Answered step by step

Verified Expert Solution

Question

1 Approved Answer

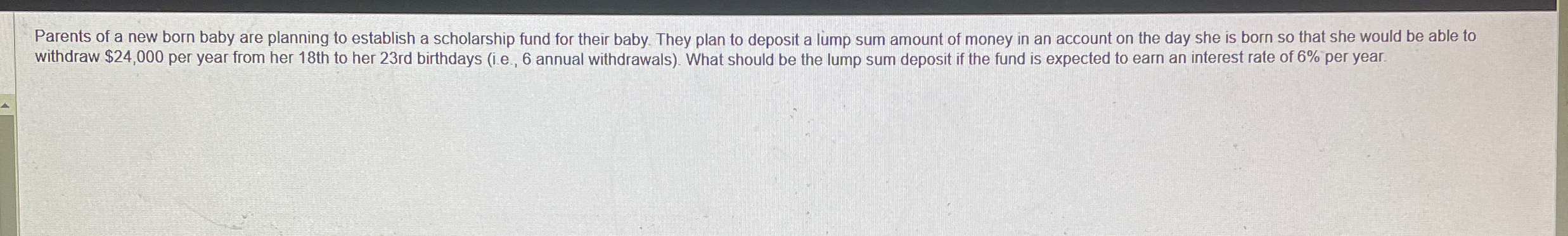

Parents of a new born baby are planning to establish a scholarship fund for their baby. They plan to deposit a lump sum amount of

Parents of a new born baby are planning to establish a scholarship fund for their baby. They plan to deposit a lump sum amount of money in an account on the day she is born so that she would be able to withdraw $ per year from her th to her rd birthdays ie annual withdrawals What should be the lump sum deposit if the fund is expected to earn an interest rate of per year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started