Answered step by step

Verified Expert Solution

Question

1 Approved Answer

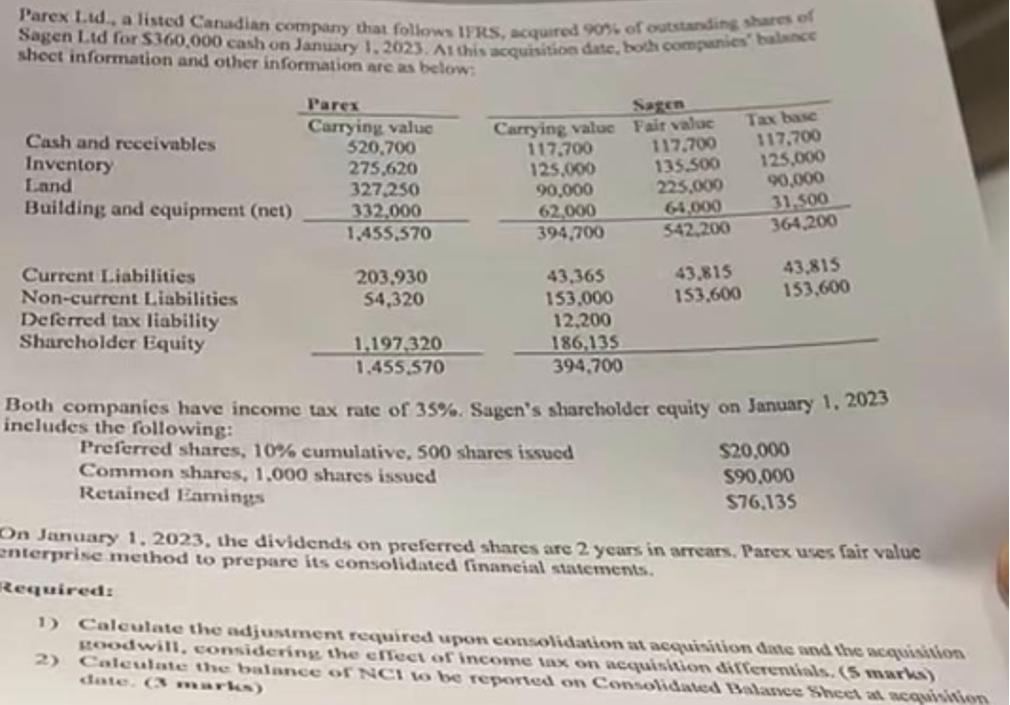

Parex Ltd., a listed Canadian company that follows IFRS, acquired 90% of outstanding shares of sheet information and other information are as below: balance

Parex Ltd., a listed Canadian company that follows IFRS, acquired 90% of outstanding shares of sheet information and other information are as below: balance Cash and receivables Parex Carrying value Sagen 520,700 Inventory Carrying value Fair value 117,700 Tax base 117,700 117,700 Land 275,620 125,000 135.500 125,000 327,250 Building and equipment (net) 90,000 225,000 90,000 332,000 62,000 64,000 31,500 1,455,570 394,700 542,200 364,200 Current Liabilities 203.930 43,365 Non-current Liabilities 43.815 43,815 54,320 Deferred tax liability 153,000 153,600 153,600 Shareholder Equity 12,200 1,197,320 186,135 1.455.570 394,700 Both companies have income tax rate of 35%. Sagen's shareholder equity on January 1, 2023 includes the following: Preferred shares, 10% cumulative, 500 shares issued Common shares, 1,000 shares issued Retained Earnings $20,000 $90,000 $76,135 On January 1, 2023, the dividends on preferred shares are 2 years in arrears. Parex uses fair value enterprise method to prepare its consolidated financial statements. Required: 1) Calculate the adjustment required upon consolidation at acquisition date and the acquisition goodwill, considering the effect of income tax on acquisition differentials. (5 marks) 2) Calculate the balance of NCI to be reported on Consolidated Balance Sheet at acquisition date. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the goodwill adjustment required upon consolidation at the acquisition date we need to determine the fair value of the identifiabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e8db117e3b_954701.pdf

180 KBs PDF File

663e8db117e3b_954701.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started