Question

Park Avenue Tire Company has been operating in Winnipeg for more than 30 years and has a very loyal customer base. The company sells and

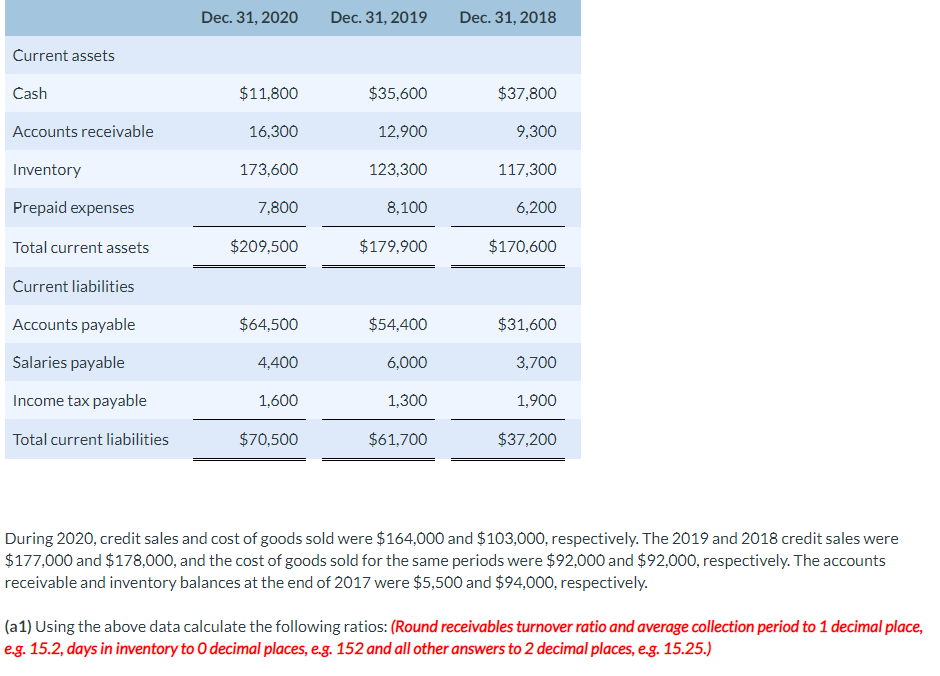

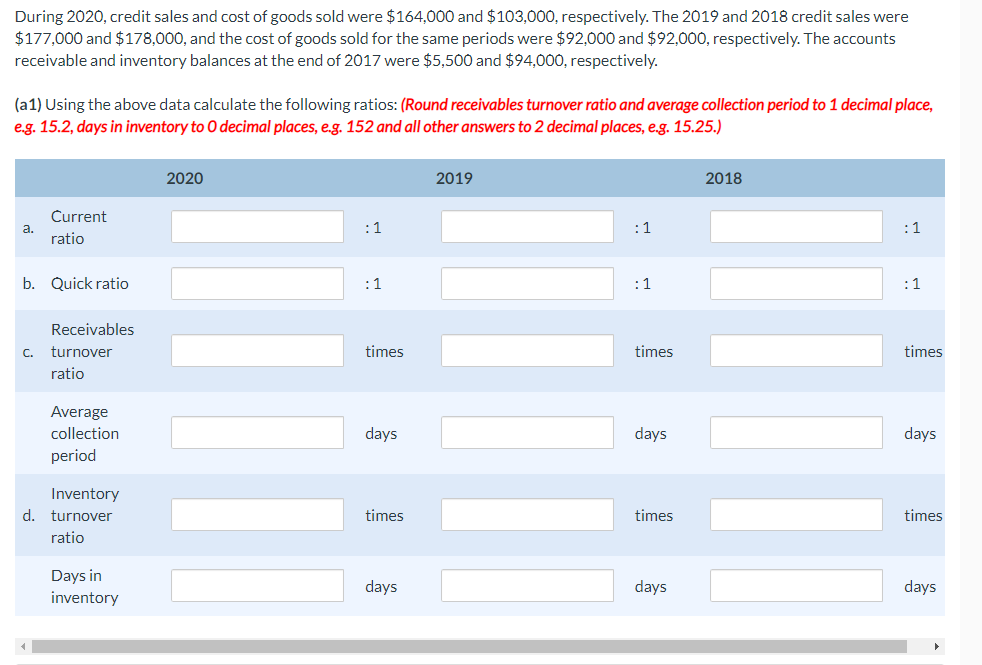

Park Avenue Tire Company has been operating in Winnipeg for more than 30 years and has a very loyal customer base. The company sells and installs tires and the owners pride themselves on the excellent business relationships they have developed with both their customers and suppliers. The company often sells tires on credit, allowing customers to pay their balances within 30 days. Collection of accounts receivable has never been a problem, with most people paying their balances within 60 days. Park Avenue purchases tires from most of the large national brands and, due to the nature of the business, generally maintains a fairly large inventory. It is essential that the company have the necessary tires on hand to meet customer needs due to increased competition from large retailers such as Canadian Tire and Walmart. The company has always had sufficient cash to pay its suppliers immediately and take advantage of cash discounts. However, this month, for the first time ever, Park Avenue does not have sufficient cash in the bank to meet its supplier payments. Chris Park, son of the original owner, Ernest Park, is currently operating the business and is very concerned about the companys inability to maintain what he feels are adequate levels of cash. Your firm has been the accountants for Park Avenue Tire Company for the past 20 years. Chris has approached the firm expressing his concerns and asking for advice on how to solve the cash flow problems. As part of your analysis, you review the companys financial statements for the past three years. Excerpts from the financial statements are presented below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started