Question

Parent Ltd owns 70 per cent of the share capital of Subsidiary Ltd. During the year ended 30 June 2020: ? Parent Ltd sold inventory

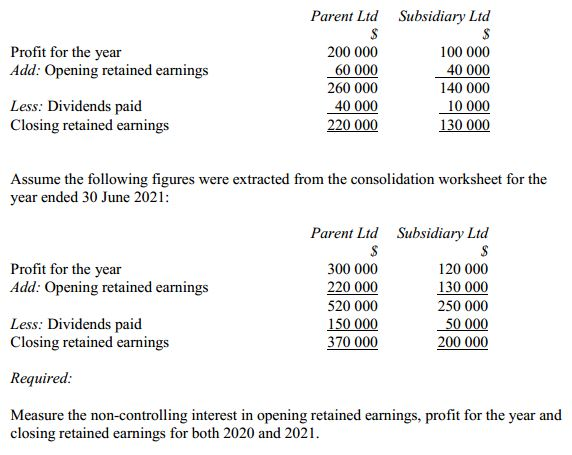

Parent Ltd owns 70 per cent of the share capital of Subsidiary Ltd. During the year ended 30 June 2020: ? Parent Ltd sold inventory to Subsidiary Ltd at a profit of $30 000 (the inventory is still on hand at 30 June 2020); ? Subsidiary Ltd sold plant to Parent Ltd for $100 000 at a profit of $20 000; and ? Subsidiary Ltd provided Parent Ltd with $20 000 of management services. The plant was sold by Subsidiary Ltd to Parent Ltd on 1 July 2019 and is depreciated on a straight-line basis. The plant has a useful life of five years with a scrap value of $0 at the end of that period. Assume a tax rate of 30 per cent. The following figures were extracted from the consolidation worksheet for the year ended 30 June 2020:

Parent Ltd Subsidiary Ltd 200 000 60 000 260 000 40 000 220 000 Profit for the year Add: Opening retained earnings 100 000 40 000 140 000 10000 Less: Dividends paid Closing retained earnings Assume the following figures were extracted from the consolidation worksheet for the year ended 30 June 2021 Parent Ltd Subsidiary Ltd 300 000 220 000 520 000 150 000 370 000 Profit for the year 120 000 130 000 250 000 50 000 200 000 Add: Opening retained earnings Less: Dividends paid Closing retained earnings Required. Measure the non-controlling interest in opening retained earnings, profit for the year and closing retained earnings for both 2020 and 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started