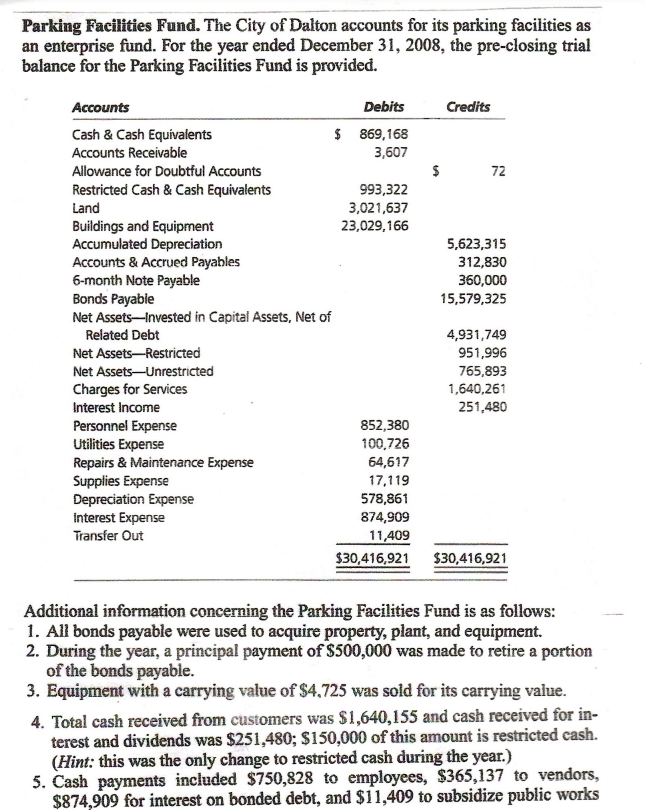

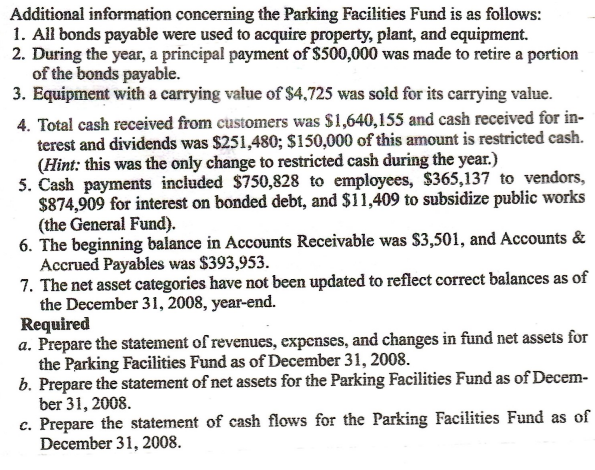

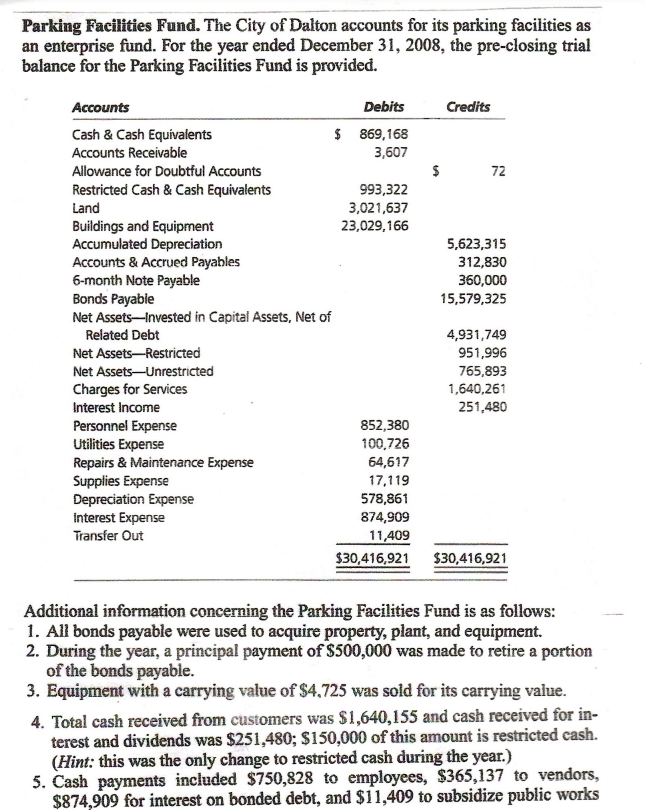

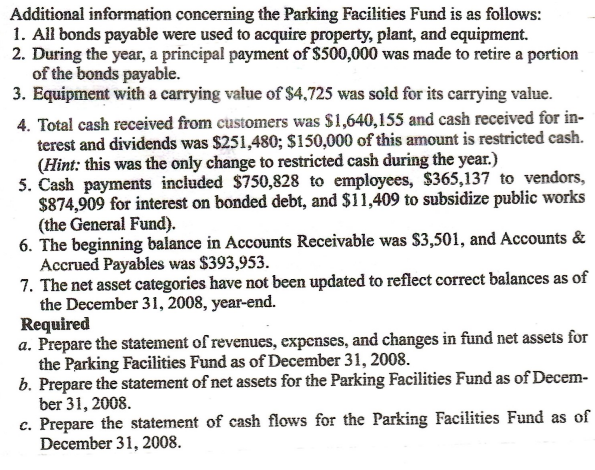

Parking Facilities Fund. The City of Dalton accounts for its parking facilities as an enterprise fund. For the year ended December 31, 2008, the pre-closing trial balance for the Parking Facilities Fund is provided. Additional information concerning the Parking Facilities Fund is as follows: 1. All bonds payable were used to acquire property, plant, and equipment. 2. During the year, a principal payment of $500,000 was made to retire a portion of the bonds payable. 3. Equipment with a carrying value of $4,725 was sold for its carrying value. 4. Total cash received from customers was $1,640,155 and cash received for interest and dividends was $251,480; $150,000 of this amount is restricted cash. (Hint: this was the only change to restricted cash during the year.) 5. Cash payments included $750,828 to employees, $365,137 to vendors, $874,909 for interest on bonded debt, and $11,409 to subsidize public works Additional information concerning the Parking Facilities Fund is as follows: 1. All bonds payable were used to acquire property, plant, and equipment. 2. During the year, a principal payment of $500,000 was made to retire a portion of the bonds payable. 3. Equipment with a carrying value of $4,725 was sold for its carrying value. 4. Total cash received from customers was $1,640,155 and cash received for interest and dividends was $251,480;$150,000 of this amount is restricted cash. (Hint: this was the only change to restricted cash during the year.) 5. Cash payments included $750,828 to employees, $365,137 to vendors, $874,909 for interest on bonded debt, and $11,409 to subsidize public works (the General Fund). 6. The beginning balance in Accounts Receivable was $3,501, and Accounts \& Accrued Payables was $393,953. 7. The net asset categories have not been updated to reflect correct balances as of the December 31, 2008, year-end. Required a. Prepare the statement of revenues, expenses, and changes in fund net assets for the Parking Facilities Fund as of December 31, 2008. b. Prepare the statement of net assets for the Parking Facilities Fund as of December 31,2008 . c. Prepare the statement of cash flows for the Parking Facilities Fund as of December 31, 2008. Parking Facilities Fund. The City of Dalton accounts for its parking facilities as an enterprise fund. For the year ended December 31, 2008, the pre-closing trial balance for the Parking Facilities Fund is provided. Additional information concerning the Parking Facilities Fund is as follows: 1. All bonds payable were used to acquire property, plant, and equipment. 2. During the year, a principal payment of $500,000 was made to retire a portion of the bonds payable. 3. Equipment with a carrying value of $4,725 was sold for its carrying value. 4. Total cash received from customers was $1,640,155 and cash received for interest and dividends was $251,480; $150,000 of this amount is restricted cash. (Hint: this was the only change to restricted cash during the year.) 5. Cash payments included $750,828 to employees, $365,137 to vendors, $874,909 for interest on bonded debt, and $11,409 to subsidize public works Additional information concerning the Parking Facilities Fund is as follows: 1. All bonds payable were used to acquire property, plant, and equipment. 2. During the year, a principal payment of $500,000 was made to retire a portion of the bonds payable. 3. Equipment with a carrying value of $4,725 was sold for its carrying value. 4. Total cash received from customers was $1,640,155 and cash received for interest and dividends was $251,480;$150,000 of this amount is restricted cash. (Hint: this was the only change to restricted cash during the year.) 5. Cash payments included $750,828 to employees, $365,137 to vendors, $874,909 for interest on bonded debt, and $11,409 to subsidize public works (the General Fund). 6. The beginning balance in Accounts Receivable was $3,501, and Accounts \& Accrued Payables was $393,953. 7. The net asset categories have not been updated to reflect correct balances as of the December 31, 2008, year-end. Required a. Prepare the statement of revenues, expenses, and changes in fund net assets for the Parking Facilities Fund as of December 31, 2008. b. Prepare the statement of net assets for the Parking Facilities Fund as of December 31,2008 . c. Prepare the statement of cash flows for the Parking Facilities Fund as of December 31, 2008