Question

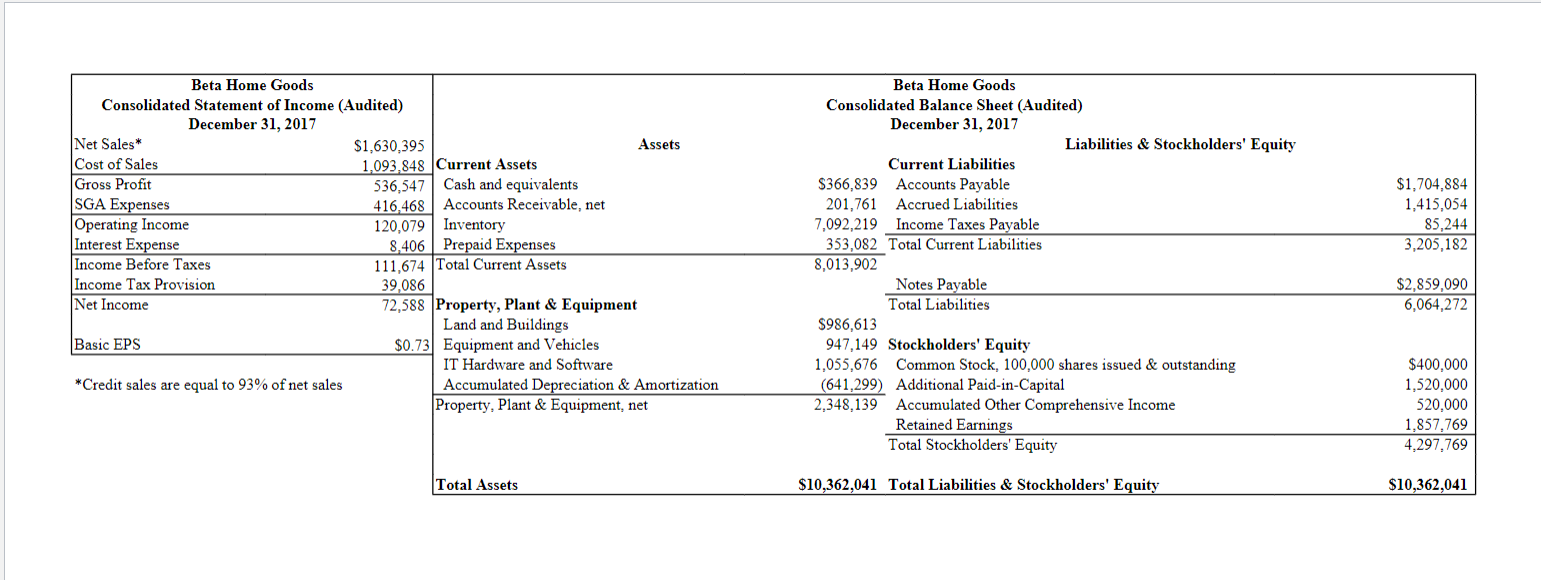

Part 1 (12 points): Analytical Procedures using the 2017 Financial Statements 1. An auditor calculating Betas quick ratio should exclude which of the following item(s)

Part 1 (12 points): Analytical Procedures using the 2017 Financial Statements

1. An auditor calculating Betas quick ratio should exclude which of the following item(s) from current assets?

a. Cash and equivalents

b. Inventory

c. Prepaid Expenses

d. B & C only

2. The numerator of Betas receivables turnover is equal to

a. Eighty-seven percent of Betas cost of sales

b. Eighty-seven percent of Betas net sales

c. Ninety-three percent of Betas cost of sales

d. Ninety-three percent of Betas net sales

3. An auditor calculating Betas inventory turnover should include which financial statement item in the denominator?

a. Cost of goods sold

b. Inventory

c. Sales

d. Total current assets

4. An auditor calculating Betas current ratio should include which financial statement item in the numerator?

a. Current assets

b. Current liabilities

c. Interest expense

d. Long-term debt

5. Assuming a 365 day year, Betas days outstanding in accounts receivables is __ days.

a. 47.90

b. 48.57

c. 61.55

6. Betas quick ratio is __ %.

a. 0.18

b. 0.30

c. 2.72

7. Betas return on equity (ROE) is __ %.

a. 0.70

b. 1.69

c. 1.84

8. Betas profit margin is __ %.

a. 2.50

b. 4.45

c. 32.91

9. Assume Betas usual credit terms are 2/10, net 30. Betas days outstanding in accounts receivables suggests bad debts are likely__ to accounts receivable.

a. Immaterial

b. Material

c. Neither A nor B: Bad debts have no relationship with accounts receivable

10. Betas profit margin, relative to the industry of average of 12%, suggests a __ level of detection risk.

a. Low

b. High

c. Neither A nor B: profit margin is irrelevant to detection risk

11. Betas ROA, relative to the industry average of 4%, suggests a __ level of inherent risk.

a. Low

b. High

c. Neither A nor B: ROA is irrelevant to assessing inherent risk

12. Betas current ratio may be distorted because the company

a. Has not fully depreciated and amortized all of its fixed assets

b. Did not present diluted EPS in its financial statements

c. Likely has a high level of bad debts

Part 2 ( 16 points): Inherent Risk (IR) Assessment. Use the summary information on p.2

and ratio analyses of last years financial statements to answer these questions.

13. List four issues from the summary information on p.2 that could impact IR at Beta

14. Summarize the information from the predecessor auditor. How does this information impact overall IR? Explain your answer.

15. What is your assessment of inherent risk for Betas allowance for doubtful accounts (low, moderate, or high)? Explain your answer.

16. What is your overall IR assessment (low, moderate, or high)? Support your conclusion using the summary information in this document and the 2017 financial statements, including the analytical procedures you performed in Part 1.

Part 3 (12 points): Audit Engagement Staffing

17. Describe your responsibility to the public interest in considering Erics issue? How does this responsibility impact your consideration of whether to remove him from the Beta audit?

18. Will you allow Eric to serve on the Beta audit? Explain your reasoning, including how investors and regulators might view his participation on the audit.

19. Assume an auditor in Erics position were allowed to stay on the Beta audit. Could this person be objective (be sure to explain your answer)? What specific advice would you give this person on how to maintain her/his objectivity?

Beta Home Goods Consolidated Statement of Income (Audited) December 31, 2017 Net Sales* $1,630,395 Assets Cost of Sales 1,093,848 Current Assets Gross Profit 536,547 Cash and equivalents SGA Expenses 416,468 Accounts Receivable, net Operating Income 120,079 Inventory Interest Expense 8,406 Prepaid Expenses Income Before Taxes 111,674 Total Current Assets Income Tax Provision 39,086 Net Income 72,588 Property, Plant & Equipment Land and Buildings Basic EPS $0.73 Equipment and Vehicles IT Hardware and Software *Credit sales are equal to 93% of net sales Accumulated Depreciation & Amortization Property, Plant & Equipment, net $1,704,884 1,415,054 85,244 3,205,182 Beta Home Goods Consolidated Balance Sheet (Audited) December 31, 2017 Liabilities & Stockholders' Equity Current Liabilities $366,839 Accounts Payable 201,761 Accrued Liabilities 7,092,219 Income Taxes Payable 353,082 Total Current Liabilities 8,013,902 Notes Payable Total Liabilities $986,613 947,149 Stockholders' Equity 1,055,676 Common Stock, 100,000 shares issued & outstanding (641,299) Additional Paid-in-Capital 2,348,139 Accumulated Other Comprehensive Income Retained Earnings Total Stockholders' Equity $2,859,090 6,064,272 $400,000 1,520,000 520,000 1,857,769 4,297,769 Total Assets $10,362,041 Total Liabilities & Stockholders' Equity $10,362,041Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started