Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paron Co is intending to acquire a subsidiary on 1 January 20x0 and has shortlisted one of its regular suppliers, Subsea Co, as a

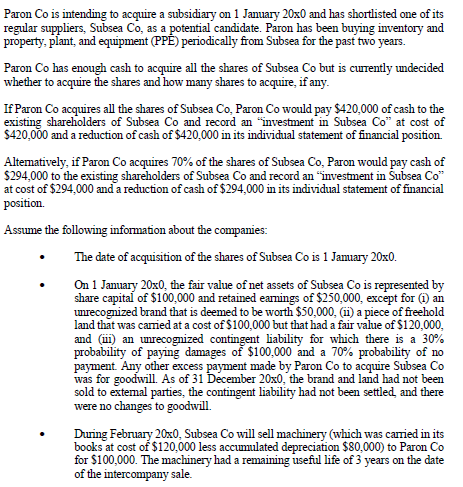

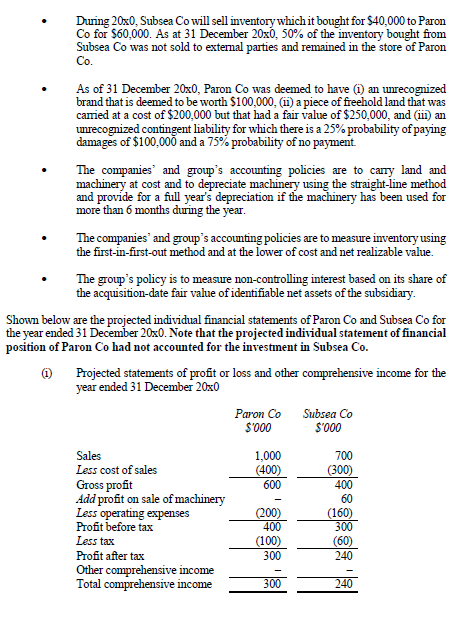

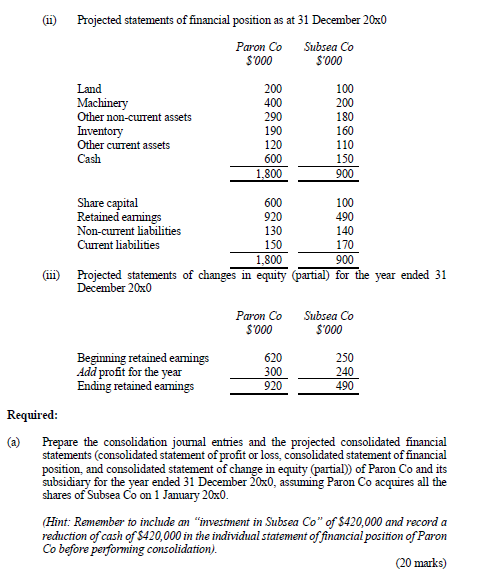

Paron Co is intending to acquire a subsidiary on 1 January 20x0 and has shortlisted one of its regular suppliers, Subsea Co, as a potential candidate. Paron has been buying inventory and property, plant, and equipment (PPE) periodically from Subsea for the past two years. Paron Co has enough cash to acquire all the shares of Subsea Co but is currently undecided whether to acquire the shares and how many shares to acquire, if any. If Paron Co acquires all the shares of Subsea Co, Paron Co would pay $420,000 of cash to the existing shareholders of Subsea Co and record an "investment in Subsea Co" at cost of $420,000 and a reduction of cash of $420,000 in its individual statement of financial position. Alternatively, if Paron Co acquires 70% of the shares of Subsea Co, Paron would pay cash of $294,000 to the existing shareholders of Subsea Co and record an "investment in Subsea Co" at cost of $294,000 and a reduction of cash of $294,000 in its individual statement of financial position. Assume the following information about the companies: The date of acquisition of the shares of Subsea Co is 1 January 20x0. On 1 January 20x0, the fair value of net assets of Subsea Co is represented by share capital of $100,000 and retained earnings of $250,000, except for (1) an unrecognized brand that is deemed to be worth $50,000, (ii) a piece of freehold land that was carried at a cost of $100,000 but that had a fair value of $120,000, and (iii) an unrecognized contingent liability for which there is a 30% probability of paying damages of $100,000 and a 70% probability of no payment. Any other excess payment made by Paron Co to acquire Subsea Co was for goodwill. As of 31 December 20x0, the brand and land had not been sold to external parties, the contingent liability had not been settled, and there were no changes to goodwill. During February 20x0, Subsea Co will sell machinery (which was carried in its books at cost of $120,000 less accumulated depreciation $80,000) to Paron Co for $100,000. The machinery had a remaining useful life of 3 years on the date of the intercompany sale. During 20x0, Subsea Co will sell inventory which it bought for $40,000 to Paron Co for $60,000. As at 31 December 20x0, 50% of the inventory bought from Subsea Co was not sold to external parties and remained in the store of Paron Co. As of 31 December 20x0, Paron Co was deemed to have (1) an unrecognized brand that is deemed to be worth $100,000, (11) a piece of freehold land that was carried at a cost of $200,000 but that had a fair value of $250,000, and (iii) an unrecognized contingent liability for which there is a 25% probability of paying damages of $100,000 and a 75% probability of no payment. The companies and group's accounting policies are to carry land and machinery at cost and to depreciate machinery using the straight-line method and provide for a full year's depreciation if the machinery has been used for more than 6 months during the year. The companies' and group's accounting policies are to measure inventory using the first-in-first-out method and at the lower of cost and net realizable value. The group's policy is to measure non-controlling interest based on its share of the acquisition-date fair value of identifiable net assets of the subsidiary. Shown below are the projected individual financial statements of Paron Co and Subsea Co for the year ended 31 December 20x0. Note that the projected individual statement of financial position of Paron Co had not accounted for the investment in Subsea Co. (1) Projected statements of profit or loss and other comprehensive income for the year ended 31 December 20x0 Sales Less cost of sales Gross profit Add profit on sale of machinery Less operating expenses Profit before tax Less tax Profit after tax Other comprehensive income Total comprehensive income Paron Co $'000 1,000 (400) 600 (200) ***** 400 (100) 300 300 Subsea Co $'000 ********* (300) (160) (60) (111) Required: (a) Projected statements of financial position as at 31 December 20x0 Paron Co $'000 Land Machinery Other non-current assets Inventory Other current assets Cash Share capital Retained earnings Non-current liabilities Current liabilities 200 400 290 190 120 600 1,800 Beginning retained earnings Add profit for the year Ending retained earnings 600 920 130 150 Paron Co $'000 Subsea Co $'000 1,800 900 Projected statements of changes in equity (partial) for the year ended 31 December 20x0 620 300 920 100 200 180 160 110 150 900 100 490 140 170 Subsea Co $'000 250 240 490 Prepare the consolidation journal entries and the projected consolidated financial statements (consolidated statement of profit or loss, consolidated statement of financial position, and consolidated statement of change in equity (partial)) of Paron Co and its subsidiary for the year ended 31 December 20x0, assuming Paron Co acquires all the shares of Subsea Co on 1 January 20x0. (Hint: Remember to include an "investment in Subsea Co" of $420,000 and record a reduction of cash of $420,000 in the individual statement of financial position of Paron Co before performing consolidation). (20 marks) Paron Co is intending to acquire a subsidiary on 1 January 20x0 and has shortlisted one of its regular suppliers, Subsea Co, as a potential candidate. Paron has been buying inventory and property, plant, and equipment (PPE) periodically from Subsea for the past two years. Paron Co has enough cash to acquire all the shares of Subsea Co but is currently undecided whether to acquire the shares and how many shares to acquire, if any. If Paron Co acquires all the shares of Subsea Co, Paron Co would pay $420,000 of cash to the existing shareholders of Subsea Co and record an "investment in Subsea Co" at cost of $420,000 and a reduction of cash of $420,000 in its individual statement of financial position. Alternatively, if Paron Co acquires 70% of the shares of Subsea Co, Paron would pay cash of $294,000 to the existing shareholders of Subsea Co and record an "investment in Subsea Co" at cost of $294,000 and a reduction of cash of $294,000 in its individual statement of financial position. Assume the following information about the companies: The date of acquisition of the shares of Subsea Co is 1 January 20x0. On 1 January 20x0, the fair value of net assets of Subsea Co is represented by share capital of $100,000 and retained earnings of $250,000, except for (1) an unrecognized brand that is deemed to be worth $50,000, (ii) a piece of freehold land that was carried at a cost of $100,000 but that had a fair value of $120,000, and (iii) an unrecognized contingent liability for which there is a 30% probability of paying damages of $100,000 and a 70% probability of no payment. Any other excess payment made by Paron Co to acquire Subsea Co was for goodwill. As of 31 December 20x0, the brand and land had not been sold to external parties, the contingent liability had not been settled, and there were no changes to goodwill. During February 20x0, Subsea Co will sell machinery (which was carried in its books at cost of $120,000 less accumulated depreciation $80,000) to Paron Co for $100,000. The machinery had a remaining useful life of 3 years on the date of the intercompany sale. During 20x0, Subsea Co will sell inventory which it bought for $40,000 to Paron Co for $60,000. As at 31 December 20x0, 50% of the inventory bought from Subsea Co was not sold to external parties and remained in the store of Paron Co. As of 31 December 20x0, Paron Co was deemed to have (1) an unrecognized brand that is deemed to be worth $100,000, (11) a piece of freehold land that was carried at a cost of $200,000 but that had a fair value of $250,000, and (iii) an unrecognized contingent liability for which there is a 25% probability of paying damages of $100,000 and a 75% probability of no payment. The companies and group's accounting policies are to carry land and machinery at cost and to depreciate machinery using the straight-line method and provide for a full year's depreciation if the machinery has been used for more than 6 months during the year. The companies' and group's accounting policies are to measure inventory using the first-in-first-out method and at the lower of cost and net realizable value. The group's policy is to measure non-controlling interest based on its share of the acquisition-date fair value of identifiable net assets of the subsidiary. Shown below are the projected individual financial statements of Paron Co and Subsea Co for the year ended 31 December 20x0. Note that the projected individual statement of financial position of Paron Co had not accounted for the investment in Subsea Co. (1) Projected statements of profit or loss and other comprehensive income for the year ended 31 December 20x0 Sales Less cost of sales Gross profit Add profit on sale of machinery Less operating expenses Profit before tax Less tax Profit after tax Other comprehensive income Total comprehensive income Paron Co $'000 1,000 (400) 600 (200) ***** 400 (100) 300 300 Subsea Co $'000 ********* (300) (160) (60) (111) Required: (a) Projected statements of financial position as at 31 December 20x0 Paron Co $'000 Land Machinery Other non-current assets Inventory Other current assets Cash Share capital Retained earnings Non-current liabilities Current liabilities 200 400 290 190 120 600 1,800 Beginning retained earnings Add profit for the year Ending retained earnings 600 920 130 150 Paron Co $'000 Subsea Co $'000 1,800 900 Projected statements of changes in equity (partial) for the year ended 31 December 20x0 620 300 920 100 200 180 160 110 150 900 100 490 140 170 Subsea Co $'000 250 240 490 Prepare the consolidation journal entries and the projected consolidated financial statements (consolidated statement of profit or loss, consolidated statement of financial position, and consolidated statement of change in equity (partial)) of Paron Co and its subsidiary for the year ended 31 December 20x0, assuming Paron Co acquires all the shares of Subsea Co on 1 January 20x0. (Hint: Remember to include an "investment in Subsea Co" of $420,000 and record a reduction of cash of $420,000 in the individual statement of financial position of Paron Co before performing consolidation). (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare the consolidation journal entries and projected consolidated financial statements for Paron Co and its subsidiary Subsea Co for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started