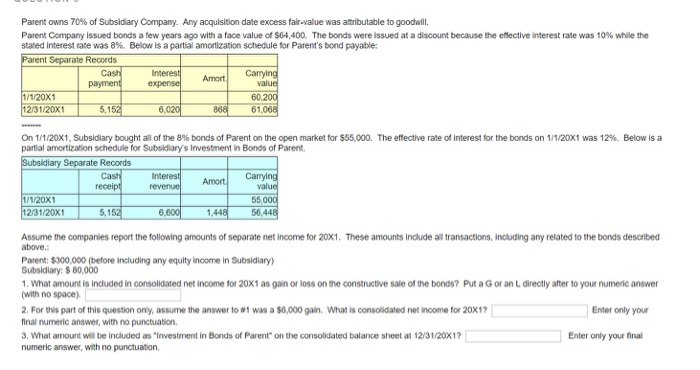

Parent owns 70% of Subsidiary Company. Any acquisition date excess fair-value was attributable to goodwill. Parent Company issued bonds a few years ago with a face value of $64,400. The bonds were issued at a discount because the effective interest rate was 10% while the stated interest rate was 8%. Below is a partial amortization schedule for Parent's bond payable: Parent Separate Records Cas interest Amort Carrying payment expense valued 1/1/20X1 60.200 12/31/20X15.1526 ,020868 61,066 On 1/1/20X1, Subsidiary bought all of the 8% bonds of Parent on the open market for $55,000. The effective rate of interest for the bonds on 1/1/20X1 was 12%. Below is a partial amortization schedule for Subsidiary's Investment in Bonds of Parent Subsidiary Separate Records Cash interest Carrying Amort receipt revenue value 1/1/20X1 55,000 12/31/20X15 ,152 6 ,600 1,448 56,448 Assume the companies report the following amounts of separate net income for 20X1. These amounts include all transactions, including any related to the bonds described above.: Parent: $300.000 (before including any equity income in Subsidiary) Subsidiary: $ 80.000 1. What amount is included in consolidated net income for 20X1 as gain or loss on the constructive sale of the bonds? Put a Goran L directly after to your numeric answer (with no space) 2. For this part of this question only, assume the answer to #1 was a $5,000 gain. What is consolidated net income for 20X1? Enter only your final numeric answer, with no punctuation 3. What amount will be included as "Investment in Bonds of Parent" on the consolidated balance sheet at 12/31/20X1? Enter only your final numeric answer, with no punctuation Parent owns 70% of Subsidiary Company. Any acquisition date excess fair-value was attributable to goodwill. Parent Company issued bonds a few years ago with a face value of $64,400. The bonds were issued at a discount because the effective interest rate was 10% while the stated interest rate was 8%. Below is a partial amortization schedule for Parent's bond payable: Parent Separate Records Cas interest Amort Carrying payment expense valued 1/1/20X1 60.200 12/31/20X15.1526 ,020868 61,066 On 1/1/20X1, Subsidiary bought all of the 8% bonds of Parent on the open market for $55,000. The effective rate of interest for the bonds on 1/1/20X1 was 12%. Below is a partial amortization schedule for Subsidiary's Investment in Bonds of Parent Subsidiary Separate Records Cash interest Carrying Amort receipt revenue value 1/1/20X1 55,000 12/31/20X15 ,152 6 ,600 1,448 56,448 Assume the companies report the following amounts of separate net income for 20X1. These amounts include all transactions, including any related to the bonds described above.: Parent: $300.000 (before including any equity income in Subsidiary) Subsidiary: $ 80.000 1. What amount is included in consolidated net income for 20X1 as gain or loss on the constructive sale of the bonds? Put a Goran L directly after to your numeric answer (with no space) 2. For this part of this question only, assume the answer to #1 was a $5,000 gain. What is consolidated net income for 20X1? Enter only your final numeric answer, with no punctuation 3. What amount will be included as "Investment in Bonds of Parent" on the consolidated balance sheet at 12/31/20X1? Enter only your final numeric answer, with no punctuation