Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parrott Company purchased 40% of Silver Company's outstanding common stock on January 1 for $400,000 when the book value of the entire Silver Company

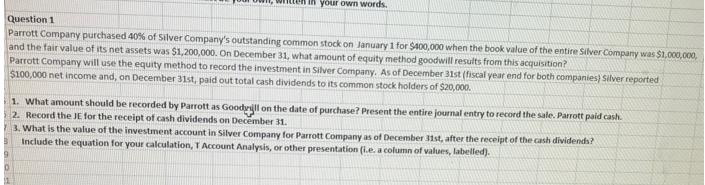

Parrott Company purchased 40% of Silver Company's outstanding common stock on January 1 for $400,000 when the book value of the entire Silver Company was $1,000,000, and the fair value of its net assets was $1,200,000. On December 31, what amount of equity method goodwill results from this acquisition? Parrott Company will use the equity method to record the investment in Silver Company. As of December 31st (fiscal year end for both companies) Silver reported $100,000 net income and, on December 31st, paid out total cash dividends to its common stock holders of $20,000. 1. What amount should be recorded by Parrott as Goodrill on the date of purchase? Present the entire journal entry to record the sale. Parrott paid cash. 2. Record the JE for the receipt of cash dividends on December 31. 3. What is the value of the investment account in Silver Company for Parrott Company as of December 31st, after the receipt of the cash dividends? Include the equation for your calculation, T Account Analysis, or other presentation (i.e. a column of values, labelled).

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started