Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the journal entries to record all 20x3 transactions for the investment above. When preparing the December 31, 20x3 fair value adjustment entry, write two

Prepare the journal entries to record all 20x3 transactions for the investment above. When preparing the December 31, 20x3 fair value adjustment entry, write two journal entries only: one for the total fair value adjustment on fVPL investments and one for the total fair value adjustment on FVOCI investments. Do not write a separate journal entry for each individual investment.

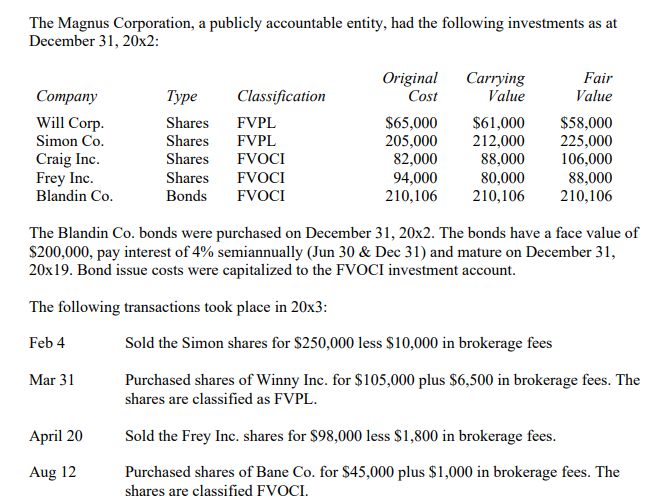

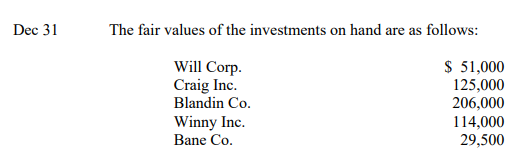

The Magnus Corporation, a publicly accountable entity, had the following investments as at December 31, 20x2: Fair Value Company Will Corp. Simon Co. Craig Inc. Frey Inc. Blandin Co. Type Shares Shares Shares Shares Bonds Classification FVPL FVPL FVOCI FVOCI FVOCI Original Carrying Cost Value $65,000 $61,000 205,000 212,000 82,000 88,000 94,000 80,000 210,106 210,106 $58,000 225,000 106,000 88,000 210,106 The Blandin Co. bonds were purchased on December 31, 20x2. The bonds have a face value of $200,000, pay interest of 4% semiannually (Jun 30 & Dec 31) and mature on December 31, 20x19. Bond issue costs were capitalized to the FVOCI investment account. The following transactions took place in 20x3: Feb 4 Sold the Simon shares for $250,000 less $10,000 in brokerage fees Mar 31 Purchased shares of Winny Inc. for $105,000 plus $6,500 in brokerage fees. The shares are classified as FVPL. April 20 Aug 12 Sold the Frey Inc. shares for $98,000 less $1,800 in brokerage fees. Purchased shares of Bane Co. for $45,000 plus $1,000 in brokerage fees. The shares are classified FVOCI. Dec 31 The fair values of the investments on hand are as follows: Will Corp. Craig Inc. Blandin Co. Winny Inc. Bane Co. $ 51,000 125,000 206,000 114,000 29,500 The Magnus Corporation, a publicly accountable entity, had the following investments as at December 31, 20x2: Fair Value Company Will Corp. Simon Co. Craig Inc. Frey Inc. Blandin Co. Type Shares Shares Shares Shares Bonds Classification FVPL FVPL FVOCI FVOCI FVOCI Original Carrying Cost Value $65,000 $61,000 205,000 212,000 82,000 88,000 94,000 80,000 210,106 210,106 $58,000 225,000 106,000 88,000 210,106 The Blandin Co. bonds were purchased on December 31, 20x2. The bonds have a face value of $200,000, pay interest of 4% semiannually (Jun 30 & Dec 31) and mature on December 31, 20x19. Bond issue costs were capitalized to the FVOCI investment account. The following transactions took place in 20x3: Feb 4 Sold the Simon shares for $250,000 less $10,000 in brokerage fees Mar 31 Purchased shares of Winny Inc. for $105,000 plus $6,500 in brokerage fees. The shares are classified as FVPL. April 20 Aug 12 Sold the Frey Inc. shares for $98,000 less $1,800 in brokerage fees. Purchased shares of Bane Co. for $45,000 plus $1,000 in brokerage fees. The shares are classified FVOCI. Dec 31 The fair values of the investments on hand are as follows: Will Corp. Craig Inc. Blandin Co. Winny Inc. Bane Co. $ 51,000 125,000 206,000 114,000 29,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started