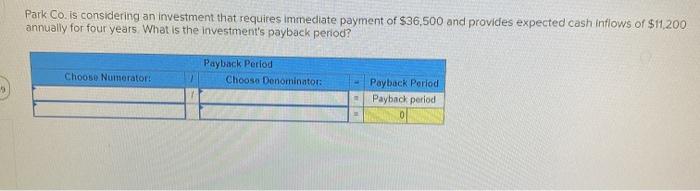

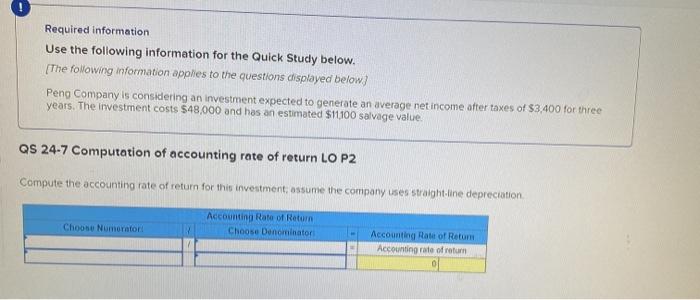

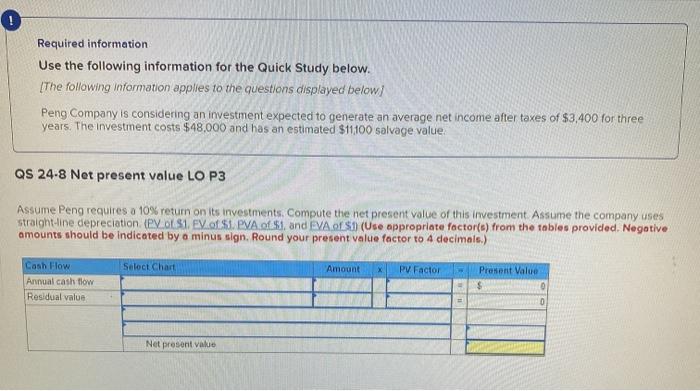

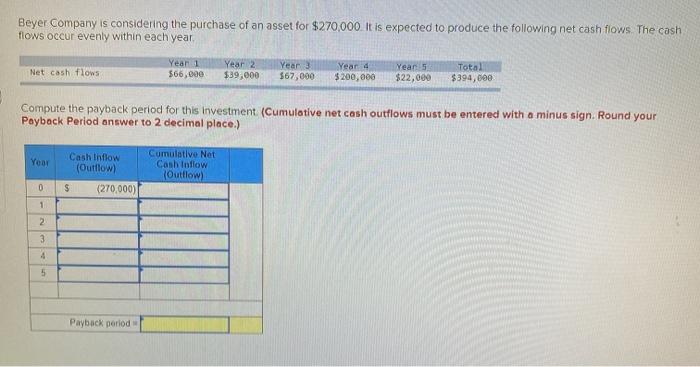

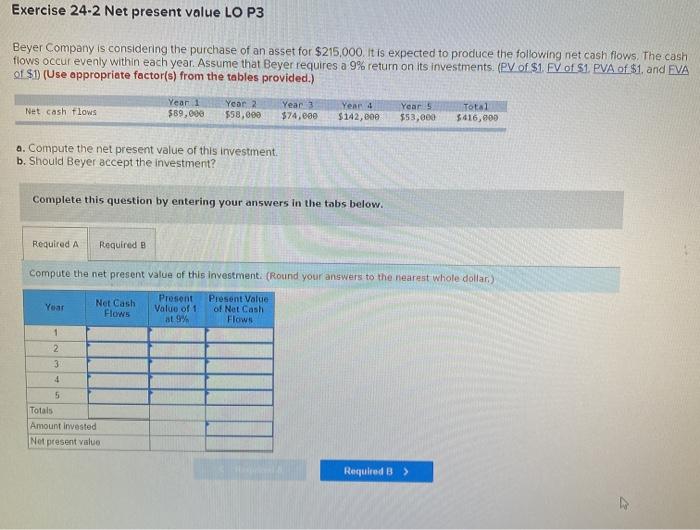

Park Co. is considering an investment that requires immediate payment of $36,500 and provides expected cash inflows of $11.200 annually for four years. What is the investment's payback period? Choose Numerator Payback Period Choose Denominator: Payback Period Payback period 0 Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below) Peng Company is considering an investment expected to generate an average net income after taxes of $3,400 for three years. The investment costs $48,000 and has an estimated $11100 salvage value. QS 24-7 Computation of accounting rate of return LO P2 Compute the accounting rate of return for this investment, assume the company uses straight line depreciation Choone Numerator Accounting Rate of Return Choose Denominatori Accounting Rate of Return Accounting rate of return Required information Use the following information for the Quick Study below. {The following information applies to the questions displayed below) Peng Company is considering an investment expected to generate an average net income after taxes of $3,400 for three years. The investment costs $48.000 and has an estimated $11100 salvage value QS 24.8 Net present value LO P3 Assume Peng requires a 10% return on its investments, Compute the net present value of this investment Assume the company uses straight line depreciation (ex. 31. EV of S.PVA of $, and EVA of S1 (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your present value factor to 4 decimals.) Select Chart Amount X PV Factor Present Value Cash Flow Annual cash flow Residual value Net present value Beyer Company is considering the purchase of an asset for $270,000. It is expected to produce the following net cash flows The cash flows occur evenly within each year Net cash flows Year 1 $66,000 Year 2 $89,000 Year 3 $67,000 Year 4 $200,000 Years $22,000 Total $394,000 Compute the payback period for this investment (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal place.) Year Cash Inflow (Outllow $ (270,000) Cumulative Net Cash Inflow (Outflow) 0 1 2 3 4 5 Payback period Exercise 24.2 Net present value LO P3 Beyer Company is considering the purchase of an asset for $215,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Assume that Beyer requires a 9% return on its investments. (PV of $1. FV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Year 1 $89,000 Year 2 $58,000 Year 3 $74,000 Year 4 $142,000 Years $53,000 Total $416,000 a. Compute the net present value of this investment. b. Should Beyer accept the investment? Complete this question by entering your answers in the tabs below. Required A Required B Compute the net present value of this Investment. (Round your answers to the nearest whole dollar) Year Net Cash Flows Present Value of 1 Present Value of Net Cash Flows at 9% 1 2 3 4 5 Totals Amount invested Not present value Required B