenses Consolidated Net Income Non-Controlling Share of NI. Controlling Share of Net Retained Earnings Stmt: Retained Earnings - 11 Net Income Dividends Retained Earnings @ Dec. Balance Sheet Cash Accounts Receivable Dividends Receivable Inventories Other Current Assets Land Buildings (Net) Equipment (Net) Investment in Sol Goodwill Unamortized Excess Total Assets: Accounts Payable Dividends Payable Other Liabilities Capital Stock ($10 par Retained Earnings Non-Controlling Int @ Jan 1st Non-Controlling earnings Jan- Total Liabilities +SE 60,000 70,000 96.000 100.000 14,000 150,000 70 000 50.000 140 000 570,000 755,300 100,000 30.000 100,000 460,000 330,000 0 156,000 170.000 l 14,000 h! 250.000 100,000 750.000 600,000 [c & d) 900.000 Ic&e] 755,300 (a & b] 0 [c] 0 [b&c 3,095,300 285.000 120,000 145.000 1,750.000 595 300 0 0 1,945,300 200.000 100.000 50.000 1000,000 595,300 1,150,000 85,000 20.000 95.000 750,000 200.000 1,945,300 1,150,000 2,895,300 10 Parent Corporation acquired a 70 percent interest in Subsidiary Corporation's outstanding voting common stock on January 1, 2011, for $735,000 cash. The stockholders' equity of Subsidiary on this date consisted of $750,000 capital stock and $150,000 retained earnings. The d between the fair value of Subsidiary and the underlying equity acquired in Subsidiary was assigned $7,500 to Subsidiary's undervalued inventory. 521.000 to under buildings, 531,500 to undervalued equipment, and remainder assigned to goodwill. The undervalued inventory items were Sold during 2011, and the undervalued buildings and equipment had remaining useful lives of seven years and three years, res Depreciation is straight line. Al December 31, 2011, Subsidiary's accounts payable include $10,000 owed to Parent. This $10,000 account payable is due on January 15, 2012. Parent sold equipo outsiders with a book value of $15,000 for $25,000 on June 1, 2011. This is not an intercompany sale transaction Separate financial statements for Par and Subsidiar are shown on the consolidated worksheet tab (in thousands): REQUIRED: Prepare consolidation workpapers for Parent Corporation and Subsidiary for the year ended 12/31/2011. (Use the accompanying excel Worksheet for solution) You must follow these steps in order: 1. Complete the Preliminary Computation Tab first 2. Complete the Journal Entries located at the bottom of the worksheet 3. Your numbers from the Journal entries should roll up to the Financial Trial Balance at the top of the worksheet (i.e. you should not input any data manually to the balance) Note: your worksheet should balance provided that your preliminary computations and journals are correct and Debits are equal to Credits.. Consolidated Workpapers For the Year ended December 31, 2011 Adjustments & Eliminations Parent Sub (70%) Debil Credit Consolidated 700,000 800,000 55,300 10.000 (300,000) (155,000) [160.000) (400,000) (60.000) (140.000) 1.500.000 55,300 [a] 10.000 (700.000) (c) (215,000) [d & el 1300.000) 350,300 0 350.300 250,300 100,000 300 000 250.300 (200.000 350,300 150.000 100.000 (50.000 200.000 450,000 [b] 350.300 (250,000] [a & f] 550,300 ITEM Income Statement: Sales Revenues Income from Sol Gain on Sale of Equipment COGS Depreciation Expense Other Expenses Consolidated Net Income Non-Controlling Share of NI. Controlling Share of Net Retained Earnings Stmt: Retained Earnings - 11 Net Income Dividends Retained Earnings @ Dec. Balance Sheet Cash Accounts Receivable Dividends Receivable Inventories Other Current Assets Land Buildings (Net) Equipment (Net) Investment in Sol Goodwill Unamortized Excess Total Assets: Accounts Payable Dividends Payable Other Liabilities Capital Stock ($10 par Retained Earnings Non-Controlling Int @ Jan 1st Non-Controlling earnings Jan- Total Liabilities +SE 60,000 70,000 96.000 100.000 14,000 150,000 70 000 50.000 140 000 570,000 755,300 100,000 30.000 100,000 460,000 330,000 0 156,000 170.000 l 14,000 h! 250.000 100,000 750.000 600,000 [c & d) 900.000 Ic&e] 755,300 (a & b] 0 [c] 0 [b&c 3,095,300 285.000 120,000 145.000 1,750.000 595 300 0 0 1,945,300 200.000 100.000 50.000 1000,000 595,300 1,150,000 85,000 20.000 95.000 750,000 200.000 1,945,300 1,150,000 2,895,300 10